Anticipation for Ethereum [ETH] 2.0 rises as metric reaches all-time high

![Anticipation for Ethereum [ETH] 2.0 rises as metric rises to all-time high](https://ambcrypto.com/wp-content/uploads/2023/01/ethereum-wale.jpg)

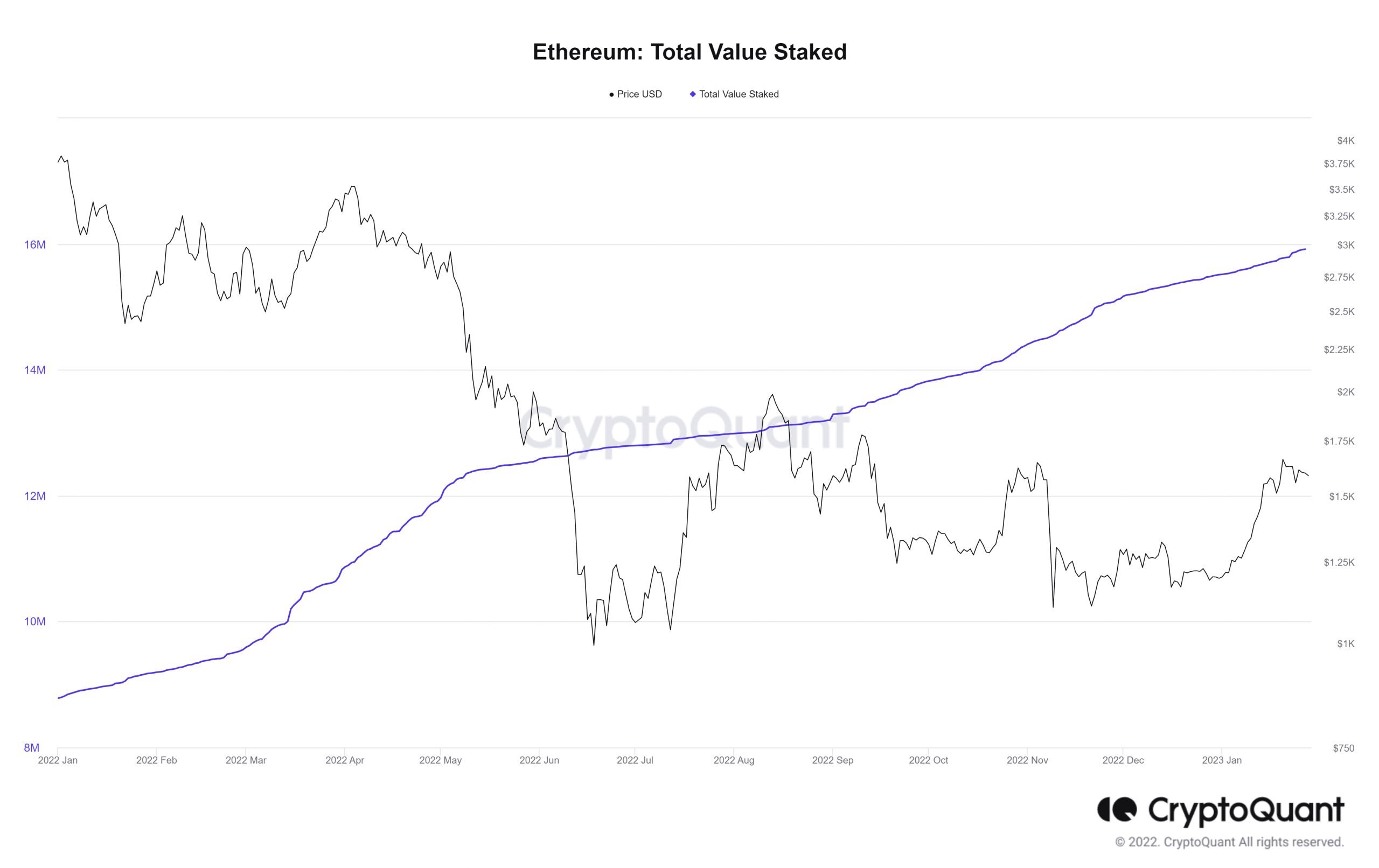

- Ethereum (ETH) total value staked has surpassed 15.9 million.

