Analyzing the effects of BNB Chain’s [BNB] decision to reduce gas fees

![Analyzing the effects of BNB Chain’s [BNB] decision to reduce gas fees](https://ambcrypto.com/wp-content/uploads/2023/04/BNB-5.png)

- A few days ago, BNB’s gas fee was reduced from 5 gwei to 3 gwei.

- Whale interest in BNB was high last week, and its social dominance metric increased.

BNB chain’s [BNB] daily transactions showed a slight uptick last week. The growth was further established by BNB’s recent weekly report, which mentioned that BNB Chain’s daily average transactions surpassed 3.5 million.

This was a significant milestone that reflected the network’s increased usage.

HOT OFF THE PRESS ?

It's BNB Chain News, the ultimate destination for a weekly catch-up on everything in our ecosystem! Read ahead for:

? New Projects on BNB Chain

? Tech and Governance Updates

? Global Developer Eventshttps://t.co/ndMy9gSTew— BNB Chain (@BNBCHAIN) April 22, 2023

Is your portfolio green? Check the BNB Profit Calculator

What propelled the hike?

Though there can be many factors at play, one of the most prominent was BNB’s decision to decline its gas fees. Just a few days ago, BSC validators voted to reduce gas fees on the BNB Chain by 40%.

The decision was made in order to compete with low-cost Ethereum layer-2 networks. The proposal calls for a reduction in gas fees from 5 gwei to 3 gwei. At the time of writing, 3 gwei had a value of $0.02.

Reminder: BNB Chain's fees are now substantially lower, which means there's never been a better time to use and develop on our network! ?

Head to our developer resources link below and get started today. https://t.co/X1nERoC4aR https://t.co/VULsZkC1BW

— BNB Chain (@BNBCHAIN) April 23, 2023

However, it was interesting to note that despite the increase in transactions, BNB’s daily active users went down slightly in the past few weeks after increasing at the beginning of March.

It has only been a few days since the reduction in the gas price, and the broader impact of this update will be interesting to watch over the upcoming weeks.

We're confident this change will continue to unlock the power of BNB Chain for all ⚡️ https://t.co/oi6Acpp7gu

— BNB Chain (@BNBCHAIN) April 22, 2023

BNB coped well

The bearish market conditions made it difficult for most cryptos to maintain their values. While a majority of the cryptocurrencies registered double-digit declines, BNB, on the other hand, fared pretty well.

According to CoinMarketCap, BNB’s price declined by just 5% in the last seven days. At the time of writing, it was trading at $329.46 with a market capitalization of over $51.3 billion.

