Analysis

ApeCoin is down 50% in Q2: When will it end?

APE’s further downside likely if the lack of demand and increasing selling pressure persists unless BTC …

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- Key technical indicators on the daily chart were negative.

- Supply on exchanges surged, highlighting sellers’ leverage.

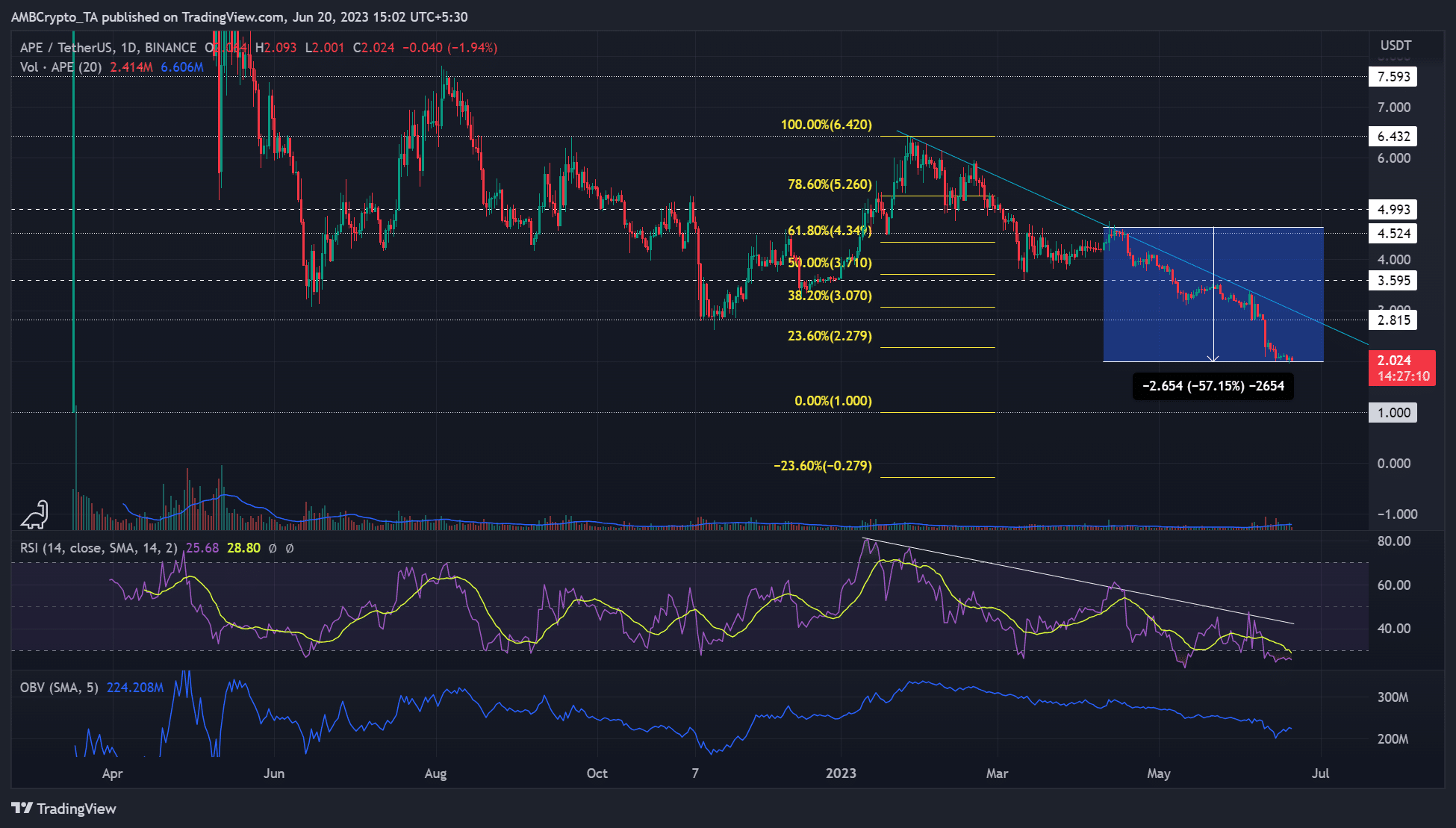

ApeCoin [APE] could close Q2 2023 in the red if the negative price charts indicators and on-chain metrics persist. The token has depreciated since late January, dropping from its peak of $6.42 and cracking key support levels.

Read

ApeCoin [APE] Price Prediction 2023-24Bitcoin [BTC] has maintained the $26k price zone since 16 June. BTC’s cues could hold APE’s further drop for a while; a slip below $26k could expose APE to more selling pressure.

Over 50% value drop – What’s next?

Based on the price range tool, APE has declined by over 55%, measured from its swing highs in mid-April of around $4.5 and $2.02 at the time of writing. Besides, the trendline resistance (cyan) has been a critical roadblock against any likely upside move.

In addition, the RSI (Relative Strength Index) has been making lower highs since late January, denoting a considerable drop in buying pressure. The demand for APE dipped, too, as shown by the declining OBV (On Balance Volume).

The above negative indicators reinforced sellers’ control and a likelihood of driving APE below $2.0. A drop to $1.0, the initial opening price for APE on Binance exchange, could be on the cards.

However, bulls could be hopeful if BTC crosses $27k. But they must clear the trendline resistance at $3, which aligns with the 38.2% Fib level and a key swing low in October 2022.

Supply on exchanges surged

How much are 1,10,100 APEs worth today?

APE recorded a surge in supply on exchanges from May, reiterating that more tokens moved to exchanges for offloading. It’s a distribution trend that has seen APE under sellers’ control.

Conversely, the declining supply outside of exchanges shows a waning interest in APE in the same period. Active addresses remain muted apart from the surge in selling volume on 10 June. Hence, sellers will likely wield influence for a while unless BTC crosses $27k.