‘And the reason we should be a bit concerned about’ Tether is…

Stablecoins, as an asset class, are evolving at an impressive pace. It goes without saying that they have almost become an indispensable part of the crypto space today. With an increased adoption rate, USDT – the market’s largest stablecoin has already gained a fair amount of traction lately.

Out of the $1.28 trillion global crypto market cap at press time, Tether accounted for $62.51 billion. Now, with every passing day, more and more cryptos have their own USDT pairs. What’s more, with the help of stablecoins, market participants are able to make full use of the arbitrage opportunities presented to them.

Despite the well-recognized glossy side, the president of the Federal Reserve Bank of Boston, Eric Rosengren, recently opined that stablecoins posed a challenge to the stability of the financial system. The official was quick to point out that Tether, along other stablecoins, were the “new disruptors” of the short-term credit markets.

In a recent interview with Yahoo Finance, the Fed official stated,

“The reason I talked about Tether and stablecoins is if you look at their portfolio, it basically looks like a portfolio of a prime money market fund, but may be riskier… We need to think more broadly about what could disrupt short term credit markets over time, and certainly stablecoins are one element.”

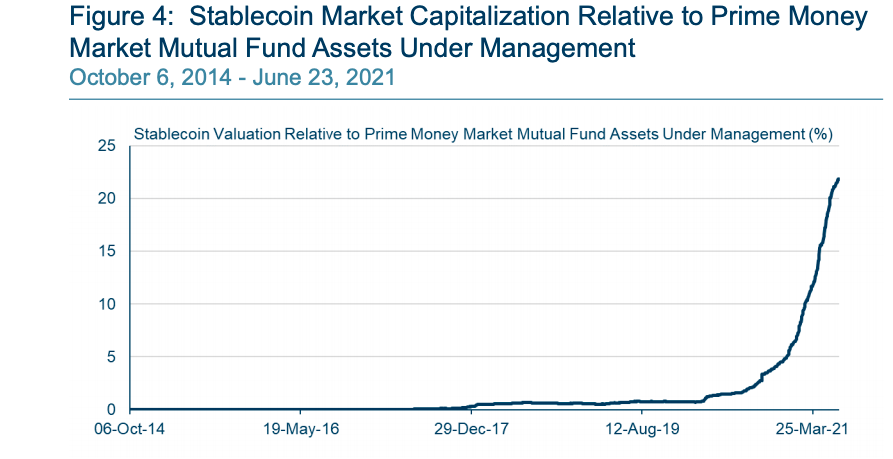

As a matter of fact, the stablecoin market cap, when compared to the prime money market assets, has fared considerably well. The spike has only gotten steeper with time and has evidently affixed itself to the northward movement.

Source: Boston Fed

Commenting on the implication of the aforementioned trend, Rosengren said,

“And the reason we should be a bit concerned about stablecoins is that it’s growing very rapidly… The prime money market funds have been slowly going down as people have looked for a less risky way to hold their transactions accounts…”

Additionally, Tether’s asset breakdown revealed that almost half of its reserves (49.6%) was in commercial papers while other major chunks lied in fiduciary deposits (18.4%) and secured loans (12.5%). The official highlighted that the spread of Tether on these assets got “quite wide” during the pandemic.

What’s more, the official presented a holistic view with respect to stability and regulations. As a matter of fact, during market turbulences, people tend to run away from financial instruments quickly, and their behavior tends to inject instability into the financial ecosystem. Commenting on the same, Rosengren said,

“I think a future financial stability problem could be occurring if we don’t start thinking carefully about what happens to things like stablecoins next time we have a bad market difficulty.”

The official concluded by acknowledging the fact that the stabecoin market is growing and becoming an “important sector” of the economy.