Arbitrum [ARB] dApps show growth, but protocol has a long road ahead

![Arbitrum [ARB] dApps show growth, but protocol has a long road ahead](https://ambcrypto.com/wp-content/uploads/2023/03/AMBCrypto_The_image_depicts_a_group_of_people_climbing_a_mounta_eaa2c6a0-be9d-471a-b541-8cc28f8ba3b7-e1680000104512.png)

- Arbitrum’s dApps observed high activity on its network.

- However, the overall state of Arbitrum returned to normal as the AirDrop hype died down.

Arbitrum [ARB] has been receiving a lot of attention due to its recent token AirDrop. The dApps on the Arbitrum network seem to have taken advantage of this attention as many of them observed growth after the AirDrop.

Is your portfolio green? Check out the ARB Profit Calculator

Santiment’s data revealed that Stargate, a DeFi protocol operating on the Arbitrum network, experienced a significant increase in its network growth despite a 51% decrease in the value of its token STG.

? #Stargate's network growth on #Arbitrum managed to hit an #AllTimeHigh yesterday despite its -51% price retrace since its Feb 18th top. Our latest insight discusses the Stargate DAO active voting as a likely contributor, and its high risk/reward nature. https://t.co/tcCFElDy2m pic.twitter.com/kpV6JKhRPv

— Santiment (@santimentfeed) March 28, 2023

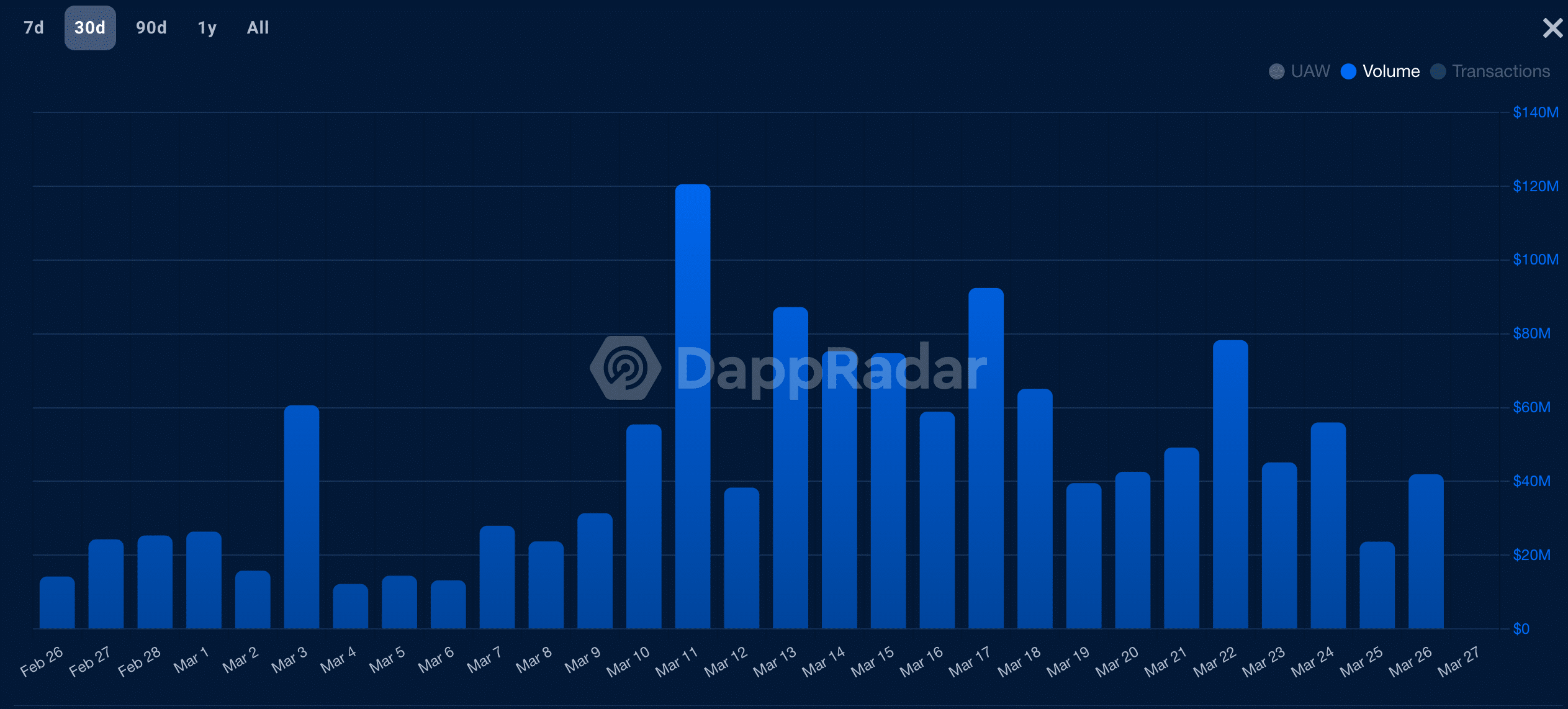

Another dApp that witnessed growth was GMX. According to Dapp Radar, the overall volume on the GMX protocol increased by 6.72% in the past 30 days. During this period, the number of unique active wallets on the GMX network also increased.

