Analyzing Uniswap’s rising leverage – Is it good news for UNI?

- Uniswap reserves on derivative exchanges have reached a record high of 69M tokens.

- UNI’s Open Interest to market cap ratio also shows that the market leverage is increasing.

Uniswap [UNI], at press time, traded at $16.45 after a 3% gain in 24 hours. UNI has been among the top performers this month, having gained by more than 78% in the last 30 days.

Uniswap’s uptrend has coincided with a recovery across the decentralized finance (DeFi) space.

Data from DeFiLlama showed that the Total Value Locked (TVL) across the DeFi industry reached $156 billion earlier this week, marking its highest level since April 2022.

Besides the rising DeFi activity, an increase in leverage seems to be influencing Uniswap’s recent price action.

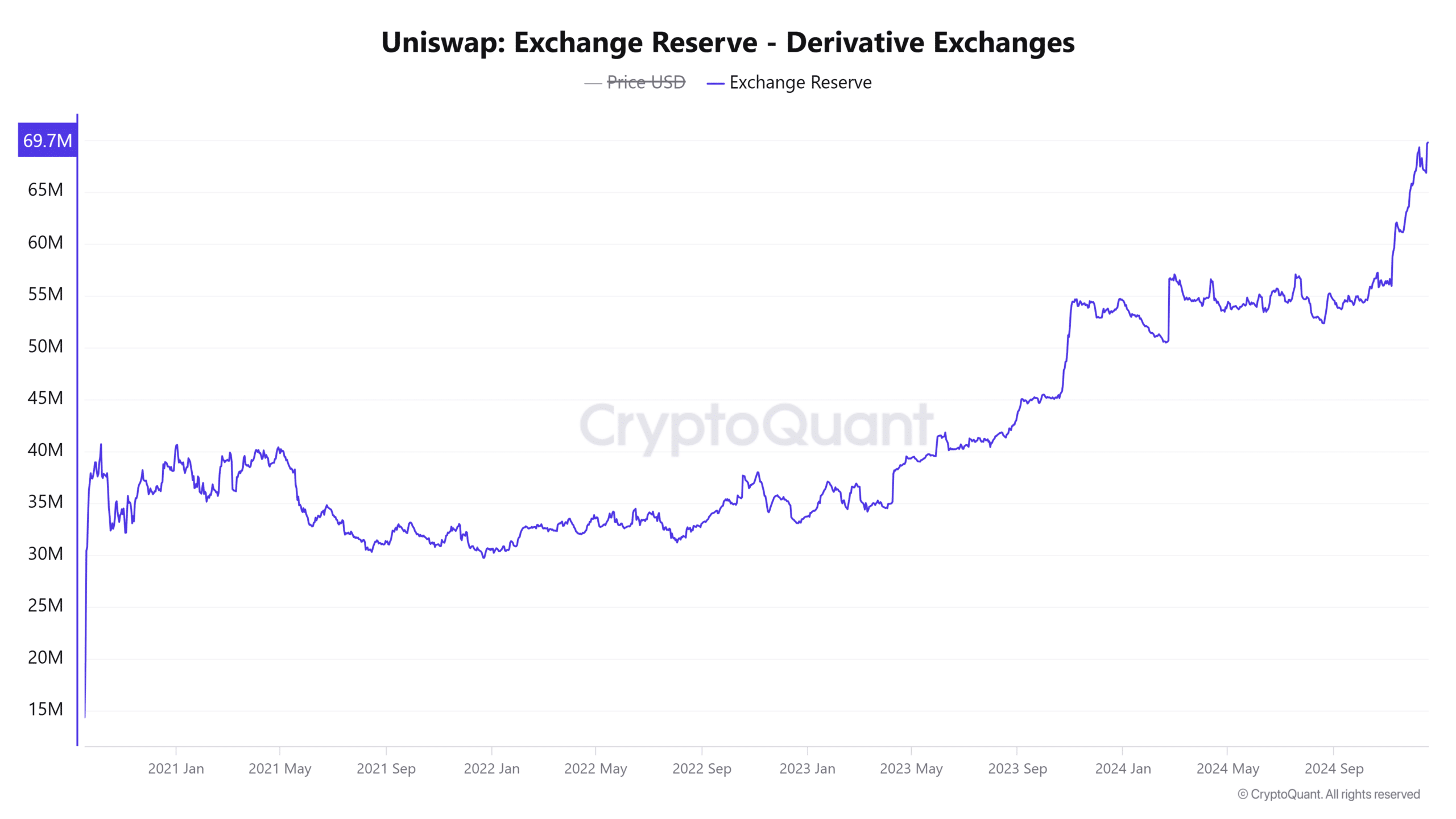

Uniswap derivative exchange reserves hit record highs

According to CryptoQuant, more than 69M UNI tokens are held on derivative exchanges, marking the highest level of derivative exchange reserves in history.

A spike in these reserves shows that there is heightened speculative activity around UNI, which could result in market volatility.

Moreover, there is a divergence between the spot market and the derivatives market due to declining reserves in the former.

CryptoQuant shows that spot exchange reserves are sitting at range lows, indicating minimal changes in selling activity.

If the derivatives market continues to see heightened activity, it could result in price swings due to unexpected liquidations.

