‘Otherside’ records highs in fee-related metrics, here’s what you should know

The apes, that were once a part of the earth, have made a smashing reappearance in the digital realm as part of the ‘Otherside’ sale that went live on 30 April.

Numbers speak louder than words…

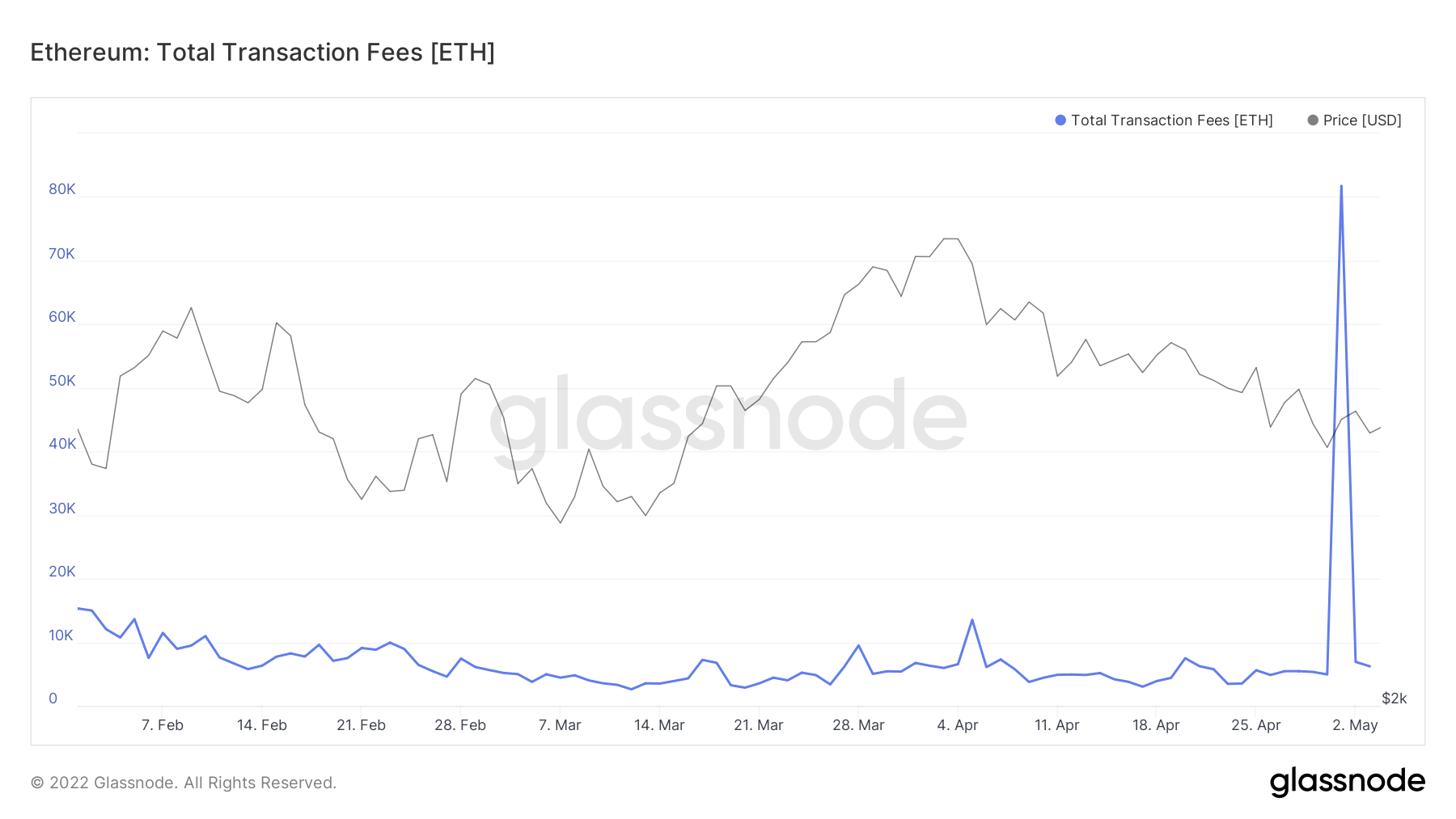

As per data from Glassnode, the total fee amount spent on the YugaLabs sale was $227 million, which is two times more than what was spent in May 2021. The total sale in May 2021 was approximately $112 million. However, at press time, the ETH fees dropped down to 6,210 ETH from an exorbitant 81,747 ETH on 1 May.

The average fee paid for minting the NFTs was $197, which was three times higher than the previous record of $65. The popularity of the apes further led to users willing to pay the heavy minting amounts.

Ethereum miners made earnings of approximately $264 million on 1 May. Glassnode further reported that 85.9% of their earnings came from gas fees, whereas the remaining 14.1% was in block subsidies. At press time, the miner revenue fees percentage dropped down to 31.84%.

