Altcoin

Aptos TVL hits ATH as APT targets 69% surge to $24 – Can it happen?

APT is positioned for a significant breakout, with forecasts pointing to a 67% rally that could push its price to $24.

- Aptos’ Total Value Locked (TVL) recently hit a lifetime high of $1.09 billion, signaling increased adoption and investor confidence.

- APT has formed a cup and handle pattern—a reliable technical indicator of potential upward momentum.

While Aptos’ [APT] monthly performance showed a modest 26.58% gain, momentum seemed to be building.

A 5.42% surge in the last 24 hours marks the beginning of what could be a sustained rally, driven by growing market optimism and favorable sentiment.

Insights from AMBCrypto highlighted key factors behind this trend, suggesting that APT’s current trajectory could soon lead to substantial gains.

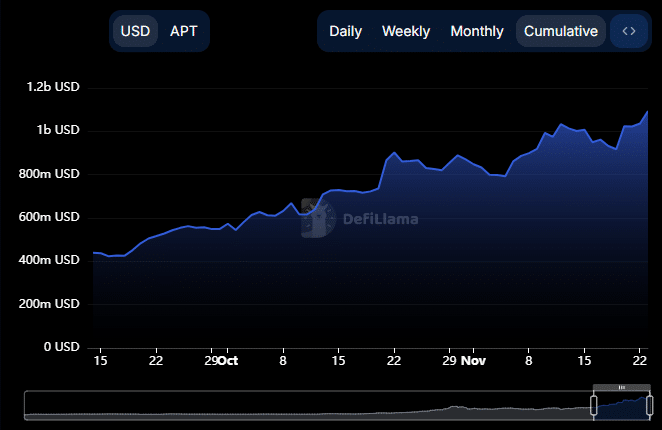

APT TVL reached a record $1.097 billion

Recent data from DeFiLlama revealed that APT’s Total Value Locked (TVL) has hit a new all-time high of $1.097 billion, which highlighted a growing market strength and investor confidence in the asset.

For the uninitiated, TVL measures the total capital locked within a protocol or platform, typically in cryptocurrency. It serves as a critical indicator of liquidity and platform adoption.

APT’s record-breaking TVL reflected strong bullish sentiment, often associated with increased liquidity and heightened buying activity.

This surge not only reinforces APT’s market appeal but also signals the potential for further price growth as demand intensifies.

Bullish sentiment drives liquidity surge

Recent data from Coinglass highlighted a sharp increase in liquidity flow into APT, fueled by heightened activity in the derivatives market.

The Funding Rate, which measures payments between long and short positions, has climbed to a yearly high of 0.0450%, reflecting strong bullish sentiment among traders.

At press time, the Funding Rate showed that long traders were dominating the market, sustaining upward momentum.

Open Interest has also seen a notable rise, increasing by 1.73% to $279.77 million. This surge suggested growing trader participation and optimism about APT’s potential rally.

The combination of a positive Funding Rate and high Open Interest reinforces the market’s confidence in the asset’s bullish trajectory.

APT eyes $24

As the market prepared for a potential rally, APT showed strong technical signals. The asset was forming a cup and handle pattern at press time, a formation often associated with significant price increases.

If this pattern completes as expected, APT could see a 69.79% gain, propelling its price to the $24 mark—an important level last reached in its debut week in October 2022.