Aptos: Does APT’s surging metrics point to a price hike?

- Aptos’ network activity and user base were surging, signaling bullish momentum for future growth.

- Rising trading volume and open interest indicated increasing investor confidence and potential price gains.

Aptos [APT] has been making waves in the crypto market, experiencing significant on-chain activity that has captured the attention of both investors and analysts.

At press time, APT was trading at $8.85, reflecting a 4.72% increase in the last 24 hours.

These bullish indicators raise the question: Can Aptos maintain this momentum and drive its price to new heights?

APT’s network activity is surging, with transaction speeds reaching an all-time high of 1,051 transactions per second (TPS). This increase is crucial, as faster transaction speeds and enhanced network efficiency typically attract more users and investors.

Additionally, daily active accounts (DAA) hit a new peak of 3.75 million on the 3rd of October.

Consequently, Aptos’ growing user base suggests rising confidence in its ecosystem, which could lead to sustained price growth.

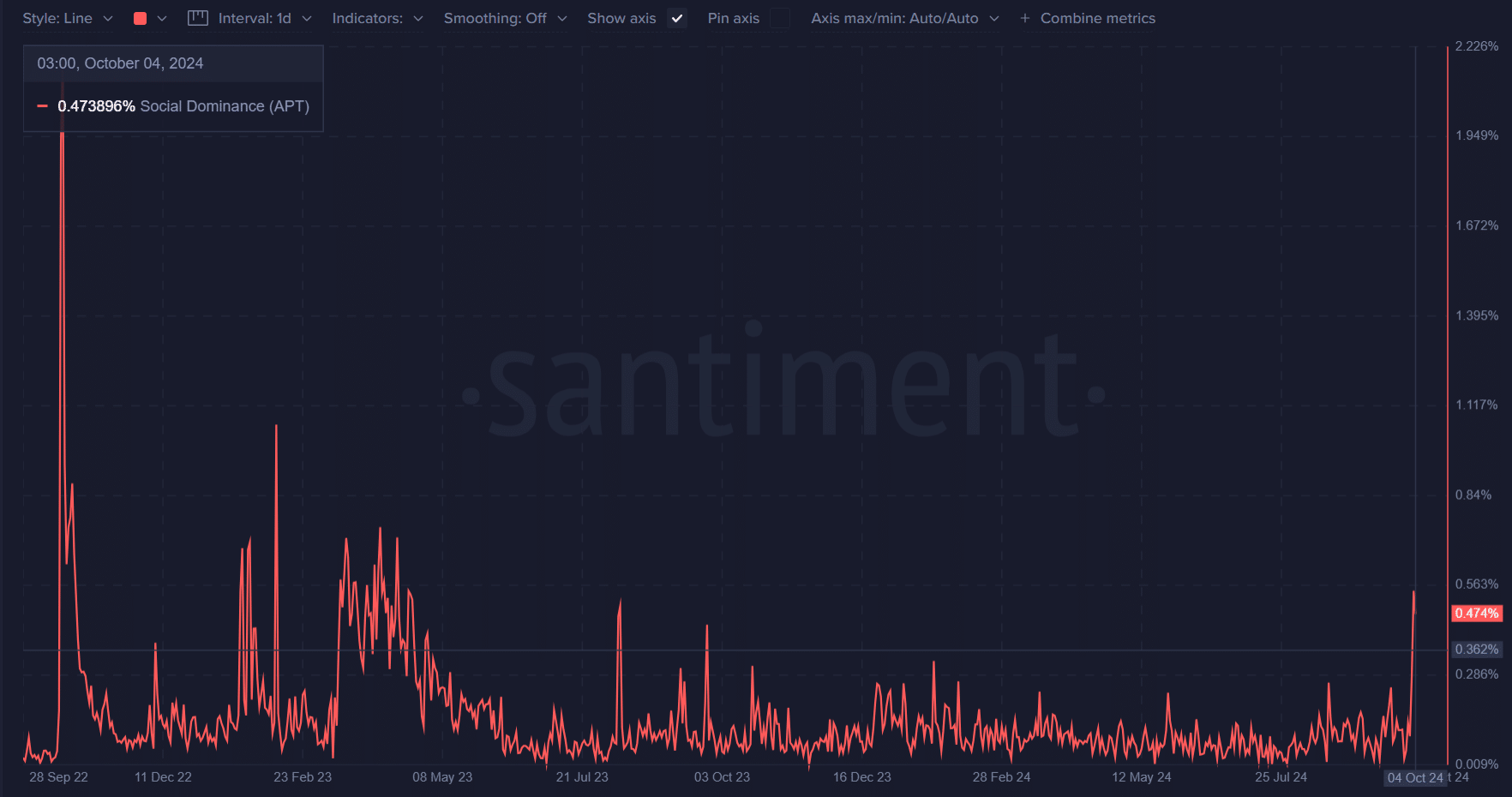

Aptos’ social dominance: What does it signal?

