Aptos [APT] shrinks under month-long range – what comes next?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- Aptos remained bearish on the 12-hour timeframe

- $3.26 million worth of long positions were liquidated

Aptos [APT] remained under the $10 psychological level, with sellers poised to extend the coin’s dip. Bears flipped the $10 level from support to resistance on 1 May and the price struggled to go above the new ceiling.

Over the past 24 hours, APT posted a slight gain of 1.28% offering bulls an opportunity to push prices back up. BTC’s recovery to $29k could offer buyers more leverage and spur a bullish breakout for Aptos.

Read Aptos [APT] Price Prediction 2023-24

Breach of the $10 support level offered bears more shorting opportunities

Aptos’ market structure on the 12-hour timeframe has been bearish since January 2023 with APT’s price making a series of lower highs.

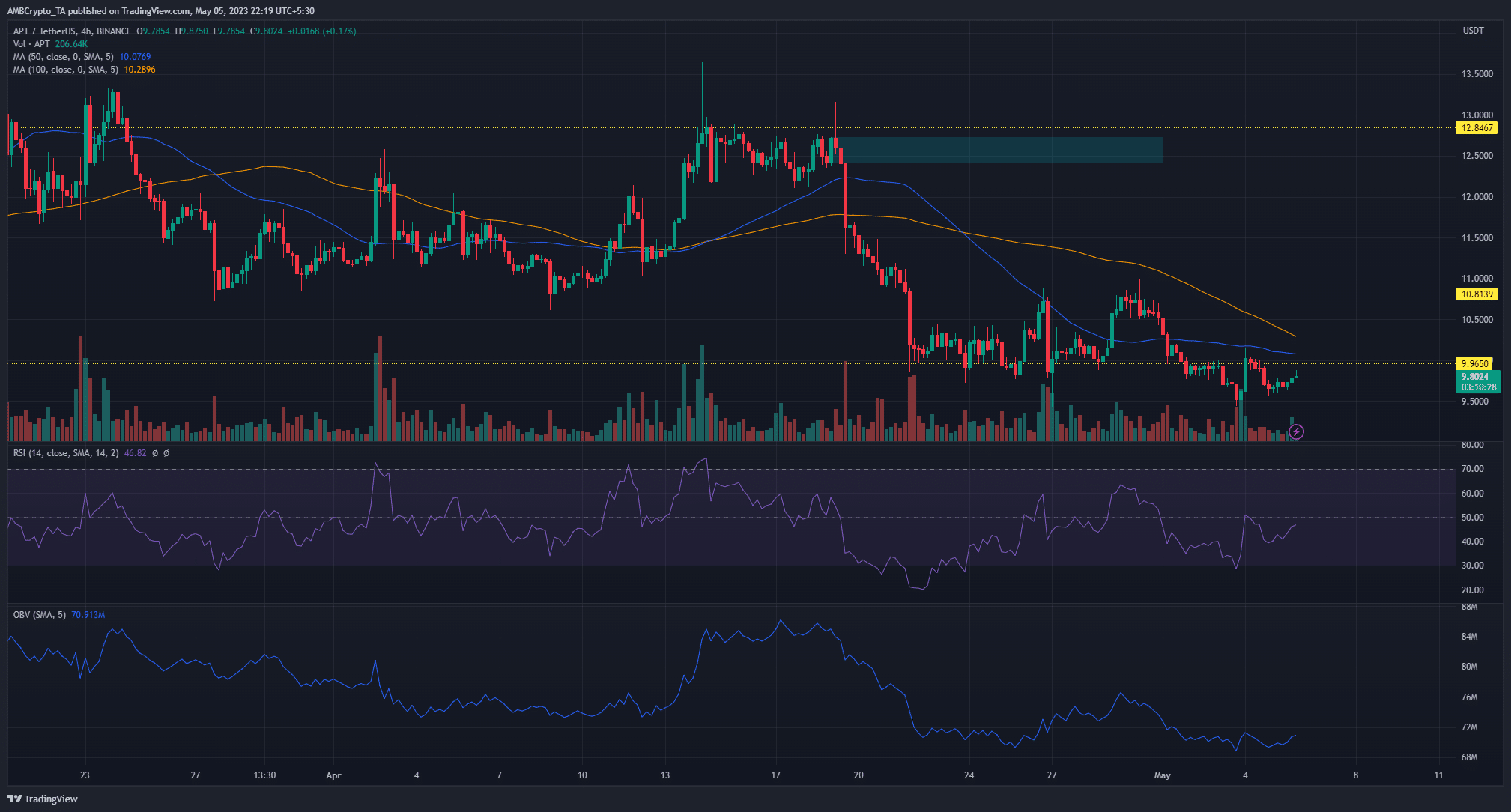

Over the past month, the price settled into a range where the $10.8 level acted as support and $13 as resistance on the four-hour timeframe. Selling pressure over the past 72 hours pushed the price below the $10 support with APT trading at $9.7, at press time.

The 50 and 100 SMA remained above the price, reaffirming the downward trend. The Relative Strength Index (RSI) also stood under the neutral 50 and lowering demand was reflected in the On-Balance Volume (OBV) declining by 7.04m.

A bullish breakout for Aptos from the current levels could target the $13 resistance. Alternatively, sellers could push the price lower, targeting January’s swing low of $7.5.

