‘Another leg’ for Bitcoin could see it hike or fall as much as…

After a solid start to the week, Bitcoin’s rally has finally cooled down. BTC’s price consolidated at $43,500 with 24% gains on the weekly charts, at press time. Despite falling on 24 February, the crypto-market’s recovery since has been impressive. Even so, the road ahead for Bitcoin doesn’t look easy.

Newbies turning Pro

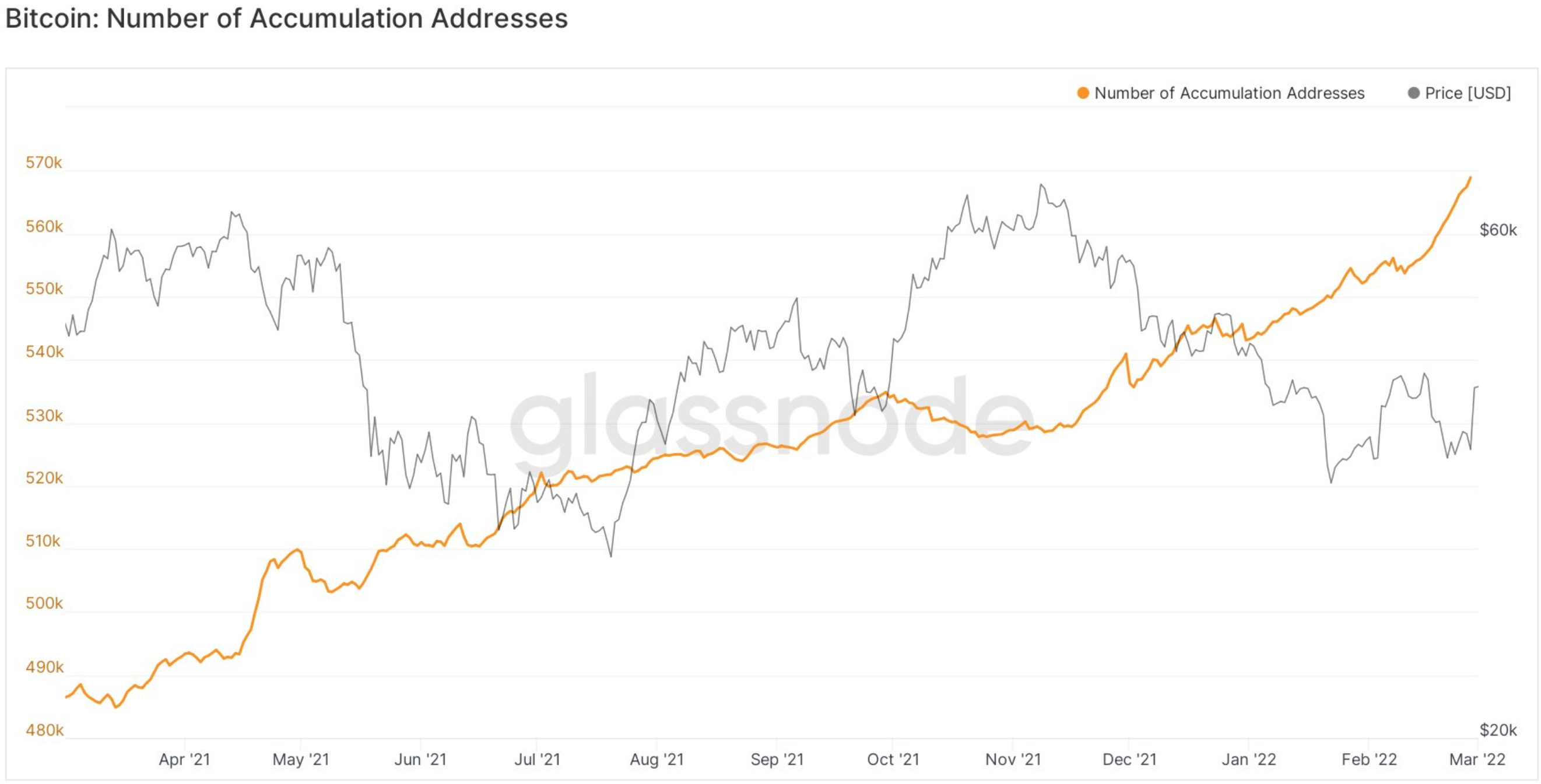

Bitcoin accumulation started in late February, as per the internet entrepreneur Lex Moskovski. Sharing the info on his Twitter page on 1 March, the exec added data from Glassnode to supplement his views.

According to the chart below, the accumulation wallets just hit a new all-time high, just shy of the 570k-mark.

