Altcoin

Aptos wants a bigger piece of the Bitcoin pie with this update – Explained

Aptos has embraced Echo protocol, but is it of any value?

- Aptos’s latest move is aimed at boosting network activity through Bitcoin

- APT’s bullish recovery brought it closer to concluding August in the green

Aptos has been busy expanding its DeFi ecosystem to leverage more organic growth. In fact, its latest announcement highlights its plan to tap into more opportunities through Bitcoin.

Aptos has announced that Bitcoin holders can bridge their BTC to the blockchain courtesy of its new collaboration with Echo Protocol. The collaboration allows Echo to roll out on Aptos. Thanks to this development, Bitcoin holders can swap their BTC for aBTC, which they can use for yield farming.

A potential impact of this development is that it may end up boosting network activity on the Aptos blockchain. Other networks such as Solana have been taking advantage of high yield offerings in DeFi to boost network activity.

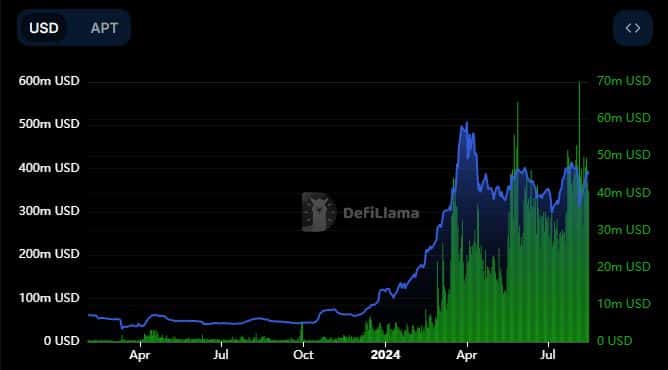

The Aptos network has seen a surge in activity so far this year. This can be evidenced by its TVL growth over the last 12 months, which was less than $100 million and has since soared to $407 million. This surge was accompanied by a hike in on-chain volume too.

Aptos’ daily on-chain volume has held steady above $30 million so far this month. For comparison, the network averaged less than $1 million in daily on-chain volumes in August 2023.

APT set to close August in the green

Aptos’ native cryptocurrency APT has been on a bullish recovery trend since 5 August. The recovery has increased the chances that APT would close the month higher than its opening price ($6.41). The cryptocurrency embarked on a retracement earlier this week though, threatening to deliver a red August.

APT’s price action bounced back by 6.25% in the last 24 hours though, to a price level of $7.25 – Likely as a reaction to news about the collaboration with Echo protocol. This means the cryptocurrency is once again trading higher than its August opening price.

On the charts, APT’s RSI indicator remained above its mid-level, confirming that the current bullish momentum remains strong. This is perhaps why it managed to bounce back quickly. It also underlines the possibility that APT may continue rallying, in which case it will close August in the green if it maintains that momentum until the end of the month.

Zooming out, APT is still trading at a more than 60% discount from its current YTD high. What this means is that the cryptocurrency is still heavily oversold on a wider scale – A view that may further strengthen its bullish outlook on the charts.