ApeCoin: A break above THIS level can result in a breakout rally

- ApeCoin’s recent breakout above key EMAs suggested a potential for more upside in the near term.

- The $0.87 resistance level was crucial for the bulls to reclaim a long-term edge.

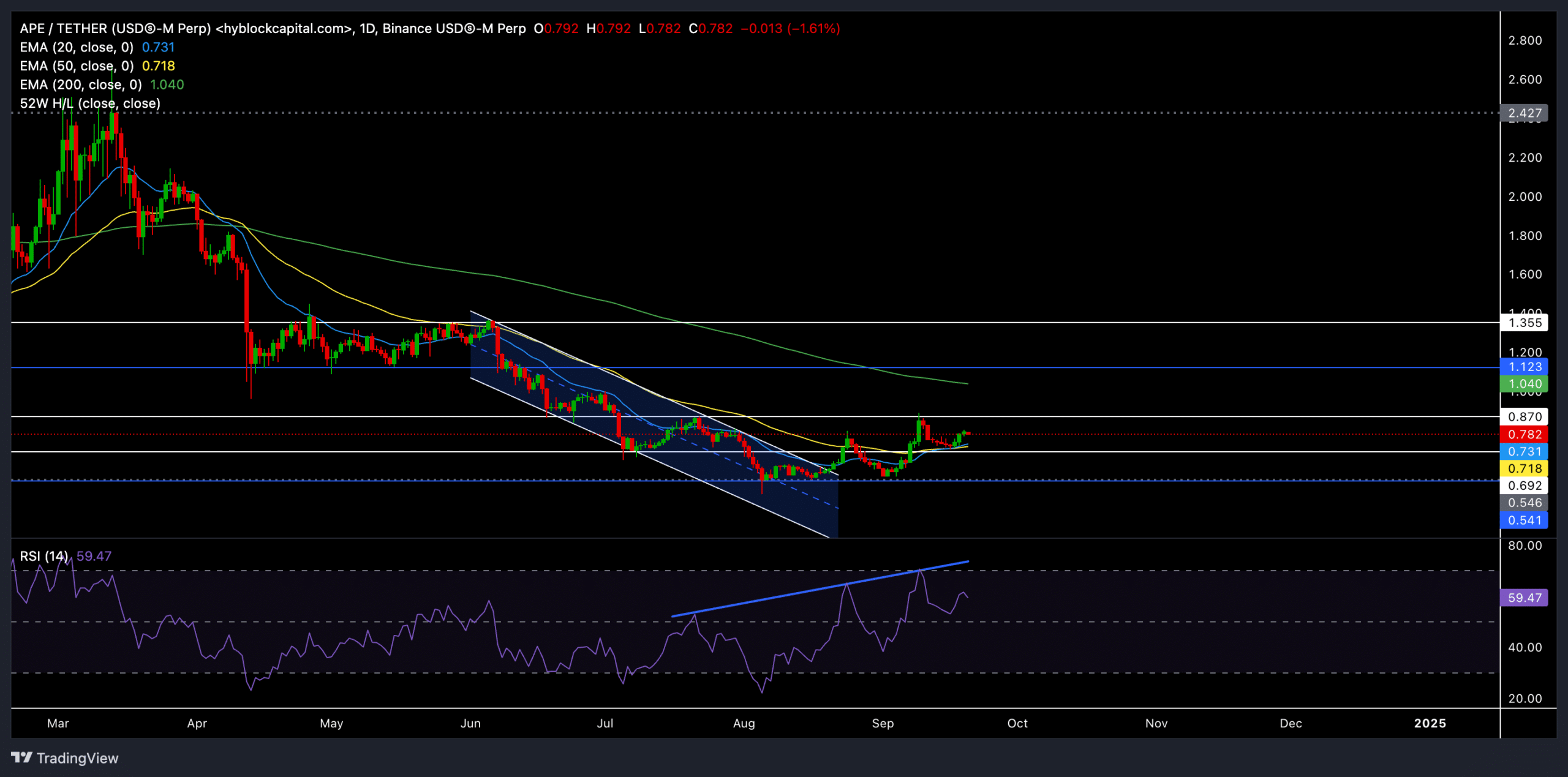

ApeCoin [APE] recently showed signs of recovery after a bullish breakout from a down-channel pattern. After consolidating around the $0.54 support, APE saw the much-needed push above the 20-day and 50-day EMAs.

The daily chart of APE/USDT highlighted a clear breakout from the descending channel that constrained its price since mid-July.

Short-term recovery and EMA crossover

After the down-channel breakout, the APE oscillated between $0.5 and $0.7.

However, the breakout pushed the price above both the 20-day EMA ($0.732) and the 50-day EMA ($0.718), suggesting renewed buying interest. This crossover of the 20 EMA above the 50 EMA further reaffirmed the bullish trend.

At the time of writing, ApeCoin traded near the $0.78 mark. Despite this positive momentum, the $0.87 resistance could slow down the rally.

It’s worth noting that the relative strength index (RSI) has reached higher highs over the past two months, while the price action’s highs have remained flat.

This showed a mild bearish divergence. If this divergence plays out, APE could face a temporary downtrend. The altcoin could witness a pullback to retest the EMAs around $0.73.

Traders should watch for a rejection near $0.87, as a failure to break above this could result in a short-term correction.

The critical resistance zone near $0.87 posed some challenges for bulls. A decisive break above this zone could open a path toward the 200-day EMA, which stood near $1.04 at press time.

This would be the next major target for buyers. Beyond the 200 EMA, the $1.12 and $1.35 levels could come into play, but this would require a strong, sustained volume increase.

Derivates data reveal THIS

A glance at the derivatives data showed a healthy increase in both volume (+14.61%) and Open Interest (+5.71%), with $129.16 million in trading volume and $44.11 million in Open Interest.

This uptick indicated that traders were positioning themselves for potential volatility, likely expecting further price action either toward or away from the $0.87 mark.

Interestingly, the Binance APE/USDT long-short ratio for accounts was 1.6455 at press time, reflecting a more bullish sentiment. Similarly, the OKX APE long-short ratio stood at 1.96.

Read ApeCoin’s [APE] Price Prediction 2024–2025

However, Traders should closely monitor the derivatives market sentiment and the RSI for signs of weakness.

As always, broader market sentiment and on-chain developments will also play a key role in shaping ApeCoin’s price trajectory in the coming days.