Source: Glassnode

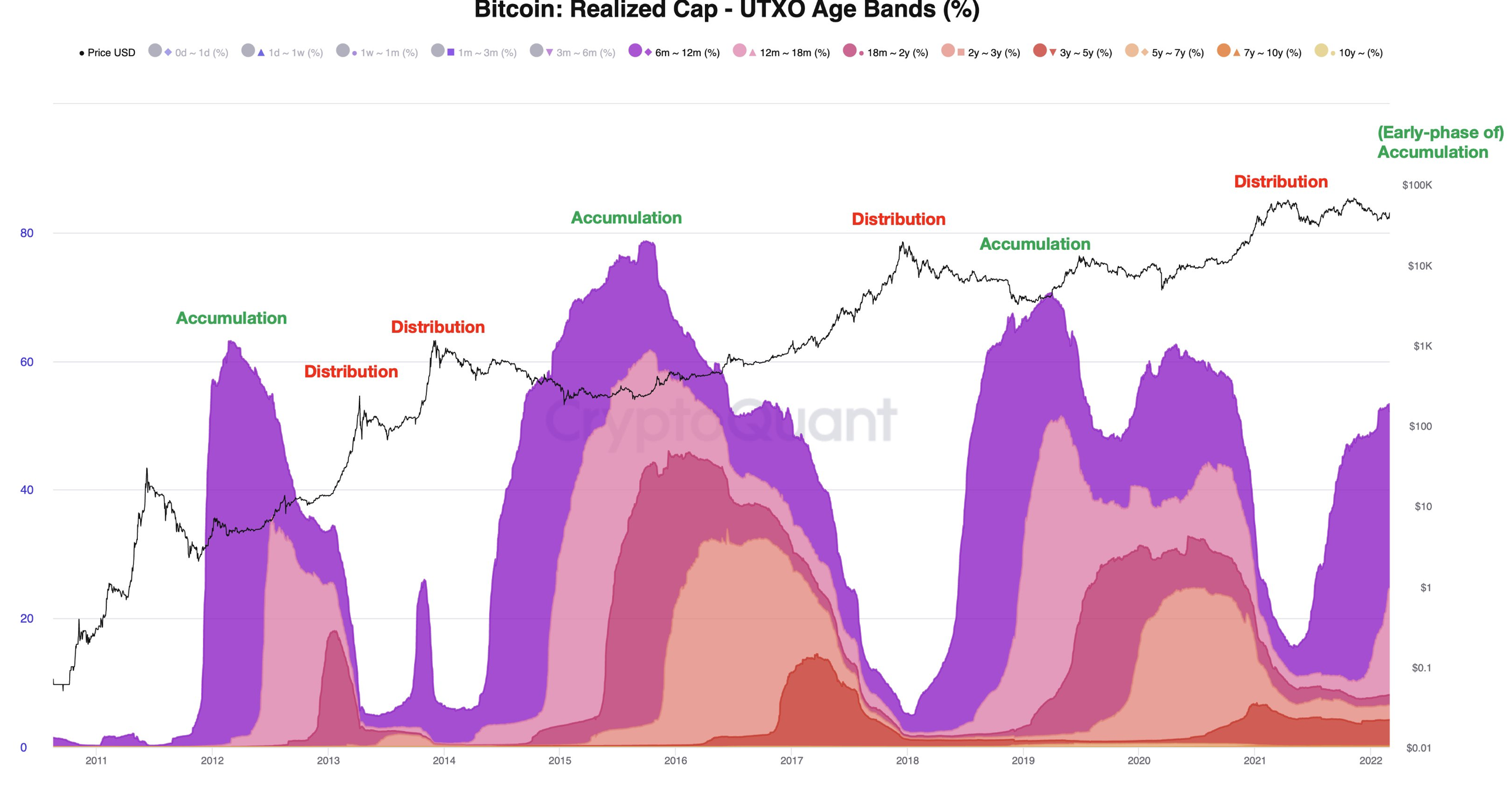

Ki Young Ju, CEO of CryptoQuant, asserted the same narrative.

According to him, recent HODLers have been playing a major role in pushing the prices of assets up the charts.

Source: Twitter

He tweeted,

“Newbies who joined last year are evolving to long-term holders. The market cap for 6-month+ old BTC takes 52% now. It was 13% at the cyclic top. Unlikely to hit the previous low($28k) as the newbies will wait for other newbies in the next cycle.”

Bitcoin indeed saw a lot of heavy bullish sentiment on Crypto-Twitter. For instance, one analyst (@TAanalyst) claimed that Bitcoin showcased a “Reversal 1-2-3-4-5-Covid-6″ pattern. Using this, he said, BTC hit the $90,000-level by end of July this year.

As per Glassnode, the increase in price was due to a large WBTC custodian creating new addresses. As opposed to whale accumulation which is traditionally considered a massive buy signal.

All good no bad?

According to Gareth Soloway, Chief Market Strategist at InTheMoneyStocks, BTC’s date with lower prices could still play out. He said Bitcoin could slip lower in the midterm. In an interview with Kitco News on 1 March, the veteran trader shared,

“We are inside of a bigger bear cycle in my opinion. Yes, I do believe eventually we will see another leg down to $20,000.”

Undeniably, Bitcoin is likely to face many resistance levels on this journey.