Apecoin bucks the trend by gaining after its token unlock, here’s why

- The latest unlock represented about 4% of the total supply of APE, worth $160 million.

- Apecoin’s staking program triggered a solid demand for APE.

Apecoin [APE], the primary token of the Yuga Labs ecosystem, recently released about 40 million tokens in the market as part of its scheduled linear unlock.

The unlock represented about 4% of the total supply of APE, worth $160 million, On the whole, more than 42% of the total supply was unlocked, at the time of writing.

? Final Call Alert ?

4.1% of $APE will be unlocked within the hour, valued at $160M !! ?

Keep a close eye on its movements with our latest features ✨https://t.co/VqxEvuJ4jM

Share your thoughts on the sentiment below ? !! pic.twitter.com/PukTfwgWix

— Token Unlocks (@Token_Unlocks) March 16, 2023

The last token unlock event on 16 February resulted in a drop of more than 7% in APE’s value as per CoinMarketCap. Surprisingly, APE bucked the trend this time as it recorded gains of more than 6% in the 24-hour period.

Read ApeCoin’s [APE] Price Prediction 2023-24

Accumulation spree for APE

Token unlocks could be tricky in the crypto space. While they are designed to provide market liquidity and help in project expansion, they can become a source of inflationary pressure, leading to a significant drop in prices.

In the present case, however, there was strong evidence to suggest that APE was being purchased in bulk leading to the unlock event.

As per Unblock Calendar, the balance of APE on centralized exchanges has gone down significantly since December last year. Interestingly, this was also the time when Apecoin launched its staking program.

Smart money wallets also started to increase their APE allocation balance. Possibly, the strong incentive of reaping staking rewards may have prompted users to hold the token instead of selling them off.

On 17th March, will start a 1-month period with linear unlock of 4% of total supply (intense?)

What it is happening on chain ahead of the unlock?⛓️⛓️

A thread?? pic.twitter.com/UlCbr92kuM

— Unlocks Calendar (@UnlocksCalendar) March 15, 2023

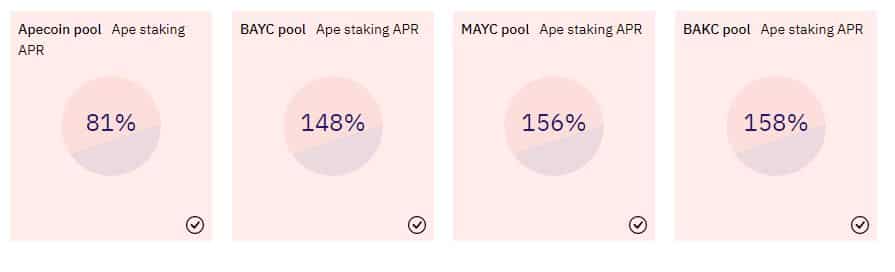

As per Dune Analytics, the APE staking pool yielded 81% annual returns at press time. There was also an incentive mechanism to reward those who stake early. Hence, there was a strong pull for stakers to hold APE.

Bulls and Apes become friends!