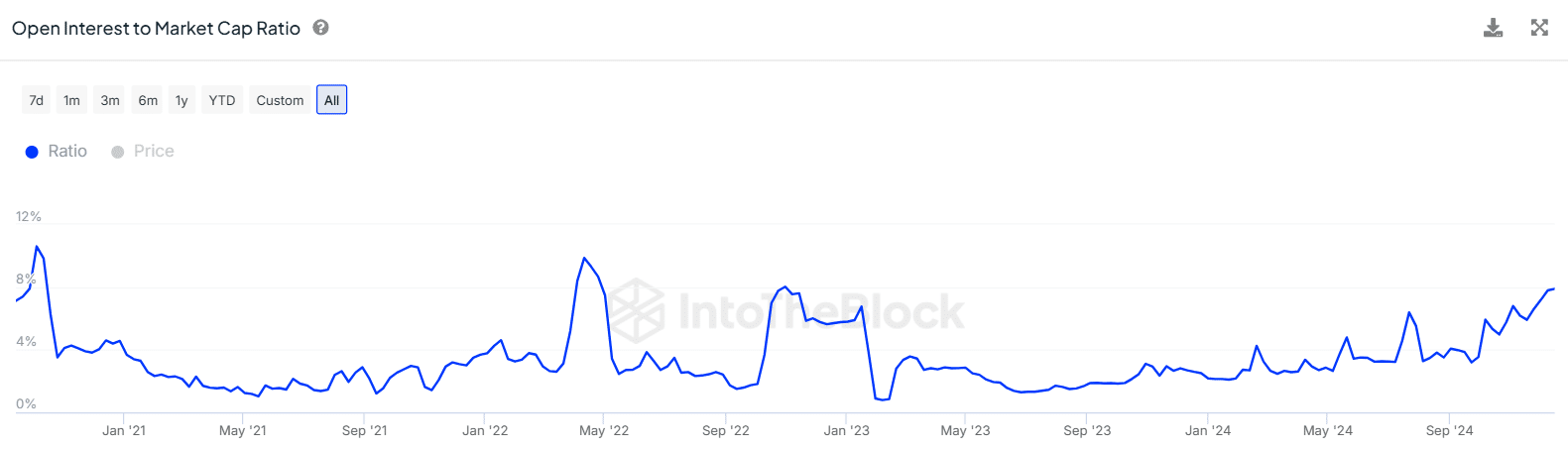

Open Interest to market cap ratio hits two-year highs

Uniswap’s Open Interest has been on a gradual rise, and at press time, it stood at $326M after a 3% increase in 24 hours.

This rise has seen the Open Interest to market cap ratio increase to 7.89%, marking the highest level since November 2022.

A higher ratio indicates greater leverage in the market, which could see UNI being prone to steep market corrections if the price deviates by a wide margin from the expectations of derivative traders.

However, given that the ratio is still at low levels, it indicates that while speculative interest has increased, traders are still cautious.

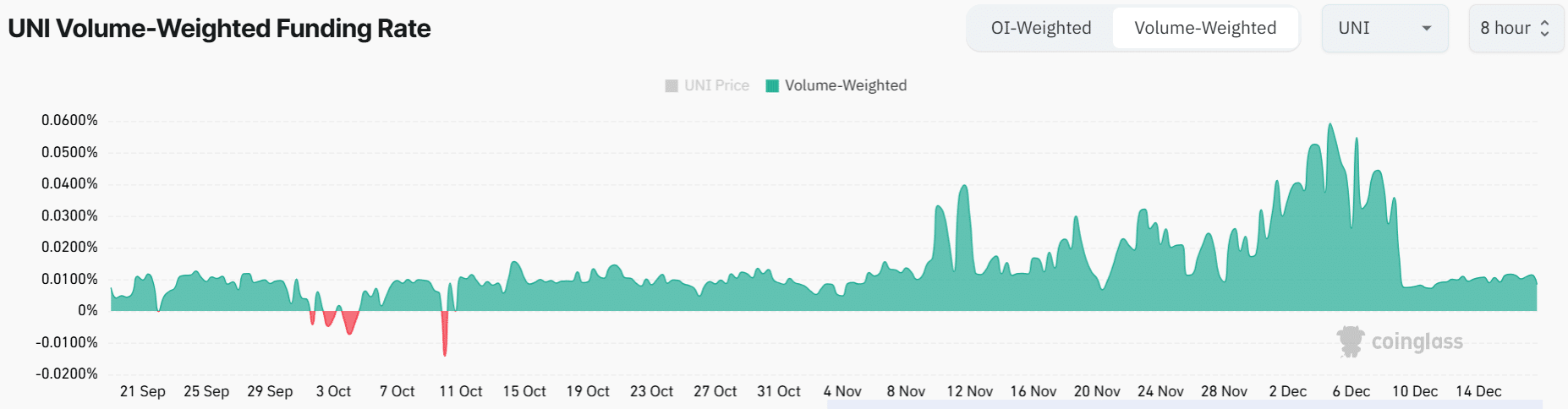

Uniswap Funding Rates show THIS

Bulls that are betting on Uniswap extending its gains are more than those anticipating that the price will reverse its gains as seen in the positive Funding Rates.

Read Uniswap’s [UNI] Price Prediction 2024–2025

According to Coinglass, UNI’s Funding Rates have been positive since mid-October, indicating that traders taking long positions are willing to pay more to maintain their positions.

However, UNI’s Funding Rates have dropped from the high levels seen earlier this month, indicating that while the market sentiment is still bullish, the demand for long positions has dropped.