Are AI tokens outpacing memecoins? Analyzing the shift in investor sentiment

- If Bitcoin stabilizes at current levels, risk-on sentiment could drive further capital inflows into speculative assets.

- Will AI tokens finally capture the momentum or will memecoins steal the spotlight?

AI tokens have surged 8% on average, with market capitalization climbing 5%, signaling renewed investor interest in AI-driven blockchain projects.

Meanwhile, memecoins have gained 7%, maintaining their speculative dominance.

With the market approaching key resistance, risk appetite remains high. Will capital rotation sustain AI’s breakout momentum, or will memecoins continue absorbing liquidity at cycle peaks?

Hype vs. utility – Where will investor conviction lie?

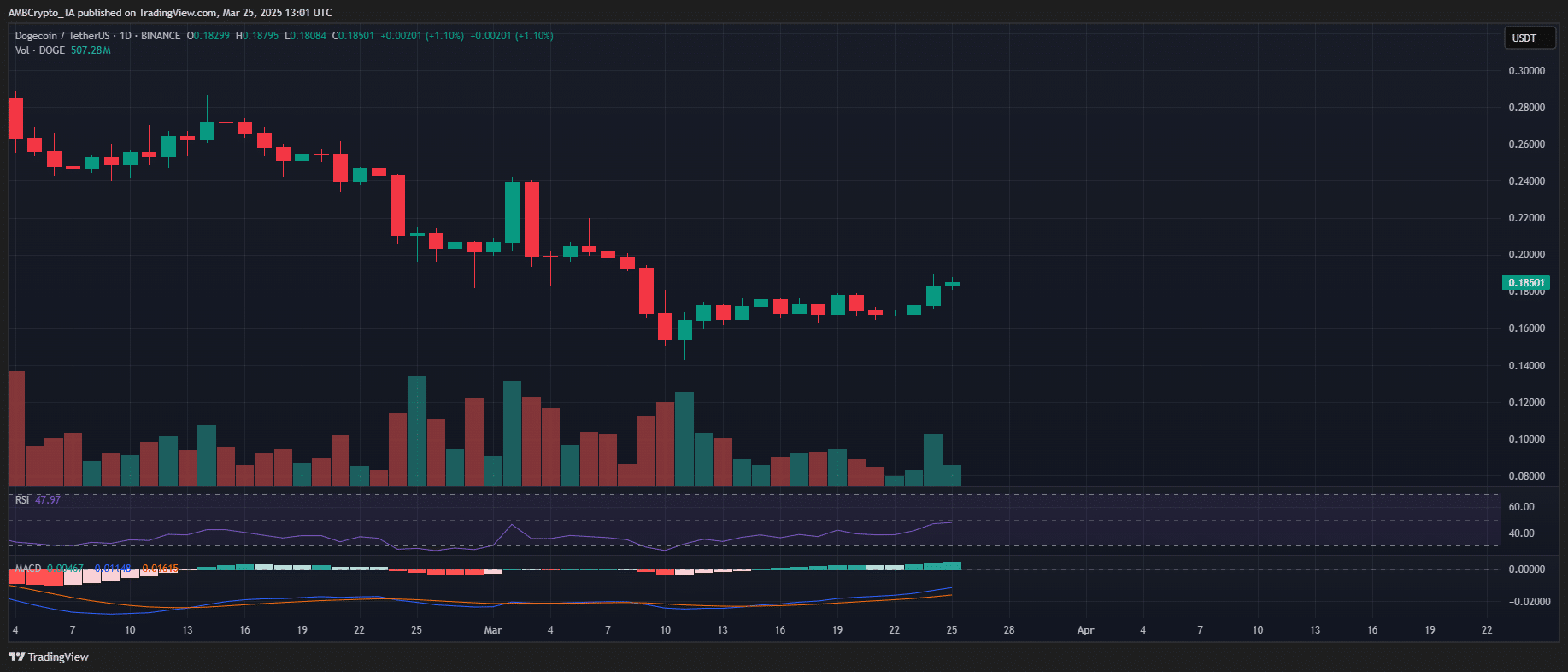

Two of the top four weekly gainers are memecoins. This surge aligns with Bitcoin’s brief reclaim of the $88k level, only to face a subsequent 3.06% pullback, demonstrating volatility within the market structure.

Dogecoin’s [DOGE] double-digit weekly surge reinforces the high-risk, high-reward dynamics currently driving the market, where traders are chasing volatility for potential upside.