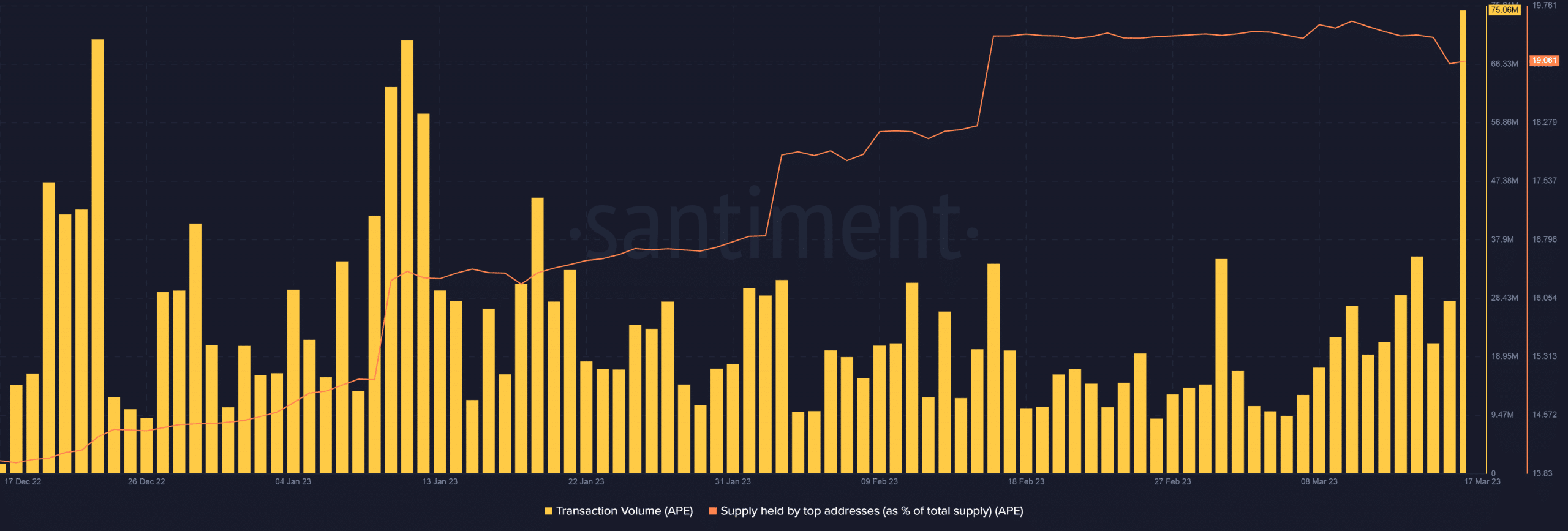

Apecoin’s transaction volume exploded to its 11-month high of 125.9 million on 17 March, lending credence to the accumulation theory.

The supply held by large addresses grew sharply since the start of the year, indicating that whales snapped up APE in abundance.

How much are 1,10,100 APEs worth today?

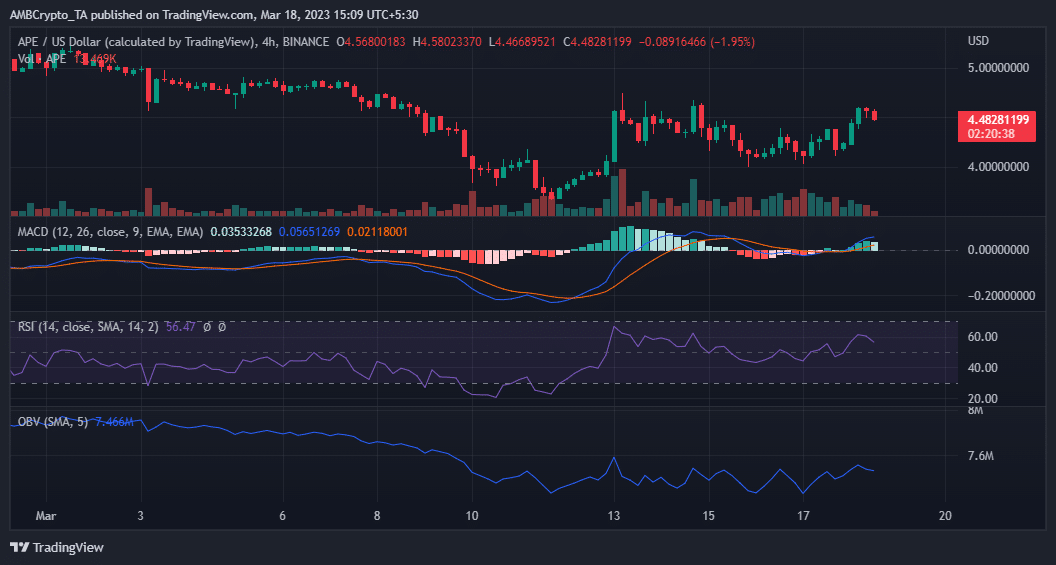

Most of the technical indicators sided with a bullish idea for APE on a daily timeframe.

The Relative Strength Index (RSI) started an upswing and sat comfortably over the neutral 50. The On Balance Volume (OBV) made higher highs and higher lows of late, suggesting strong demand.

The Moving Average Convergence Divergence (MACD) confirmed the start of a bullish cycle after the crossover.

![Bittensor [TAO] tops the AI charts once again, but 3 hurdles loom](https://ambcrypto.com/wp-content/uploads/2025/04/420567A0-9D98-4B5B-9FFF-2B4D7BD2D98D-400x240.webp)