Is your portfolio green? Check APT Profit Calculator

Shorts reign supreme in the futures market

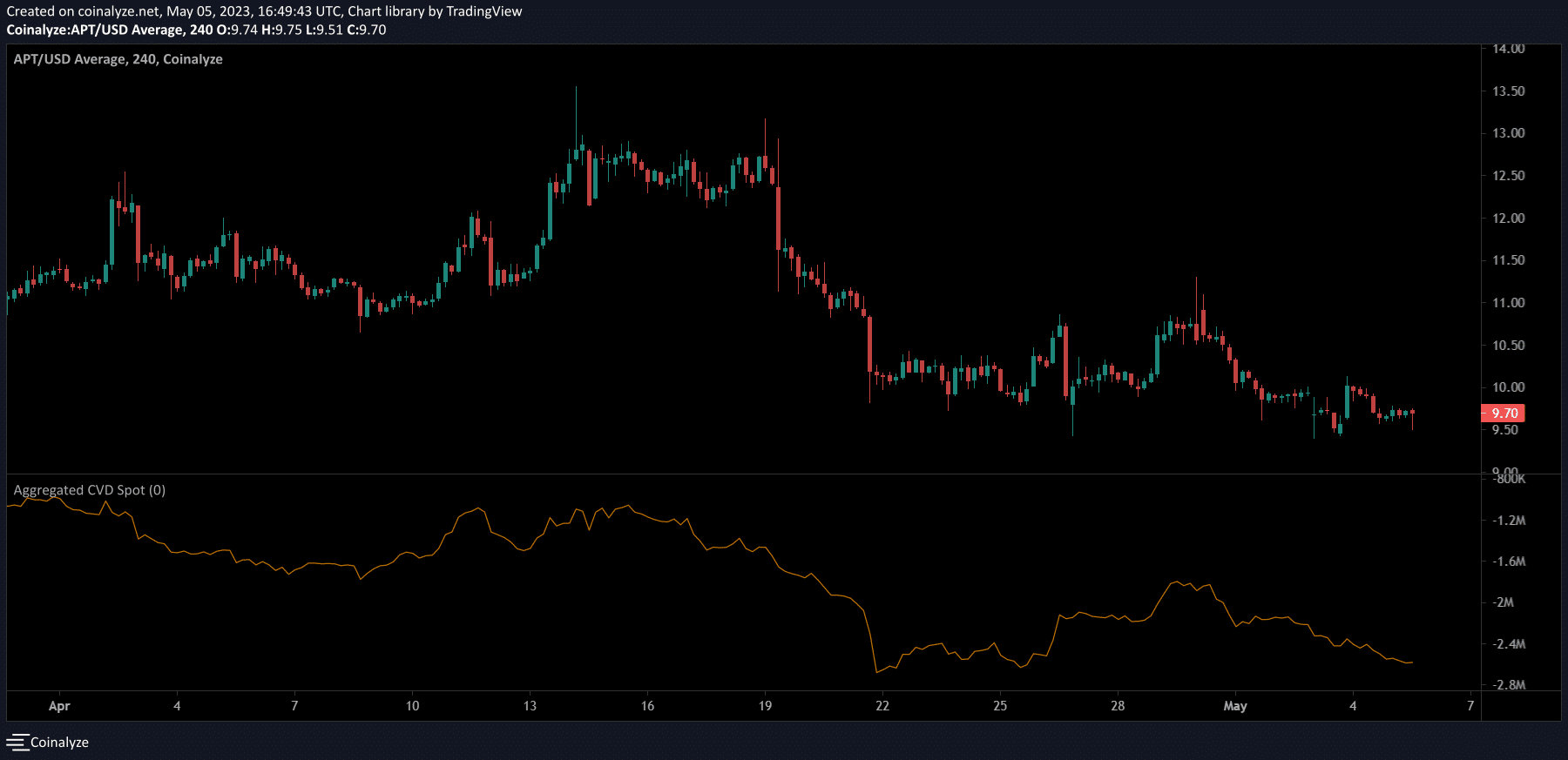

According to data from Coinalyze, the aggregated spot Cumulative Volume Delta (CVD) continued its decline, confirming the prevailing bearish sentiment

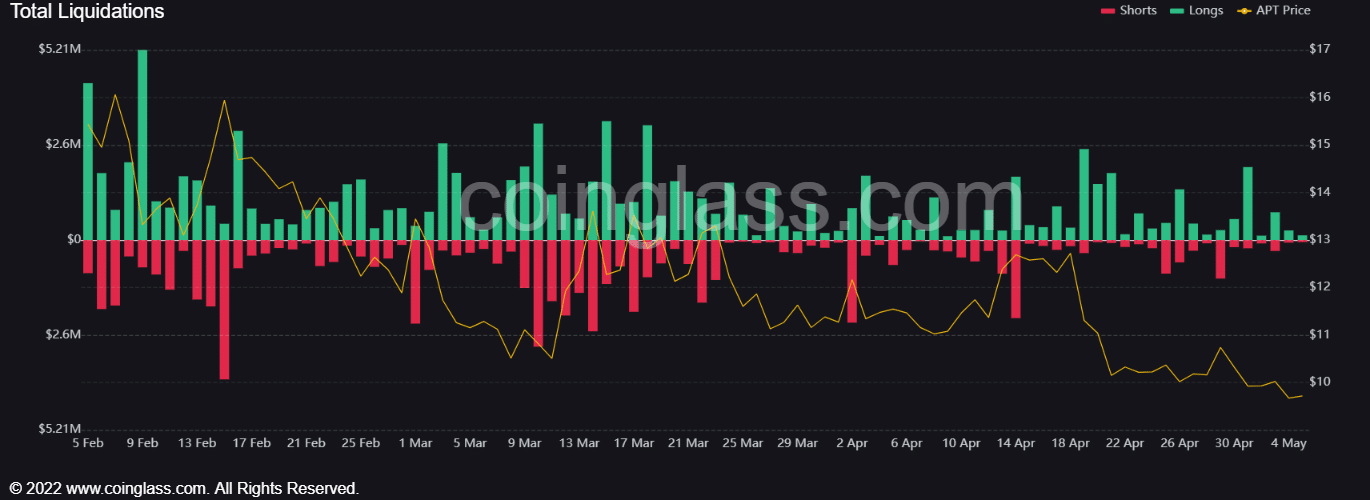

In addition, $3.26m worth of long positions were wrecked out of $4.07m total liquidations over a four-day period. On the other hand, short positions saw only $751.47k worth of liquidations, indicating longs were paying shorts.

Overall, sellers could be looking to extend their dominant position. However, BTC’s recovery could catch bears out. Traders should keep an eye on BTC’s price action alongside new developments around Aptos before making moves.