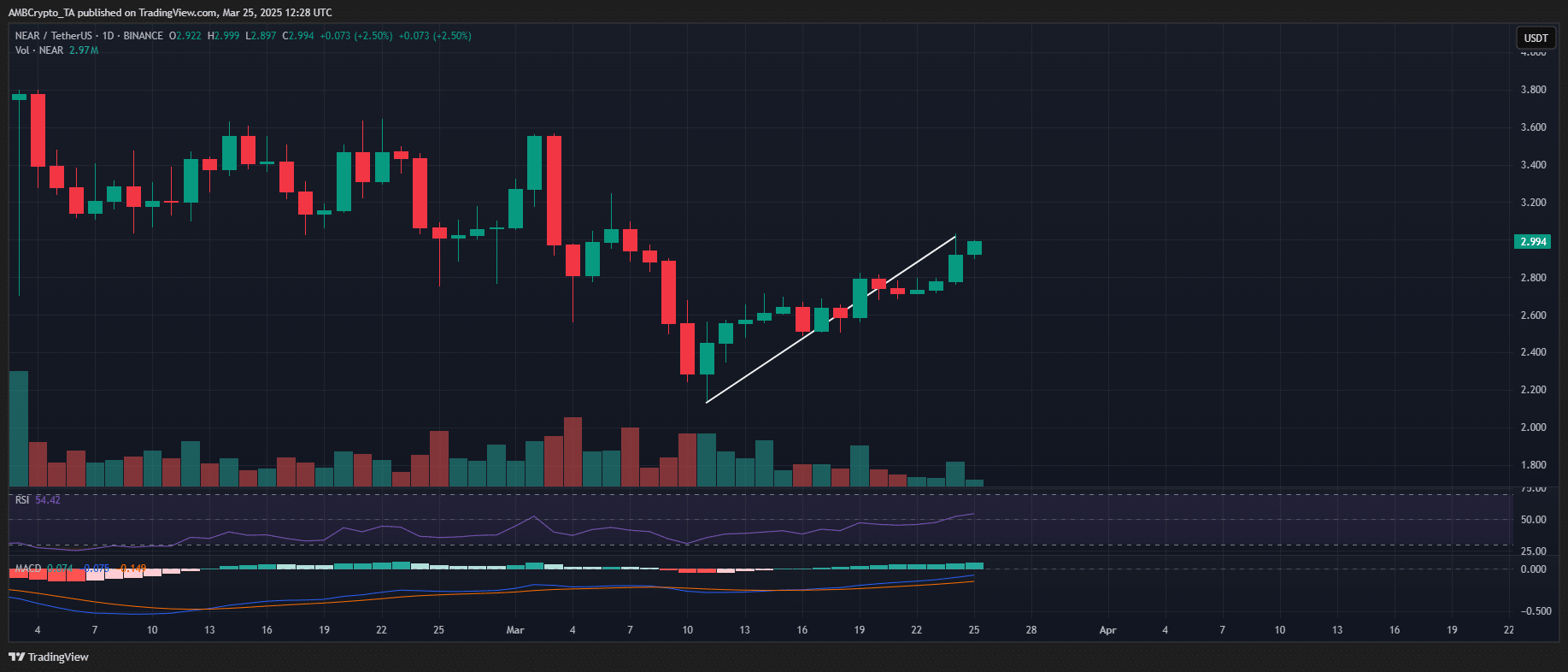

Simultaneously, the AI tokens are seeing increased bullish momentum. Near Protocol [NEAR], the leading AI-based token with a market cap surpassing $3 billion, achieved an 18% weekly price appreciation.

In a comparative analysis of the two-week price action, however, NEAR showed a more robust bullish trend, positioning it as the stronger performer relative to DOGE.

Since the 11th of March, NEAR has consistently rallied, clearing two key resistance levels and reclaiming the $3 psychological barrier.

With the RSI remaining in neutral territory, the asset is not showing signs of overbought conditions, indicating that the current uptrend is likely to remain intact, provided Bitcoin [BTC] consolidates within a defined range.

AI tokens : New speculative frontier over memecoins?

AI tokens like NEAR, with a total supply of 1.19 billion, offer a more controlled supply dynamic compared to memecoins like DOGE, which has an inflated circulating supply of 148.57 billion.

This limited supply reduces inflationary risks and supports long-term value retention. In contrast, meme coins often rely on speculative demand and community “hype”, making them more vulnerable to volatility.

DOGE, despite extensive endorsements, whale activity, and substantial social media presence, has struggled to breach the $1 price level.

With AI tokens gaining traction and exhibiting increased social dominance, memecoins may be losing their speculative appeal that typically drives “supercycles” during market peaks.

This shift towards AI projects suggests a change in market sentiment, with more capital moving into assets that have clear utility and real-world use cases.