Arbitrum Vs Optimism: Taking a look at who dominates the L2 sector

- The L2 sector continued to see high activity; Arbitrum and Optimism showed improvements.

- Interest in tokens went on declining and prices fell.

The Layer 2 (L2) space observed an increasing amount of traction over the last few days. With growing developments and fast-paced growth, protocols such as Arbitrum [ARB] and Optimism [OP] showed improvements in many areas.

Read Optimism’s Price Prediction 2023-2024

As a result, there was high activity observed on the Arbitrum network. It also performed well on the Uniswap network, one of the largest DEX in the DeFi sector.

Initially, only Ethereum was responsible for the majority of the volume on the DEX. However, as interest in Arbitrum increased, the overall volume dominance of the Uniswap protocol has grown.

The ultimate comparison!

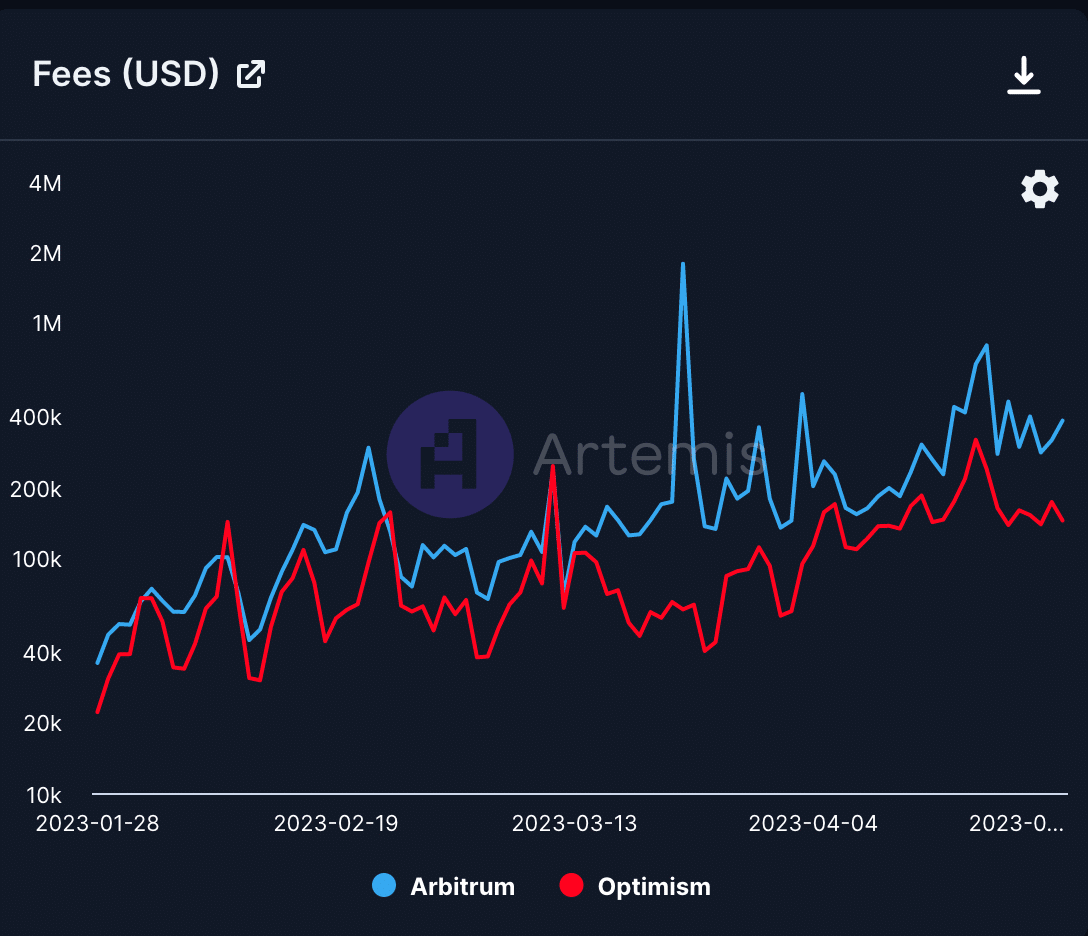

According to Artemis’ data, the fee generated on both Arbitrum and Optimism grew significantly over the last few months due to high activity. The recent attention garnered by Arbitrum helped the protocol outperform Optimism.