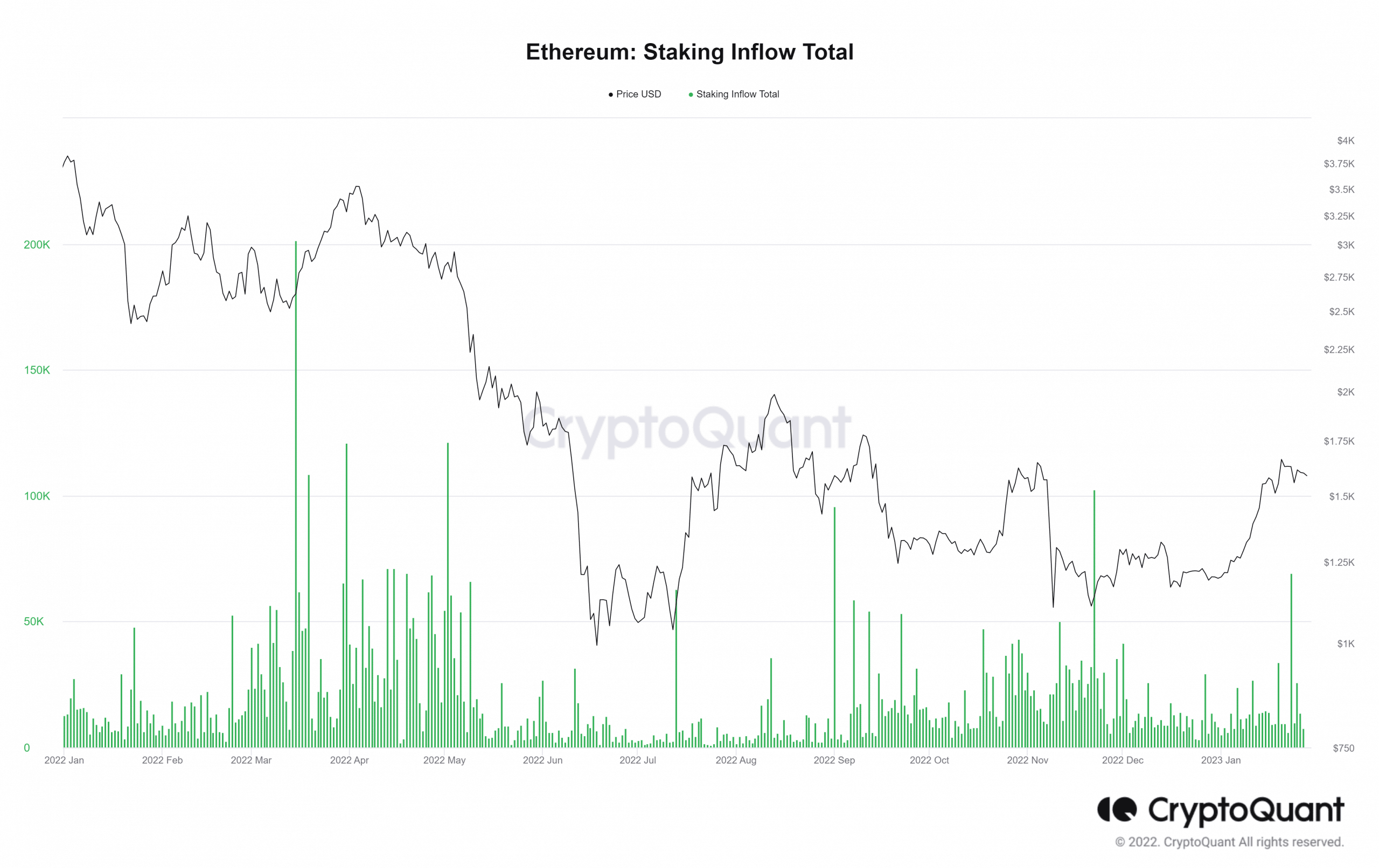

- The increase in the value of ETH might be a major contributor to the increase in stake inflow.

Since the merge, validators have been able to contribute to network security by staking their Ethereum [ETH]. However, the total amount of ETH that has been staked has increased and now stands at a record high. Is there any reason to expect more stake increases, and what could be driving the current ones?

Read Ethereum’s [ETH] Price Prediction 2023-24

Total value staked hit record-high

The second-largest blockchain, Ethereum, reached a significant new milestone on 27 January, nearly four months after it transitioned to a proof-of-stake network. According to Crypto Quant, over 15.9 million ETH have been staked on the Ethereum Beacon Chain.

The total number of ETH staked has reached a new all-time high of 15,9 million

• Accounting for more than 13% of the total ETH supply.

1/6 ?? pic.twitter.com/wesx84E2hK

— CryptoQuant.com (@cryptoquant_com) January 27, 2023

At press time, the total amount staked is over $25.3 billion, and this also represented over 13% of the total ether supply. This is about two years after the launch of Ethereum’s staking contract in 2020, when the network’s proof-of-stake Beacon Chain was introduced.

ETH Staking Inflow and New Depositors see constant activities

Additional examination of several other charts, such as the Staking Inflow Total chart, revealed some intriguing findings. The documented staking influx increased at the beginning of the week. It reached over 69,000, the most significant level since November 2022.

January has had a higher stake inflow than December of the prior year overall.

