Analyzing the state of Arbitrum since its mega AirDrop event in March

- On-chain activity like user activity and transactions surged higher for Arbitrum.

- At the time of writing, ARB was down 7.82% over the past 24 hours.

Popular layer-2 (L2) rollup Arbitrum [ARB] has been on a roll since the launch of its native token in March. It recorded an uptick in most of its key performance indicators (KPIs), according to a report by on-chain analytics firm Nansen.

Nansen noted that unlike many of its predecessors who failed to sustain traction following their AirDrop, the largest Ethereum [ETH] scaling solution managed to buck the trend.

Realistic or not, here’s ARB’s market cap in BTC terms

Onwards and upwards for Arbitrum

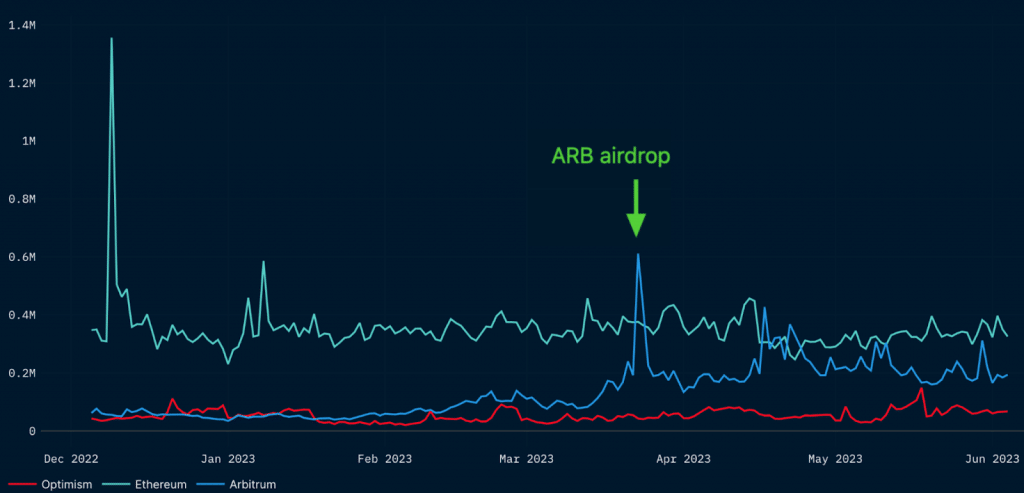

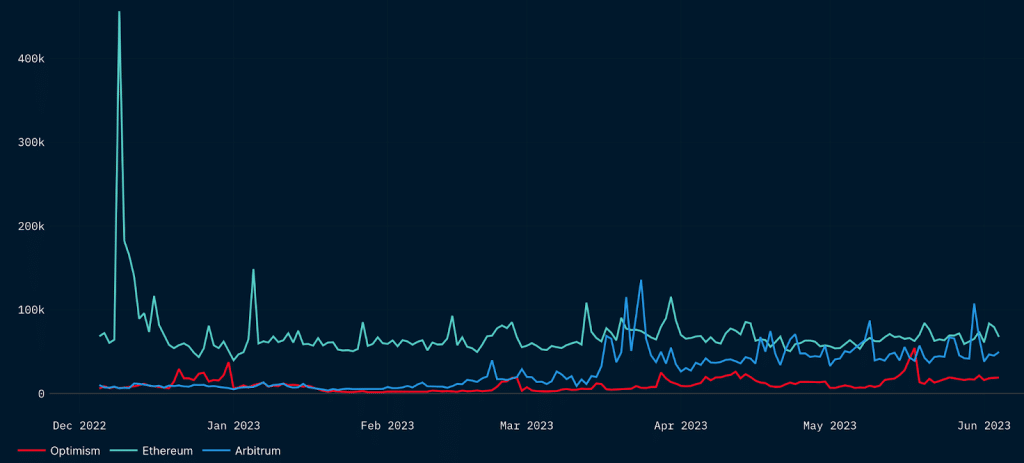

As can be seen below, the number of users surged to a record level of more than 600,000. This was on the day of the AirDrop. However, the momentum carried forward since then. Furthermore, user activity comfortably surpassed the second-biggest ETH rollup, Optimism [OP], and was at par with Ethereum itself.

The transactional activity followed a similar trajectory with the count remaining higher than that of ETH for a good part of April.

Another factor that needed to be considered was network growth. The rate at which new users were entering the system consistently increased since the day of the AirDrop saw an all-time high (ATH) in new wallet creation. Just like previous metrics, this trajectory was comparable to that of ETH.

As far as bridging activity from ETH was concerned, Arbitrum maintained a healthy market share. This was when compared to other L1 and L2 solutions. However, after peaking during the Airdrop claim period, it lost some of its dominance to sidechain Polygon [MATIC].

Is your portfolio green? Check out the ARB Profit Calculator

This trend aligned with predecessors

While Arbitrum outperformed the majority of projects in terms of post-Airdrop activity, one indicator seemed to be replicating historical trends. Along with Optimism, which also went for AirDrop previously, the activity of wallets that retained their tokens was analyzed.

The transaction share of this cohort declined from 5-20% before the AirDrop to just 5% after the tokens became claimable. Similarly, Optimism users who retained their OP tokens reduced their share in total transactions from 30-65% to just 6% at the time the report was made.

Thus, users who increased their on-chain activity to be eligible to claim AirDrops, dramatically reduced their presence after availing them.

At the time of writing, ARB was bleeding heavily after plunging 7.82% over the past 24 hours to $0.9183, as per CoinMarketCap.

![Aptos [APT]](https://ambcrypto.com/wp-content/uploads/2025/06/Gladys-12-1-400x240.webp)