However, other recent developments on Optimism may help the protocol get back in the race with Arbitrum.

According to new data provided by Delphi Digital, Kwenta, a trading platform utilizing Synthetix on the Optimism network, was consistently processing a daily volume of $100 million.

The rapidly improving dApps on the network could provide benefits to the overall Optimism ecosystem in the long run.

Source: Dune Analytics

Even though the progress of dApps on the Optimism network may attract new users, the protocol needs to improve its ability to maintain the users on its platform.

According to Dune Analytics’ data, the Optimism protocol was having difficulty in retaining both long and short-term users. On the other hand, Arbitrum managed to do relatively well in this regard.

Is your portfolio green? Check out the Arbitrum Profit Calculator

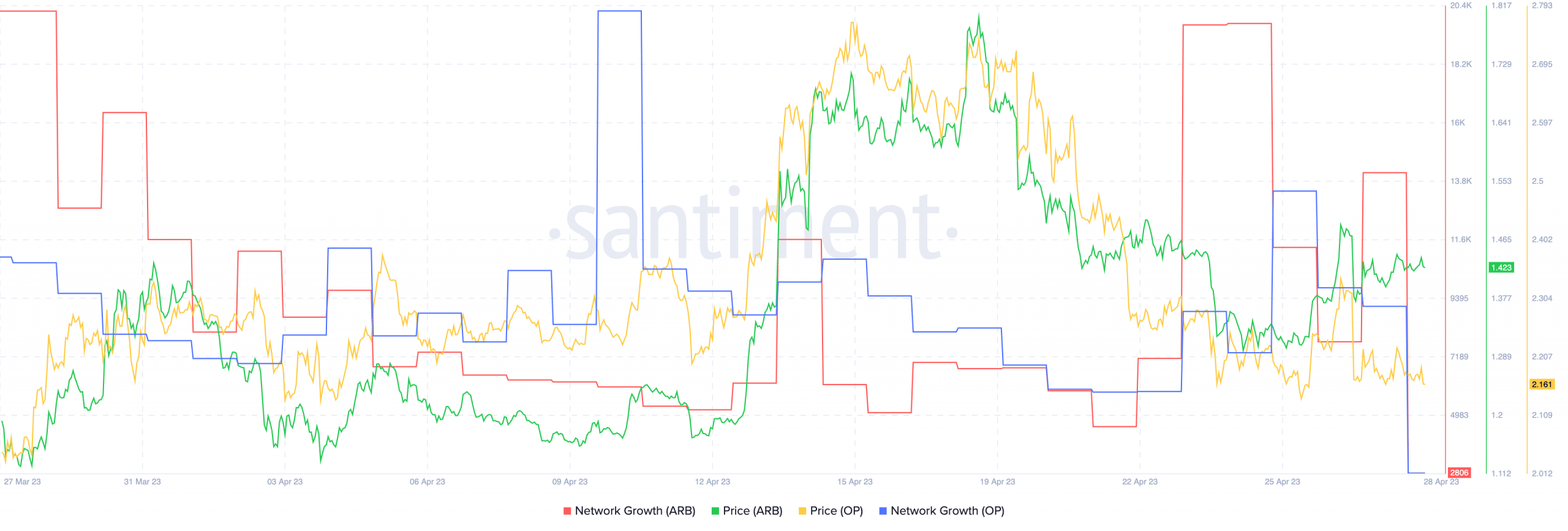

In terms of the tokens, it appeared that the crypto community has lost faith in both of the protocols. Both OP and ARB witnessed a decline in prices.

Additionally, the network growth of both protocols fell as well, suggesting that new addresses were beginning to lose interest in these tokens.