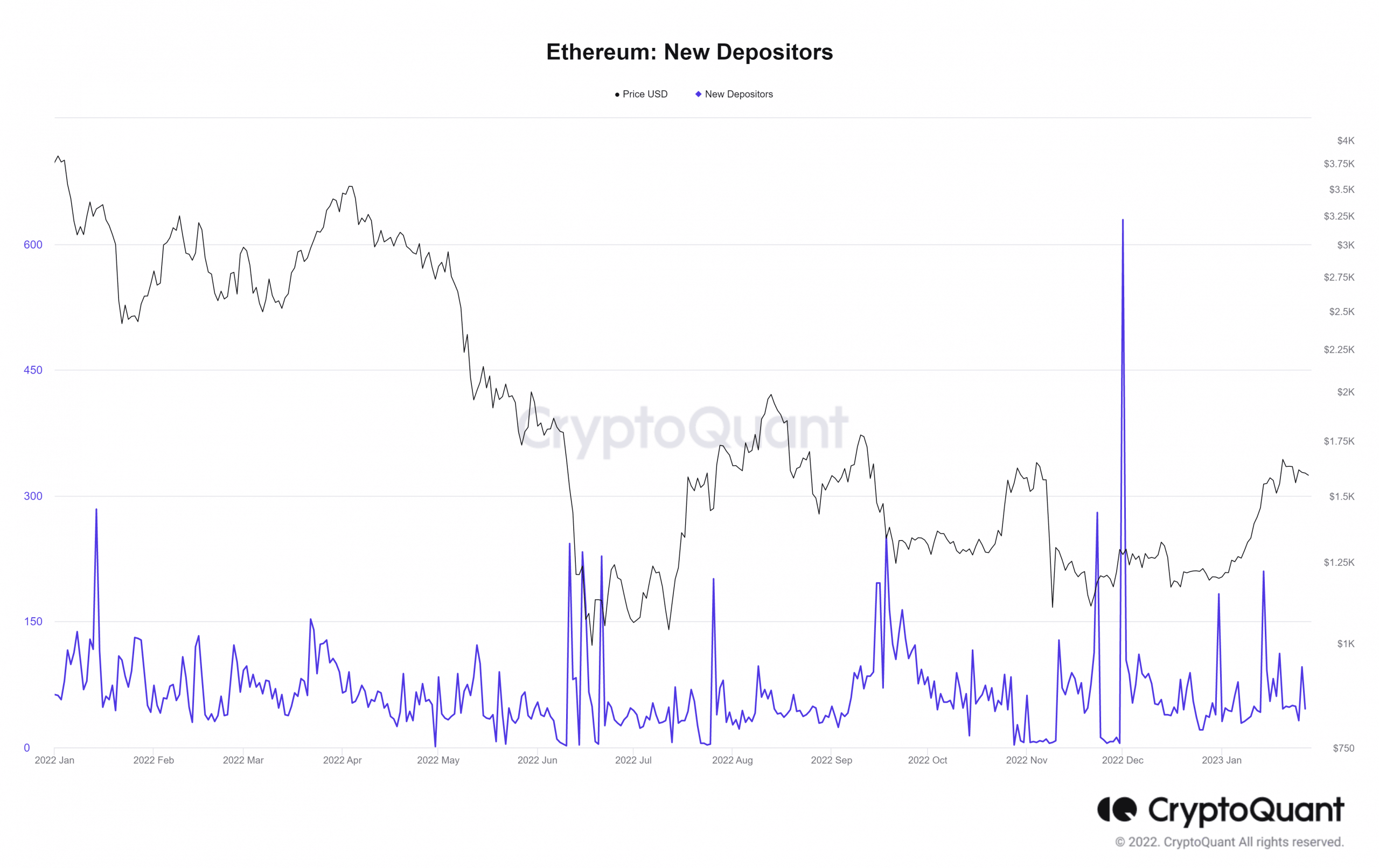

Even though there were no spikes, a peek at the New Depositors chart provided further information about Ethereum staking. As of the time of this writing, 46 new depositors were listed for 27 January. Even while this may not be a large amount, the chart demonstrated a steady stream of new depositors. With this in mind, one could wonder why stakes are constantly entering the network.

Possible reasons for an increased stake

Ethereum was trading at about $1,590 at the time of this writing. Since the beginning of January, the asset’s worth has increased by 33%, as shown by the current price level. One cause of the rise in staking may be a price surge similar to the one Ethereum recently saw.

This was paired with the perception that the Shanghai Upgrade, which would allow the withdrawal of staked ETH, is imminent. To provide incentives, staking payouts will rise in response to a significant ETH withdrawal when the withdrawal feature is activated.

Is your portfolio green? Check out the Ethereum Profit Calculator

Staking rewards for ETH decrease as more of the cryptocurrency is staked. Until the merge’s completion, Ethereum validators have an APY of roughly 5%. However, APY is highest for individuals running their validator nodes.

Staking ETH through a centralized exchange or a staking pool would likely result in reduced earnings because of the validator fees that will be paid. The only time this is different is when centralized exchanges use promotional strategies to increase their reward APYs above on-chain rates to attract staking market share.