Are Bitcoin exchanges helping BTC turn bullish? Key data says…

- Bitcoin saw higher exchange outflows compared to inflows as demand started to recover.

- Derivatives remained weak as Micro strategy led the charge in the spot market.

The sell pressure we witnessed in Bitcoin [BTC] this week might be short-lived. New data suggested that the pace at which BTC is flowing out of exchanges is starting to accelerate.

AMBCrypto’s previous analysis suggested that Bitcoin would likely experience a resurgence of buying pressure between the $59,896 price point and $61,801.

However, a pullback on the 1st of August signaled growing buying pressure. This prompted a glance at on-chain data, which confirmed that Bitcoin’s demand was rising once again.

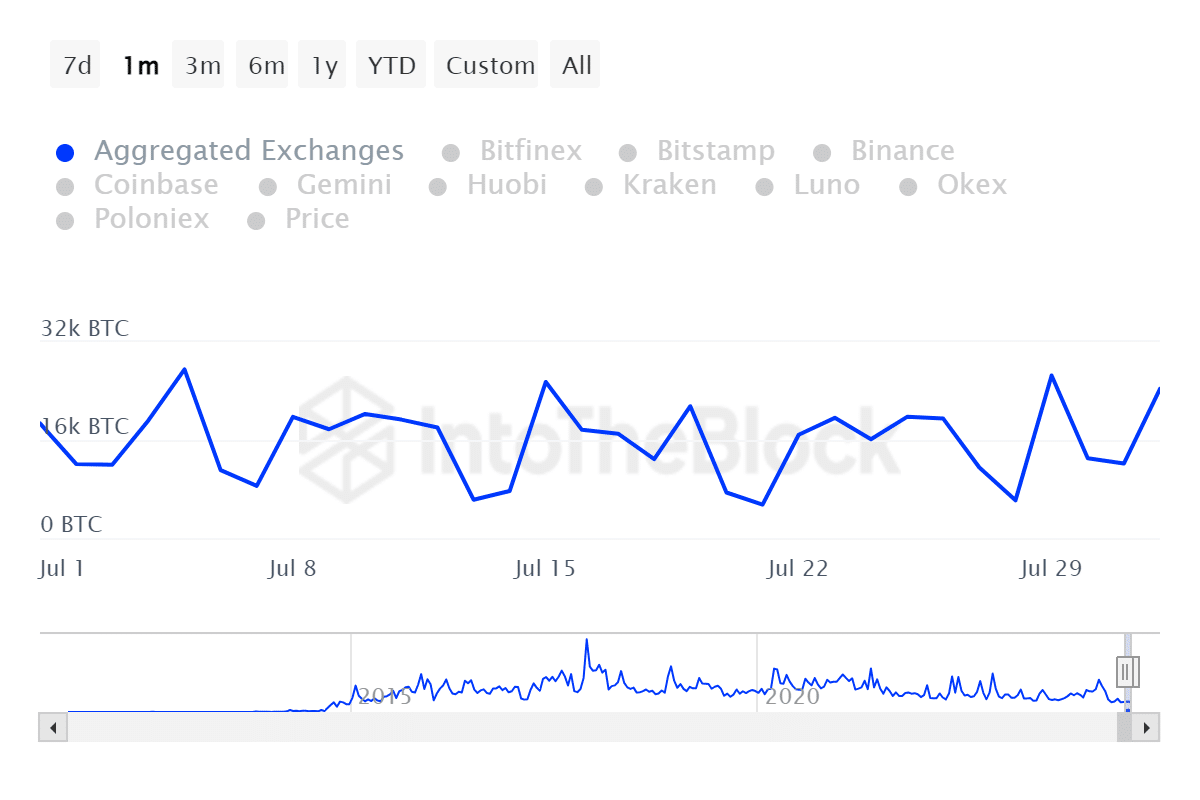

Our assessment revealed that Bitcoin’s aggregated exchanges outflow volume peaked at 24370 BTC in the last 24 hours.

This means the BTC exchange outflows are once again close to their highest levels this week, which were observed on the 29th of July at 26,530 BTC.

The same Bitcoin metric attained higher lows in the second half of June. Potentially indicating that every sell pressure wave has been weakening since then.

If that is the case, then Bitcoin’s potential downside will be limited. This could pave the way for more upside. However, it also requires a comparison with BTC’s exchange inflow volumes.

