Aptos stablecoins gain $39.5 mln in 7 days: Impact on APT?

- Aptos TVL resumed its upward trajectory, but was overtaken by the network’s stablecoins market cap.

- APT bounced back over 60% from local lows, but has room for more upside.

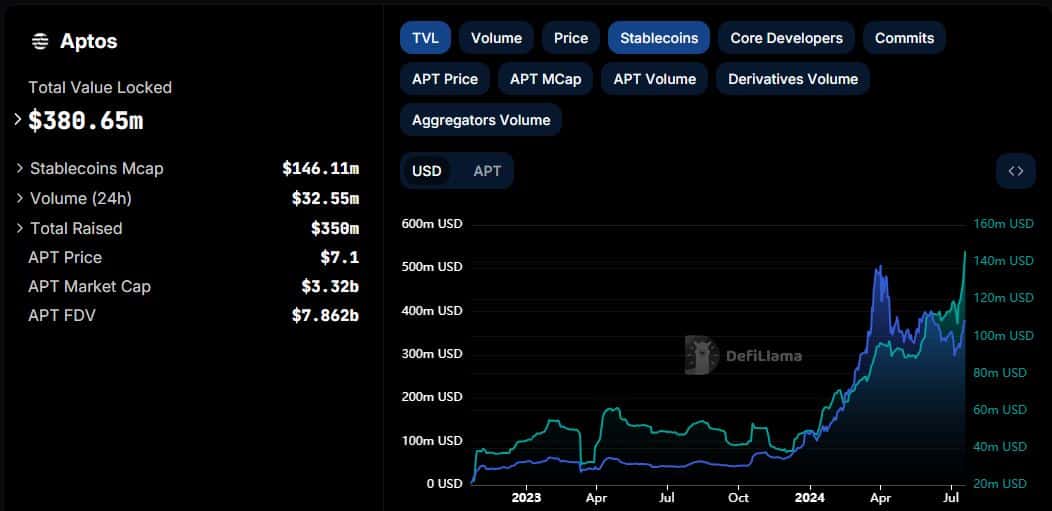

Total value locked (TVL) has been instrumental in underscoring Aptos’ [APT] growth. As is the case for many other crypto protocols, the TVL regressed since April, after previously indicating robust recovery in Q1 2024.

Aptos’ TVL slowed down between April and the first week of July, dropping from its year-to-date high of $429.66 million on the 1st of April. Roughly $124.04 million was withdrawn from the TVL up until the 6th of June.

The recent return of confidence into the market has triggered a positive TVL growth for Aptos. The latter stood at $380.65 million at press time.

Stablecoins flip TVL: What it means for Aptos

Aptos’ TVL growth hinted that investors were once again confident in the state of the market, hence the willingness to lock their funds in the protocol.

Aside from positive TVL, AMBCrypto also observed a surge in stablecoins on the network. Aptos had a stablecoins market cap of $146.11 million at the time of writing — a $39.5 million gain in the last seven days.

The surge allowed the Aptos stablecoins market cap to flip the TVL. The higher market cap to TVL ratio could indicate that investors are still cautious.

This is in light of the recent volatility, which would explain why many would choose liquidity. It may also signal lower DeFi engagement, but the upbeat trajectory offers some confidence.

Will APT maintain the bullish trajectory?

On the flip side, the stablecoins and TVL metrics both aligned with healthy growth. A reflection of the recovery we have seen in the last few days.

Aptos’ native cryptocurrency APT traded at $7.01 at press time after pulling off a 27% rally from its recent local lows.

APT was trading at a 63.9% discount from its YTD high at press time, despite the recent rally. This performance is largely a reflection of the overall state of the market.

In other words, APT’s price action will likely continue being swayed by the overall market sentiment. Nevertheless, it is still trading at a discount compared to previous highs.

Read Aptos’ [APT] Price Prediction 2024-25

APT’s closest major resistance level is just above the $10 price zone. The MACD indicator confirmed that the bulls have the advantage at press time.

The RSI also confirmed a similar observation, a sign that there was still room for more potential upside. APT had a market capitalization of $3.27 billion at the time of writing.

![Jupiter's [JUP] price action is 'stuck' - When will the market trend change?](https://ambcrypto.com/wp-content/uploads/2025/02/Jupiter-Featured-400x240.webp)