These developments led to a 28.6% surge in the TVL of Arbitrum last week, according to data provided by L2Beats.

Still a long way to go

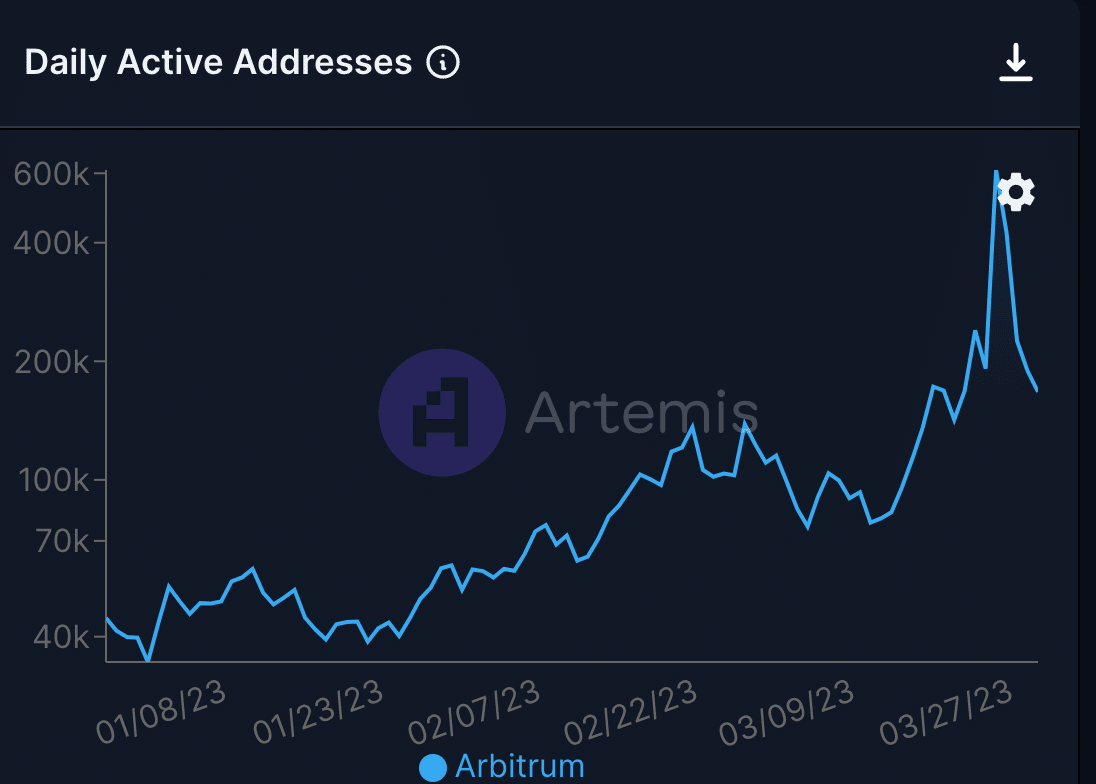

However, the growth of the aforementioned dApps wasn’t reflected by the Arbitrum network. According to Artemis’ data, the daily activity addresses on the network declined materially over the last few days, falling from 611,000 addresses to 167,300 addresses at press time.

