Aptos: Is a rebound possible for APT at key $8.09 level?

- APT is at a pivotal junction, with this support level likely to determine whether the asset trends upward or continues its decline.

- On-chain metrics reveal an aggressive sell-off from market participants, while broader indicators point to sustained selling pressure among traders.

In the past 24 hours, Aptos [APT] has suffered a significant drop of 6.61%, ranking it among the day’s top losers, according to CoinMarketCap data.

This downturn continues a bearish trend for APT, which has seen consistent sell-offs and a 10.05% decline over the past week.

At this critical point, APT could either recover from recent losses or extend its downtrend. AMBCrypto’s analysis provides further insights into potential outcomes for the asset.

Can the support level hold for APT?

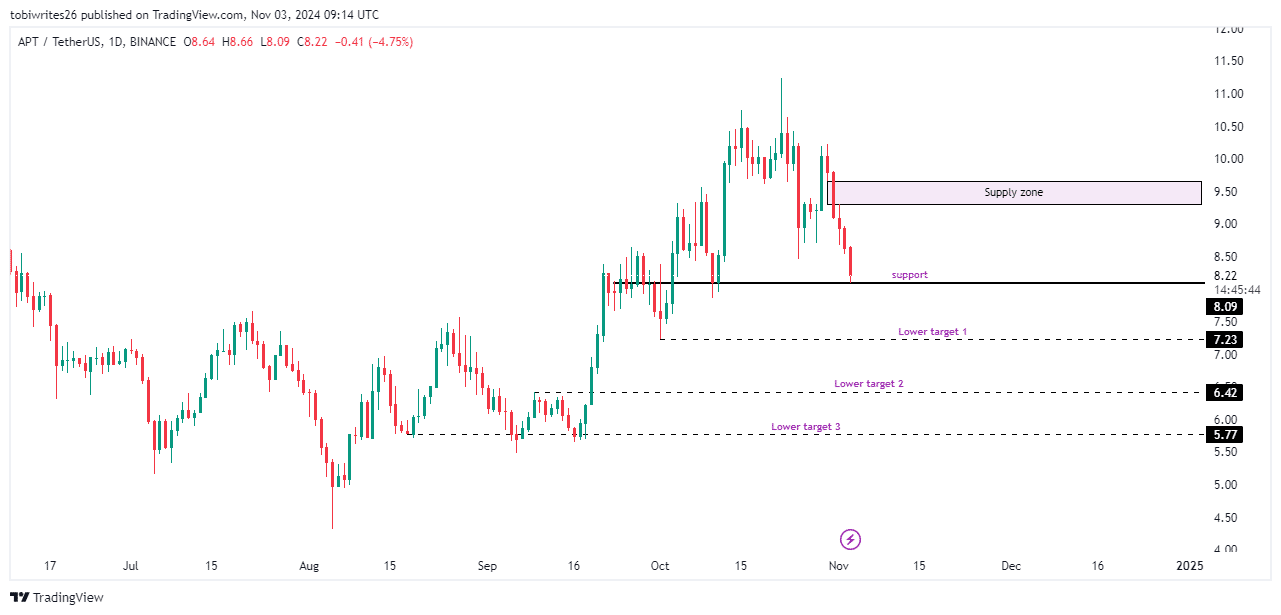

APT has reached a critical point on the chart that could determine whether it rebounds or declines further. This key support level is located at $8.09.

Typically, a support level should attract enough buying pressure to trigger a price recovery, though this isn’t always guaranteed. A bounce from here could drive the price back into a nearby supply zone before any cooling off.

If APT fails to hold this level, the next downside target is $7.23. Continued market interest decline could then lead to another drop toward $6.42 or even lower to $6.04.

APT on the edge as bearish pressure intensifies

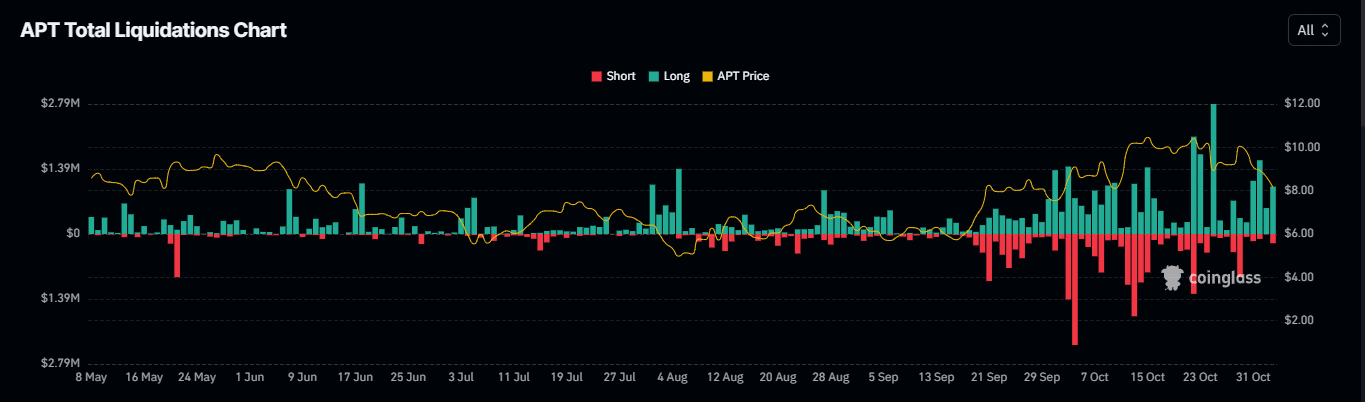

On-chain data from Coinglass reveals that APT may be nearing a significant downturn as intensified sell-off activity pressures its price downward.

Liquidation data—which gauges market direction by analyzing losses from long and short positions—indicates a prevailing bearish sentiment.

Over the last 24 hours, the market has seen $1.65 million in liquidations, with a staggering $1.45 million from long positions, suggesting that traders expecting a price rally were caught off guard.

Meanwhile, short liquidations amounted to just $202,370, pointing to the dominance of bearish pressure.

Declining Open Interest also signals a potential fall for APT. After peaking at $259.04 million on October 14, Open Interest has dropped to $168.96 million, reflecting waning buying interest.

Open Interest measures the number of active, unsettled derivatives contracts in the market. A sharp drop often suggests a rise in short positions as traders increasingly anticipate further declines for APT.

Demand for APT declines as Exchange Netflow rises

At the time of writing, APT’s Exchange Netflow has increased over the past 12 hours, indicating waning market confidence and contributing to the asset’s current price decline.

Read Aptos’ [APT] Price Prediction 2024–2025

Exchange Netflow measures the inflow and outflow of a cryptocurrency from exchanges. A positive Netflow suggests increased inflows, often signaling potential price drops as more tokens are available for sale.

In contrast, a negative Netflow indicates outflows, typically a bullish signal as supply on exchanges decreases. With APT’s positive Netflow, a further decline may be on the horizon.

![Bitcoin [BTC]](https://ambcrypto.com/wp-content/uploads/2025/06/Gladys-5-1-400x240.webp)