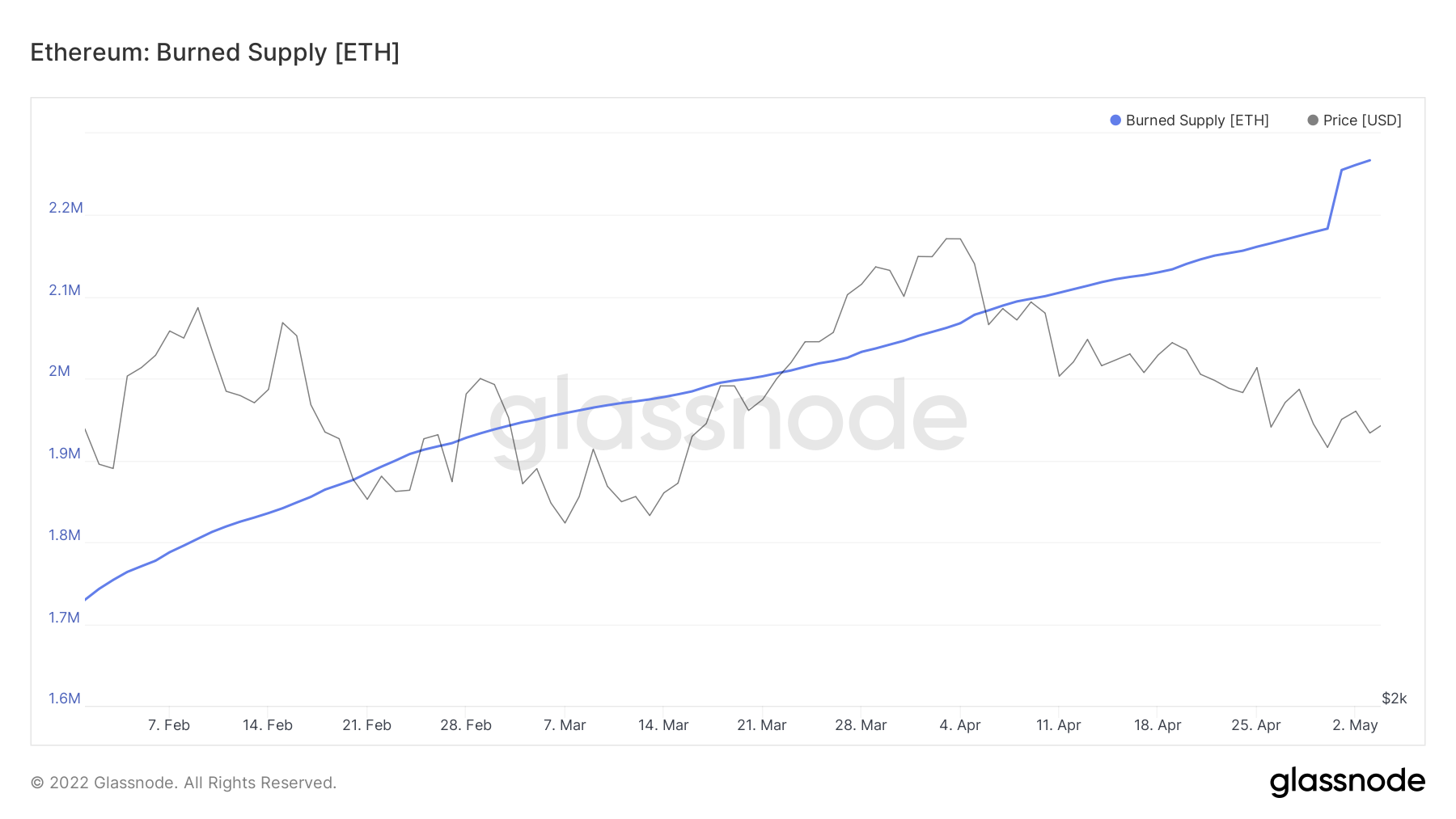

Furthermore, a total of 71,700 ETH was burned on 1 May, which is worth approximately $200 million. At press time, the total ETH burned supply stood at $226 million. The total ETH burned went up from $210 million on 30 April, to $225 million on 1 May.

A net change of -58,280 in the Ethereum overall supply led to the Otherside sale becoming the most deflationary in the history of Ethereum.

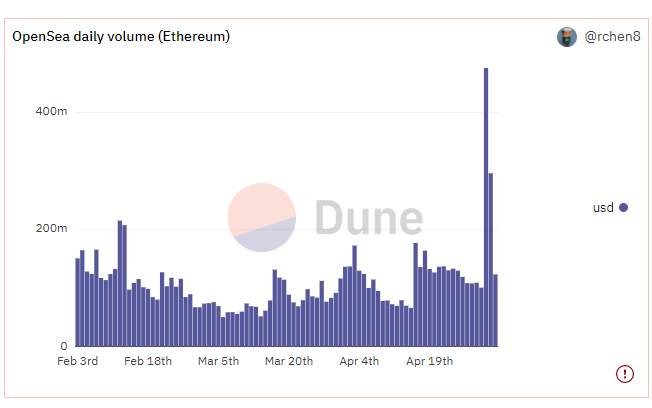

In addition to the data given above, the Dune Analytics statistics presented below further highlight the daily volume of Opensea with regard to Ethereum transactions. It can be seen that the daily volume on 1 May stood at approximately $476 million from $ 101 million on 30 April, at press time, the daily volume stood at $123 million.

There’s no slowing down…

Despite the series of tweets sent out by YugaLabs addressing glitches related to failed transactions and money lost due to gas fees, the demand for the NFTs didn’t slow down. As numbers and statistics don’t lie, the aforementioned data definitely depicts the “other side” of the story.