Arbitrum: Here’s why bulls may have their eyes fixed on the L2 ecosystem

- The Arbitrum TVL has outrightly outperformed others in the last month.

- Whales accumulated some tokens under the chain showing buying opportunities.

Layer-two protocol (L2) Arbitrum has been one of the eye-catching revelations of the crypto ecosystem despite the turbulence that hit the market in 2022.

While it may have gained the attention of many investors, the Ethereum [ETH]-scaling solution was almost always at loggerheads with its competitor Optimism [OP].

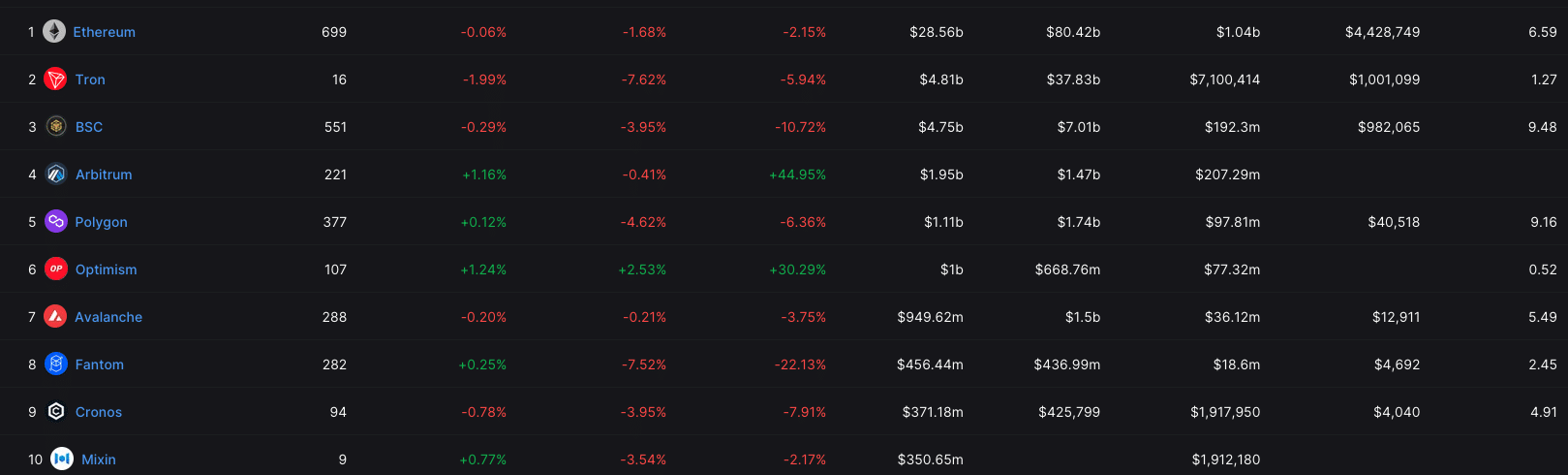

However, Arbitrum seems to be winning the race due to its position as per Total Value Locked (TVL). The TVL simply represents the number of assets being staked in a protocol.

At press time, the Aritbrum TVL was $1.95 billion. This ensured that the protocol was fourth on the list behind Ethereum, Tron [TRX], and the Binance Smart Chain.

Big bulls eye the opportunity zone

But a notable stride with the Arbitrum TVL is how it has outperformed every other chain in the DeFi space. According to DeFi Llama, the optimistic rollup scaling solution had gained 44.95% in the last 30 days. This implied that there had been more unique deposits into Arbtirum than any other protocol.

This noteworthy improvement could also have been vital to the reception tokens under the Arintrum ecosystem have received. And this is not just limited to retail investors.

According to Lookonchain, a whale accumulated Gains Network [GNS], and Genaro Network [GNX].

A whale bought 28,762 $GMX ($1.9M) and 59,064 $GNS ($420K) from #Binance in the past week, then staked $GMX and $GNS.

The whale is bullish on the #Arbitrum ecosystem and bullish on decentralized #derivatives projects.https://t.co/m1FxWtrt9y pic.twitter.com/HCMmzQymDV

— Lookonchain (@lookonchain) March 6, 2023

An action like this suggests that the whales trust the Arbitrum ecosystem strides to drive the tokens to greens. Also, both tokens have significantly decreased in value over the last month.

While GNX shredded 9.67%, GNS decreased 11.90% in the last seven days. Hence, the intent could reflect a possible buying opportunity.

Crests and troughs but Arbitrum stays the course

Furthermore, the contracts created under the Arbitrum ecosystem were 118200 at the time of writing. Cumulatively, the metric stood at 1.7 million.

This metric defines the rate at which readable smart contracts are being developed but the data showed that the momentum has not been exceptional.

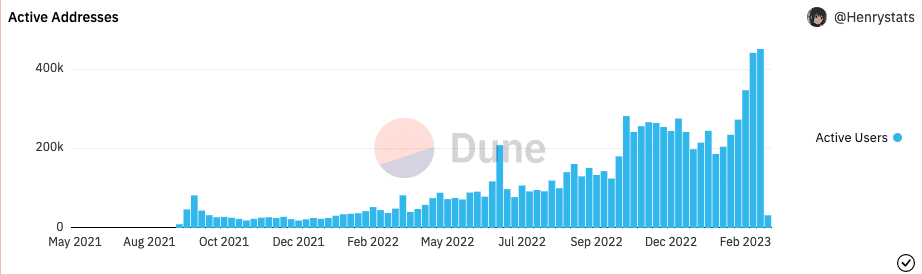

However, one part that may have driven the belief in Arbitrum is the active addresses. The active addresses measure the number of unique daily interactions or speculation concerning an asset.

At press time, Dune Analytics revealed that the Abritrum active addresses were 32090. But the metric has been on an incredible rise such that it hit an All-Time High (ATH) in February.

Meanwhile, the Arbitrum network has continued its layer-two functionality, scaling Ethereum-compatible smart contracts and ensuring validators process transactions on the second-layer chain.