Altcoin

Analyzing SUI’s market position: Bullish sentiment fuels 60% rally hopes

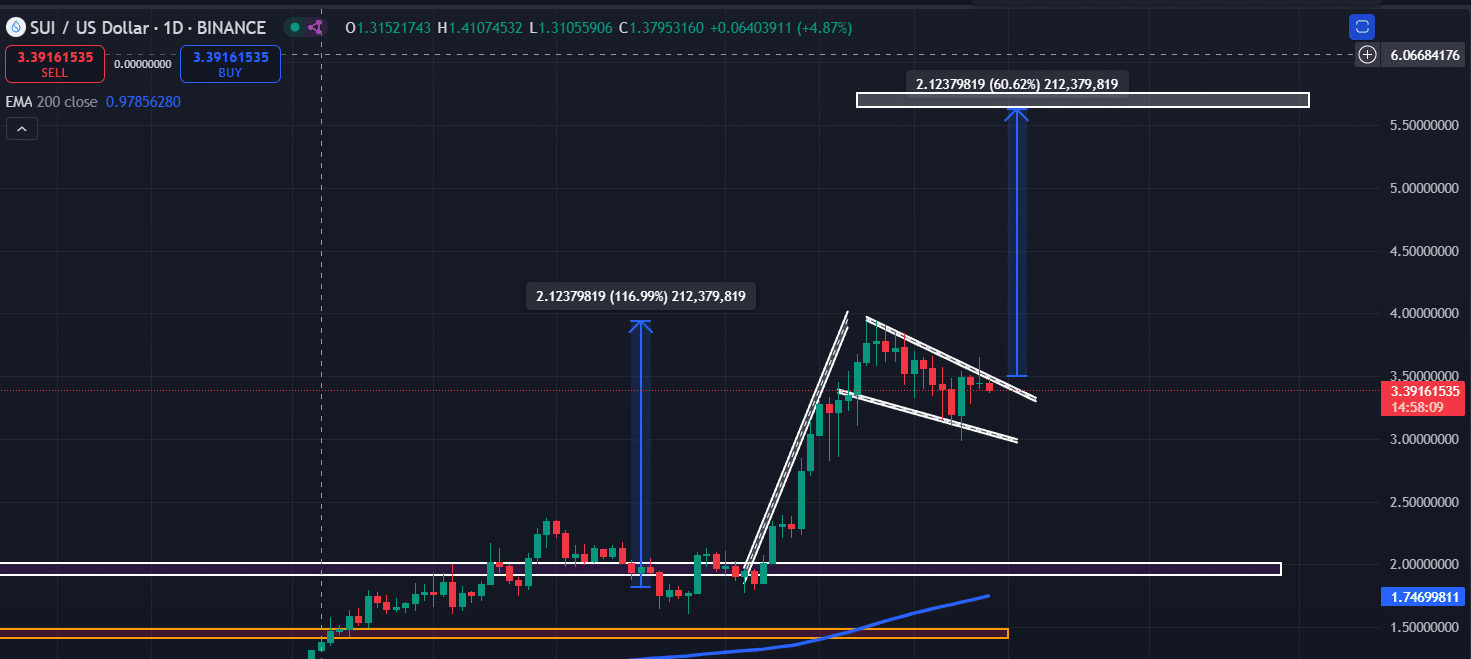

SUI could soar by 60% to the $5.70 level if it closes a daily candle above the $3.5 level.

- 68.20% of top SUI traders hold long positions, while 31.80% hold short positions.

- Traders are over-leveraged at $3.326 on the lower side and $3.538 on the upper side.

SUI, the native token of the Sui network, is making waves in the rapidly evolving cryptocurrency landscape by outperforming major cryptocurrencies like Bitcoin [BTC], Ethereum [ETH], and other major financial assets.

Besides an impressive performance, the altcoin is poised to continue this rally as it has formed a bullish price action pattern.

SUI technical analysis and key levels

According to expert technical analysis, SUI has formed a bullish flag and pole price action pattern on the daily time frame and is on the verge of breaking out of this formation.

Based on the recent price action and historical momentum, if SUI breaches and closes a daily candle above the $3.5 level, there is a strong possibility it could soar by 60%, reaching the $5.70 level in the coming days.

Based on the SUI daily chart, it appears that the price has already been corrected sufficiently to continue its rally further.

On the positive side, SUI’s Relative Strength Index (RSI) stands at 58.60, suggesting that the token has the potential to rally, as it remains below the overbought zone.

Bullish on-chain metrics

With strong bullish price action, traders on Binance are strongly participating with the token, as reported by on-chain analytics firm Coinglass.

According to the data, the Binance SUIUSDT Long/Short ratio currently stands at 2.14, indicating strong bullish sentiment among traders. At present, 68.20% of top SUI traders hold long positions, while 31.80% hold short positions.

This data from an on-chain analytics firm indicates that traders are expecting prices to rally, which has the potential to attract more investors and traders in the coming days.

Major liquidation level

As of now, the major liquidation levels are at $3.326 on the lower side and $3.538 on the upper side, with traders being over-leveraged at these levels, according to Coinglass’s SUI liquidation map data.

If market sentiment remains unchanged and the price rises to $3.538, nearly $22.18 million worth of short positions could be liquidated.

Conversely, if sentiment shifts and the price declines to $3.326, approximately $10.50 million worth of long positions could be liquidated.

Read Sui’s [SUI] Price Prediction 2024–2025

SUI was trading near $3.41 and has experienced a price decline of over 3.5% in the past 24 hours. During the same period, its trading volume dropped by 35%, indicating reduced participation from traders.

This suggests that traders and investors might be waiting for a breakout before deciding to participate further.