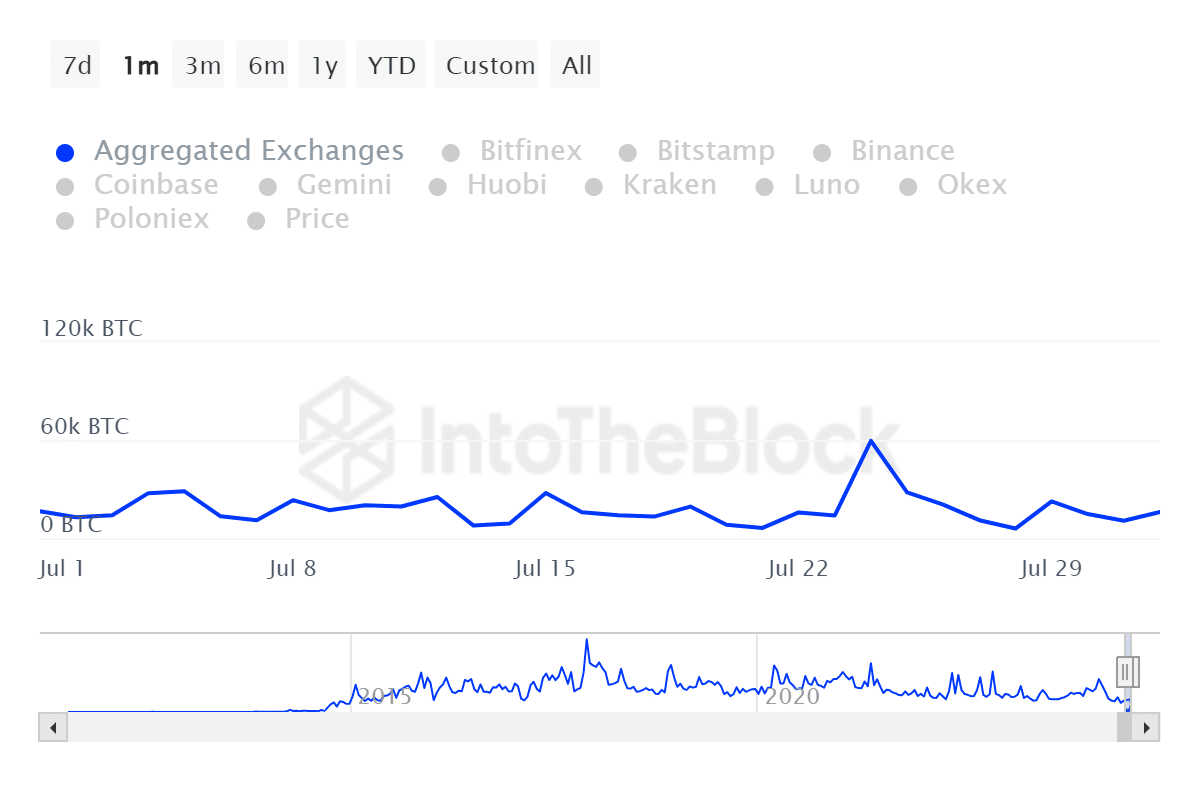

Bitcoin’s aggregated exchanges inflow volumes metric revealed that inflows had a monthly peak of 59,460 BTC on the 24th of July.

The latest data indicated that there were 15,950 BTC flowing into exchanges. This confirmed that exchange outflows were higher than inflows, hence a net positive on the asset’s demand.

Who is buying?

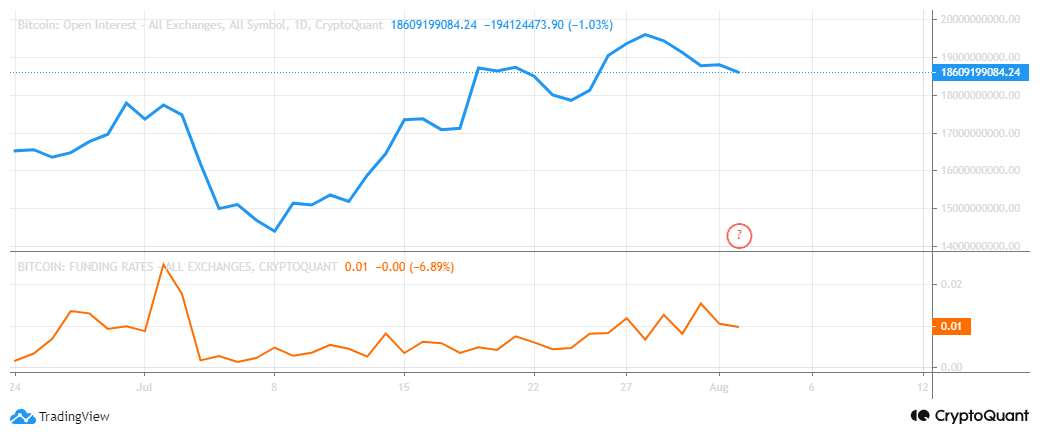

AMBCrypto’s findings on the above data coincided with declining exchange reserves. However, the derivatives segment signaled that demand was still weak.

Open Interest was still on a downward gradient at the time of observation, Funding Rates had also slowed down, indicating some uncertainty at the press time price point.

All this suggested that most of the prevailing demand came from the spot market. Bulls like MicroStrategy have been taking advantage of the dips.

The company’s chairman Michael J. Saylor recently revealed that the company added 169 BTC to its coffers. In other words, the company now holds roughly 1.14% of Bitcoin’s current circulating supply.

MicroStrategy also revealed that it intends to keep up the purchase. The company planned to issue more shares worth around $2 billion, which it intends to use for more Bitcoin purchases.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Keep in mind that although Bitcoin’s current demand is shining sell pressure, there was still a significant amount of selling.

July also confirmed that there are still bearish factors in the market that have the capacity to trigger selloffs. Governments selling their BTC holdings and economic data are some examples.