Aptos welcomes USDT: Could this drive TVL to the $1B milestone?

- Aptos readies for faster expansion of its DeFi segment now that it has embraced USDT natively.

- APT price demonstrates robust demand at key Fibonacci level. Why the next few weeks might be extremely bullish.

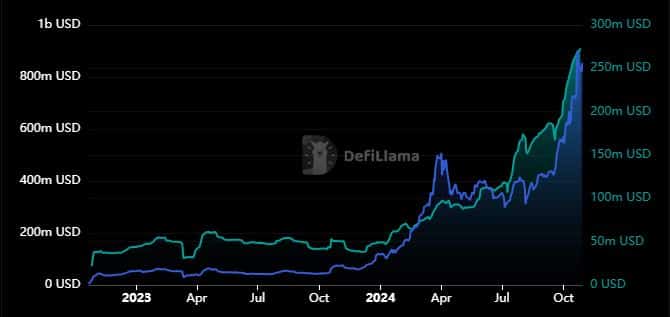

Aptos [APT] TVL briefly soared above $900 million on 22nd October, and this is the first time that it has come close to the illusive $1 billion TVL. However, that might soon change following the network’s latest announcement.

Aptos has announced that the USDT stablecoin is finally coming to its mainnet. The official announcement revealed that this was part of the network’s plan for deeper involvement in global payments.

The addition of USDT into the Aptos ecosystem may bring various benefits such as boosting DeFi growth and attracting more users. These benefits may also bootstrap Aptos TVL growth. The latter has been steadily growing and closing in on the $1 billion mark.

The total value locked in the Aptos ecosystem was $855.43 million at the time of writing. It peaked above $900 million just a week ago. Having USDT in the Aptos ecosystem may help propel the TVL above $1 billion.

Aptos stablecoin marketcap also performed quite well even before the USDT integration. It grew from less than $50 million at the start of 2024 and recently soared to a new ATH of $273.36 million. Analyst anticipates new highs in Aptos stablecoin marketcap.

APT price action recap

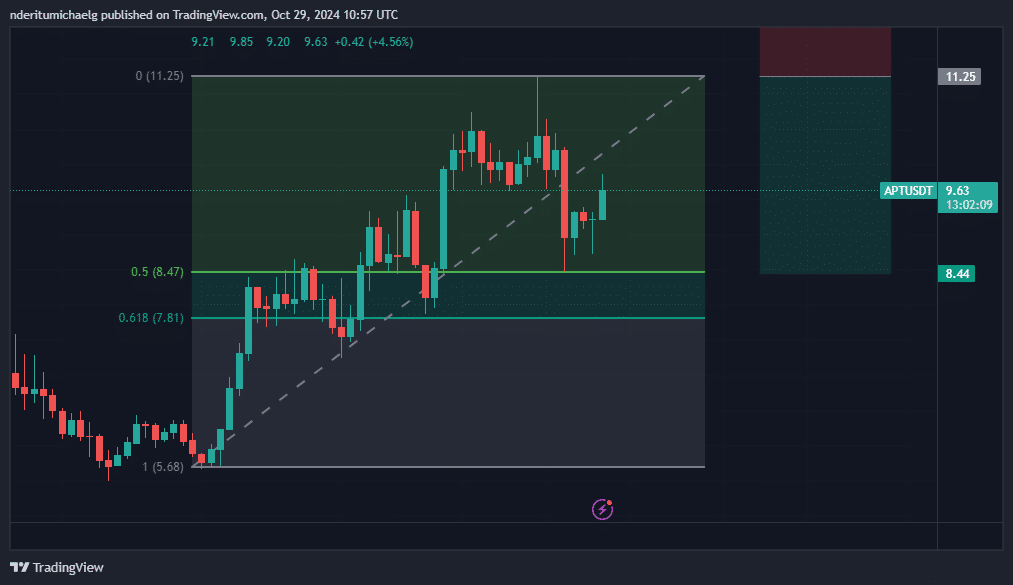

APT pulled back by 25% from its weekly high last week, during which it peaked at $11.24. It recently bottomed out at $8 on 25th October, Friday, but has since then experienced some accumulation.

APT traded at $9.66 at the time of writing, which was a 13% recovery from its lowest price level on Friday. This recovery signals strong the return of strong demand at significant levels.

Fibonacci retracement indicated that the bearish pullback would likely occur between $7.81 and 8.47. This was based on the start of the September/October uptrend to the latest peak last week. The price pivoted after briefly entering the upper limit, followed by an immediate return of bullish momentum.

Read Aptos’ [APT] Price Prediction 2024–2025

APT bulls also regained activity after the price briefly dipped below its 50% RSI level. This outcome confirmed that the momentum observed in the last 4 weeks was still at play.

Note that the longer term price action has been building up towards the formation of a cup and handle pattern. This suggests that it could be about to experience another massive uptick in the coming weeks, especially if the overall market conditions turn extremely bullish.