ApeCoin bulls reclaim key levels and that means…

- APE’s recent reversal set the stage for bulls to re-enter and change the short-term narrative.

- Traders should closely monitor the long/short ratios on key exchanges to assess any shifts in sentiment.

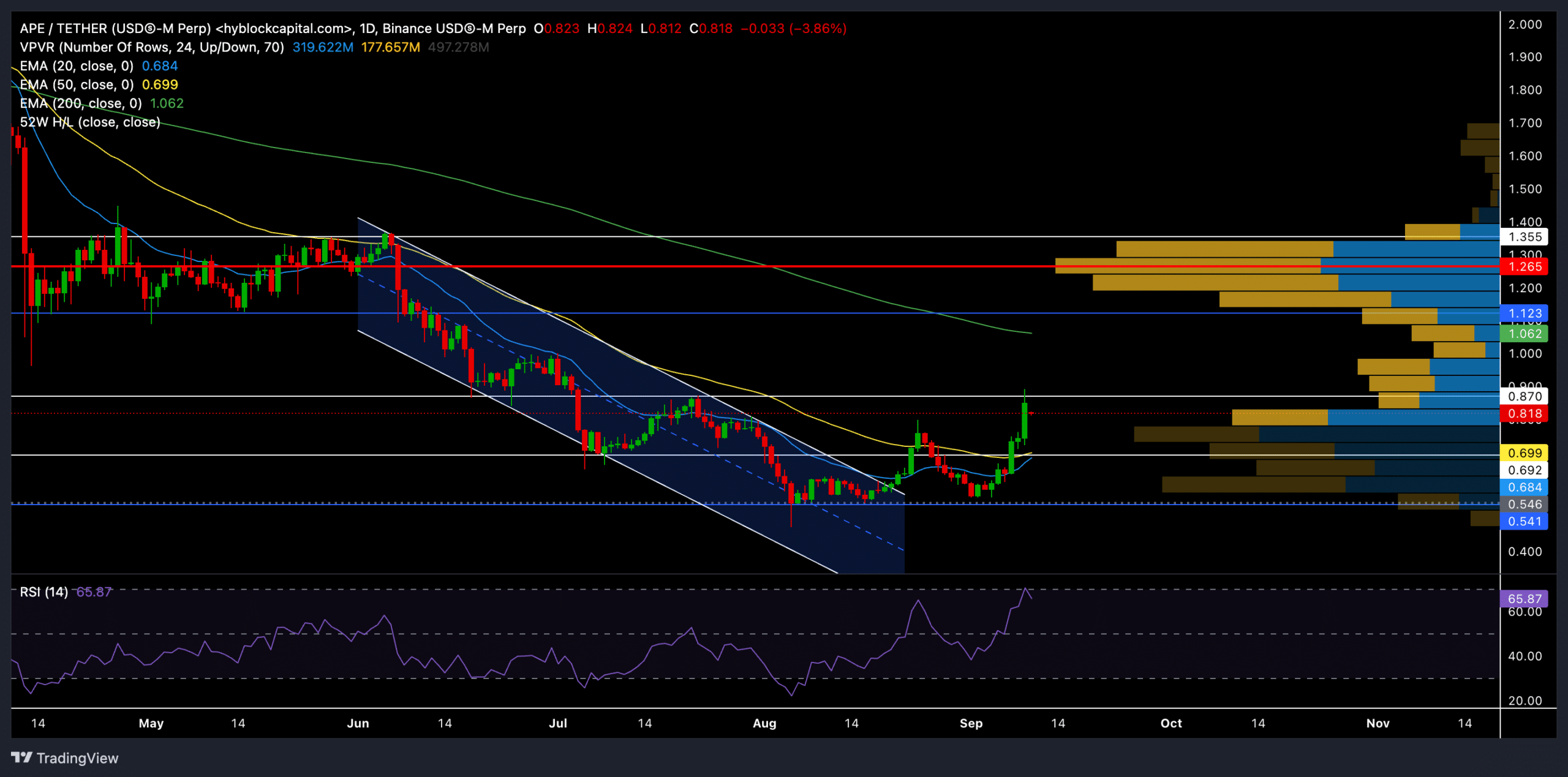

ApeCoin [APE] has shown signs of recovery, recently breaking out of a descending channel pattern on its daily chart, sparking hopes for a bullish reversal.

After experiencing significant selling pressure earlier, APE saw a promising 52% rally over the past week and briefly touched the $0.87 resistance level. However, the question remained: Can the bulls sustain this momentum, or will we see a period of consolidation?

Current price action and key levels to keep an eye on

ApeCoin’s recent breakout from its descending channel pattern marked a crucial shift in sentiment. APE was trading around $0.818 at the time of writing, up by approximately 11% in the last 24 hours.

Per the VPVR (Volume Profile Visible Range) metric, the price hovered within a high-liquidity zone. This suggested that consolidation around the $0.7 to $0.87 range is highly probable in the near term.

For APE to maintain bullish momentum, buyers must breach the immediate resistance at $0.87. A clear break above this level could pave the way for a retest of the 200-day EMA, which stood at $1.062.

It’s worth noting that this is a crucial level that could trigger a stronger uptrend if reclaimed.

On the downside, immediate support was at $0.699, near the 20-day and 50-day EMAs. Bulls need these levels to hold for them to maintain their near-term edge.

A breakdown below these EMAs could lead to a test of the previous support at $0.541—where buyers might look to step in again.

The Relative Strength Index (RSI) was at 65.87 at press time. While not fully overbought yet, it suggested the potential for a short-term correction or consolidation as buying momentum cools down.

A continued dip toward the 50-58 range would hint at a likely consolidation in the coming days.

Signs of a slowdown?

Per the latest derivatives data, APE’s volume surged by over 151% to reach $501.31M. On the other hand, open interest saw a rise of 20.44% to $55.20M. Despite this, the long/short ratio shows a mixed sentiment.

Binance APE/USDT long/short ratio stood at 0.7928 to show that short positions slightly outweighed longs.

However, the top traders on Binance show a more bullish sentiment, with a ratio of 1.1526 for positions. Also, the ratio on OKX stood at 1.38, showing a more optimistic view.

This suggested a neutral to slightly bullish sentiment in the derivatives market, with no strong bias emerging just yet.

Is your portfolio green? Check the ApeCoin Profit Calculator

The price action in the coming days will largely depend on whether the bulls can push the price above $0.87 and, eventually, the 200-day EMA.

A failure to do so could lead to sideways action or a minor pullback, offering buyers an opportunity to re-enter within the $0.7-$0.87 range.