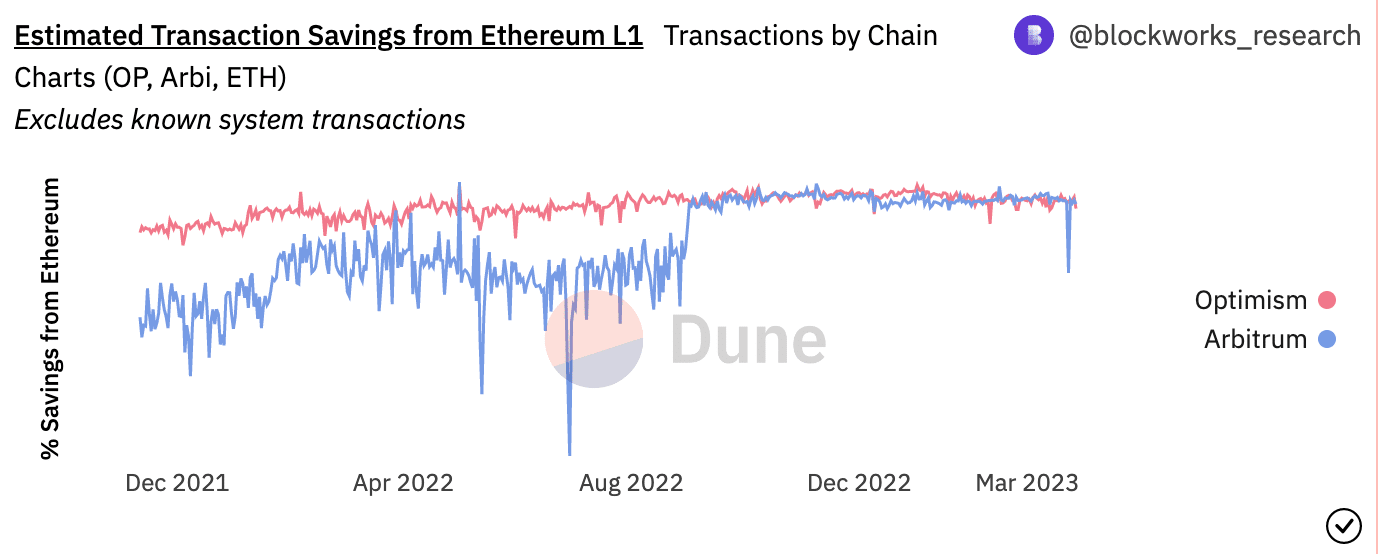

This decline in activity was observed despite Arbitrum offering lower transaction fees to its users, which helped them save higher amounts of ETH on each of their transactions. According to Dune Analytics’ data, Arbitrum outperformed other L2 solutions like Optimism in terms of savings provided to users.

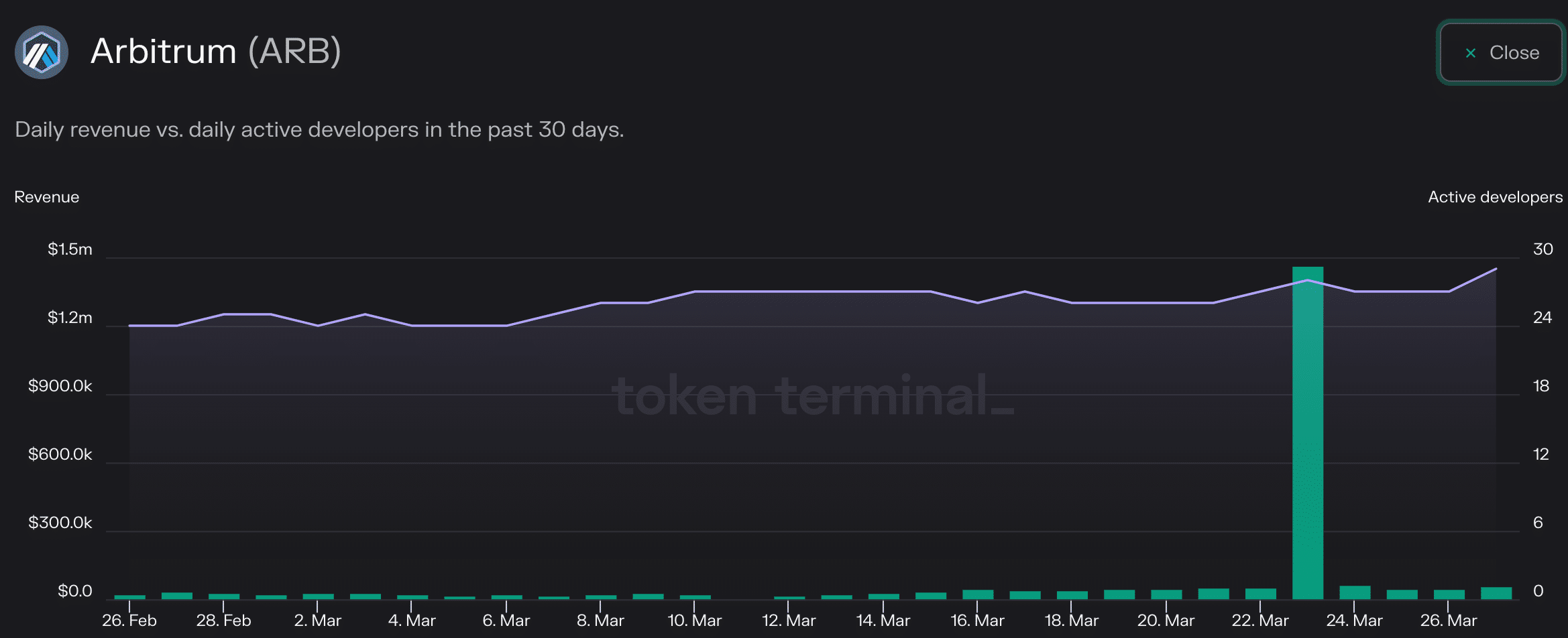

Even though there was a decline in activity on Arbitrum, there wasn’t much of an impact on the revenue that was being generated. According to Token Terminal’s data, the revenue rose by 22.7% in the last 24 hours.

Realistic or not, here’s ARB’s market cap in BTC’s terms

The number of active developers on the network spiked during this period as well. This indicated that Arbitrum was capitalizing on the renewed attention on its network to roll out new upgrades and updates on the network.