However, network growth alone does not paint the full picture. APT’s social dominance currently stands at 0.47%, indicating a rise in discussions surrounding the project.

Historically, an increase in social dominance has often preceded price surges, as more investors and traders begin to take notice.

Therefore, the current spike in social engagement could signal a positive shift in market sentiment, boosting APT’s visibility and price action.

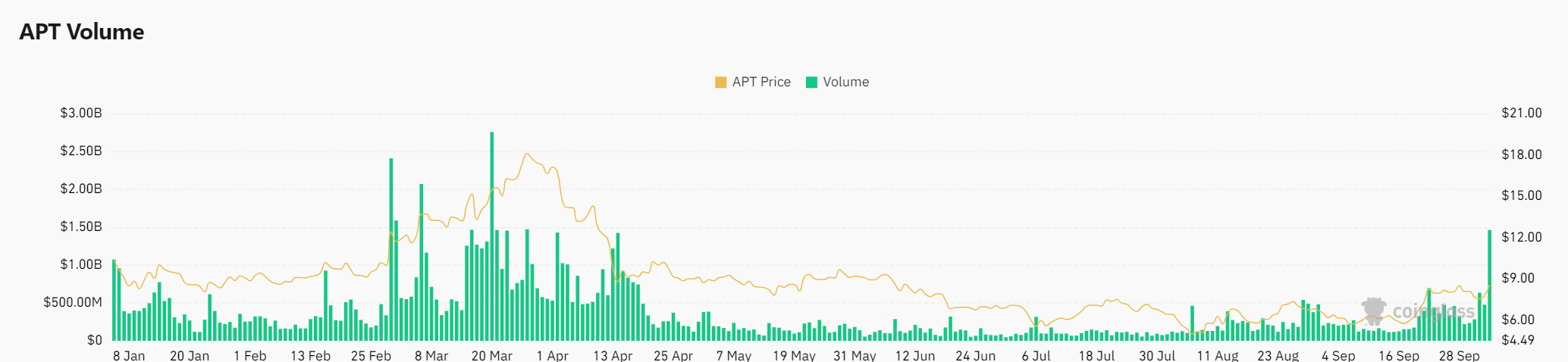

Aptos volume surge: Will it continue supporting price growth?

In addition to the network’s expansion, APT has experienced a massive 106.53% surge in trading volume, reaching $1.57 billion. This increase indicates heightened interest from traders, which could translate into further bullish price movements.

Moreover, the surge in volume demonstrates that Aptos is not only being talked about but is also being actively traded, a strong indicator of growing market confidence.

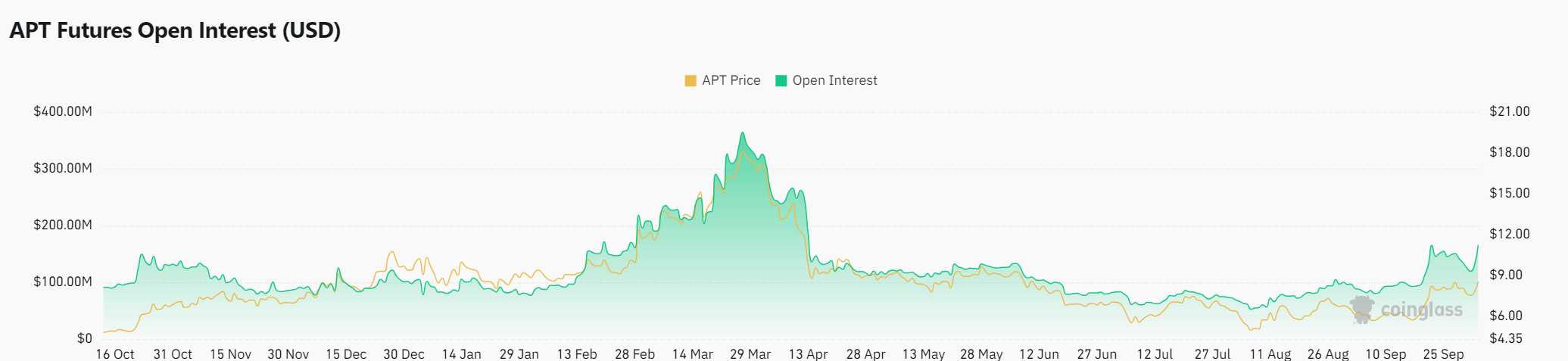

Open interest: Is more buying pressure on the horizon?

Furthermore, open interest in APT futures contracts has grown by 14.27%, now totaling $183.26 million. This rise in open interest typically indicates that more traders are taking long positions, betting on Aptos’ future price increase.

As a result, this increase could signal that buying pressure is building, potentially driving the price higher.

Read Aptos’ [APT] Price Prediction 2024-25

Considering the surge in network activity, rising social dominance, increased volume, and growing open interest, Aptos appears to be in a strong position for continued growth.

Therefore, the combination of these factors suggests that Aptos could sustain its bullish momentum and push toward higher price levels soon.