Are Bitcoin sell-off fears real? $7B in unrealized profits suggests…

- Bitcoin HODLing has climbed to impressive levels, with holders now anticipating higher prices.

- Worth assessing the potential risk in case of a major sell-off

Bitcoin investors have been eagerly waiting for Bitcoin to reclaim the $70,000 price level. This can be evidenced by the massive amount of unrealized profits – A sign that BTC holders have been opting to HODL, in anticipation of higher prices.

In fact, according to a recent CryptoQuant analysis, Bitcoin currently has over $7 billion worth of unrealized profits. This observation highlights the level of HODLing going on and the expectations of higher price levels. However, it also underscores the potential for a massive retracement if or when profit taking resumes.

If Bitcoin holders starting taking profits off the table, the sell pressure may lead to an outcome similar to what happened towards the end of July. At the time, the price crashed hard in a matter of days. So far, the prevailing optimism has allowed BTC to hold on to its gains on the charts.

At press time, Bitcoin was trading at $68,350, less than 2.4% away from hitting $70,000. The cryptocurrency also seemed to close in on the next resistance range between $69,400 and $71,500.

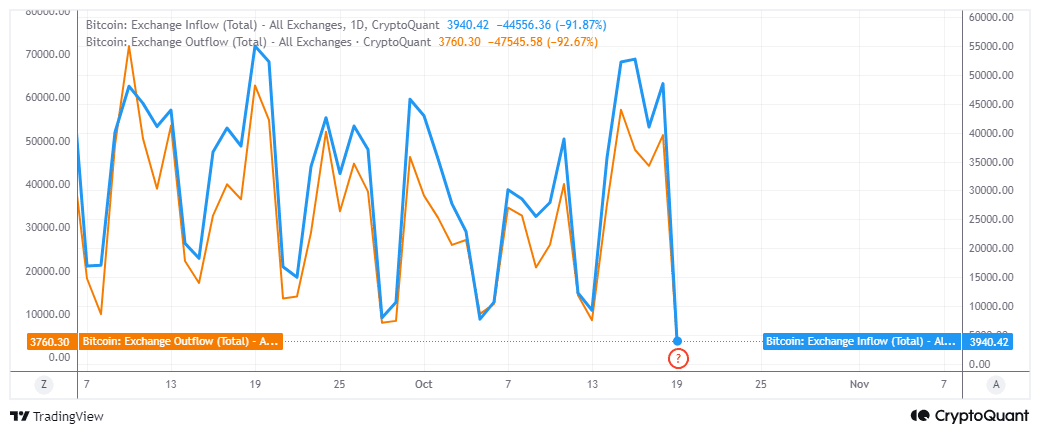

Bitcoin flows fall to the lowest levels in 2024

Bitcoin exchange flows might offer us interesting insights into the crypto’s latest bullish wave.

The latest uptick in both exchange inflows and outflows occurred between 13 and 16 October. However, exchange flows have since cooled down to their lowest levels this year.

In fact, data showed that 3,760 BTC moved out of exchanges in the last 24 hours. Roughly 3,940 BTC moved into exchanges, which means exchange inflows were slightly higher than the outflows.

Exchange flow swings suggest that BTC might be ready for a volatility resurgence. However, will another swing up have bullish or bearish energy? That remains to be seen, although address flows may offer us some insights.

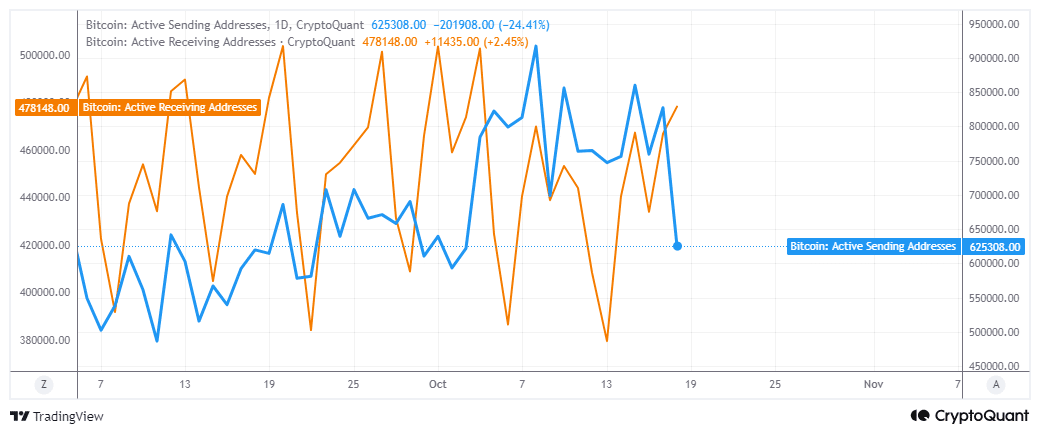

The number of active sending addresses have been declining since mid-October. For instance – They fell from 860,161 addresses on 15 October to 478,148 addresses by 18 October.

On the contrary, receiving addresses grew from 379,545 addresses on 13 October to 625,308 addresses on 18 October. The data also revealed that addresses buying Bitcoin were not only higher than those selling it, but receiving addresses grew while sending addresses retreated.

Address activity confirmed a shift, one demonstrating declining sell pressure despite the recent price hike. While these outcomes suggest that Bitcoin may push higher, a surprise wave of sell pressure may still be on the cards.