These metrics helped BNB in the bear market

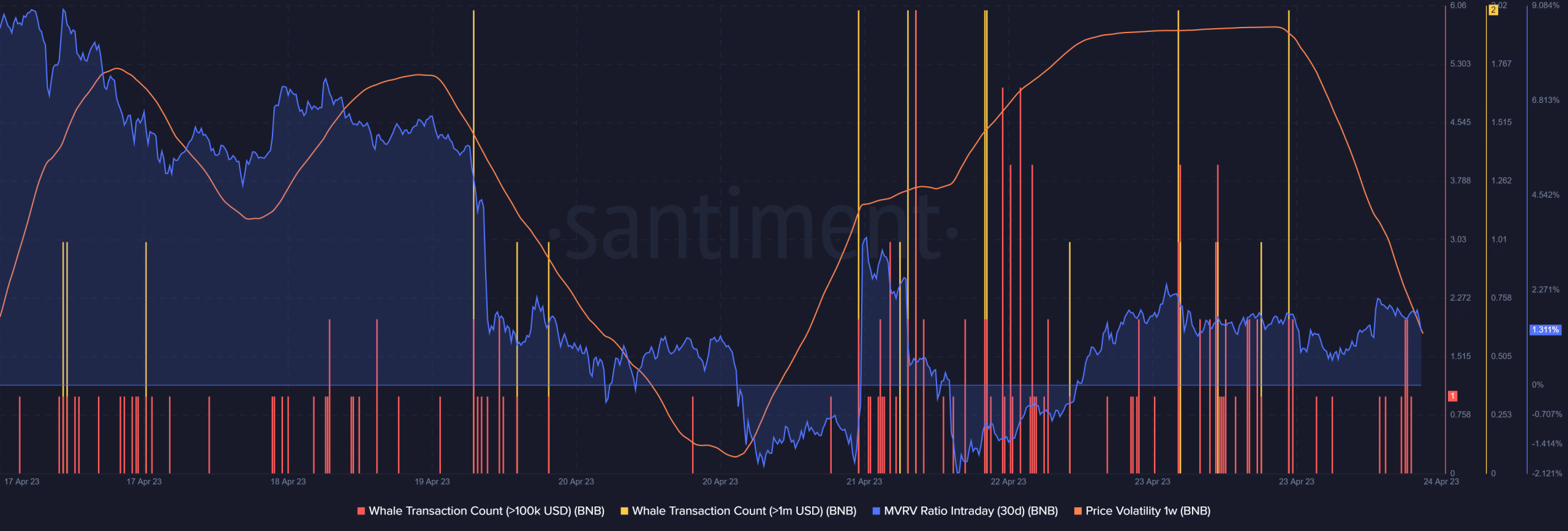

Santiment’s chart revealed quite a few factors that might have played a role in allowing BNB to minimize its price decline. For instance, BNB’s MVRV Ratio did not remain on the negative side for long during the bear market, which was a positive sign.

How much are 1,10,100 BNBs worth today?

In fact, the whales also had an interest in BNB, as evident from the whale transaction count. It did not seem likely that BNB’s price would be subjected to an unprecedented decline in the near term, as its 1-week price volatility declined lately.

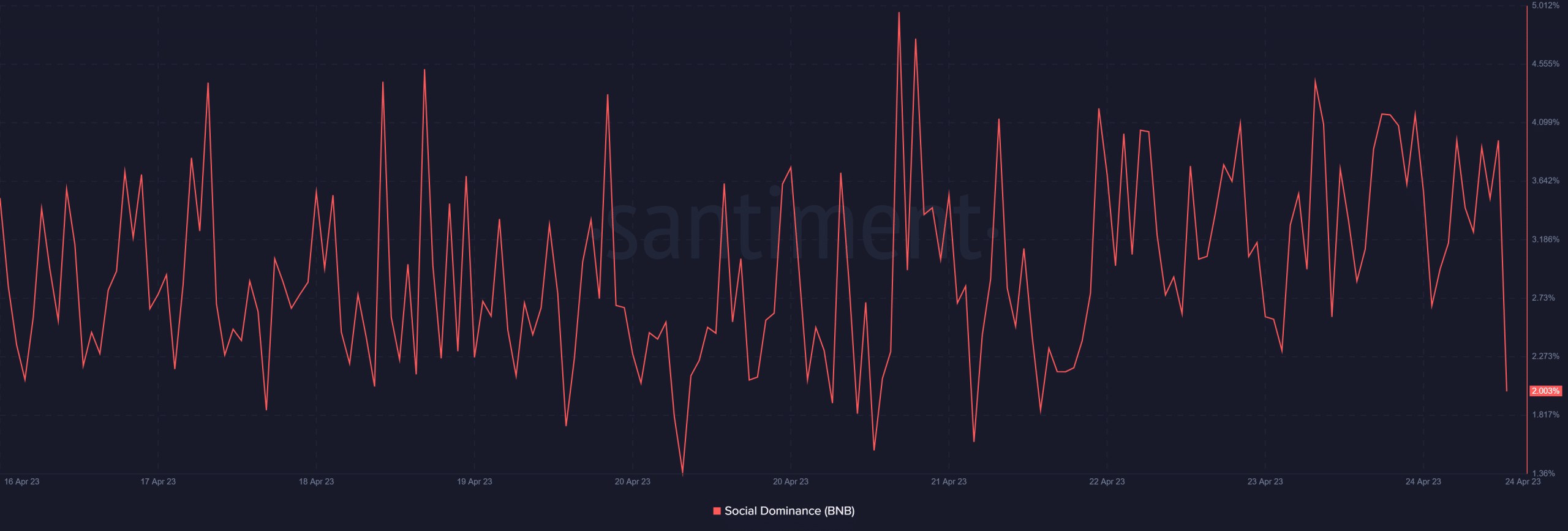

Furthermore, BNB’s performance on the social front also remained decent. The network’s social dominance metric increased in the last week, thus reflecting BNB’s popularity.