Dogecoin

Are Dogecoin traders cashing out after October’s 26% rally?

After the recent gains, Dogecoin recorded a sudden surge in the wallets that are in profits.

- DOGE inflows to exchanges increased by 38% in 24 hours after the rally showed signs of exhaustion.

- Whales are also becoming inactive after large transaction volumes dropped from 17 billion to 9 billion in six days.

Dogecoin [DOGE] has gained by 26% in the last 30 days after a surge in retail interest. These gains saw DOGE reach a four-month high of $0.149 earlier this week.

However, at press time, DOGE had shed some of these gains to trade at $0.137.

One of the factors that might have contributed to this drop is a rise in profit-taking activities. After the recent gains, Dogecoin recorded a sudden surge in the wallets that are in profits.

According to IntoTheBlock, 78% of DOGE holders, around 5 million addresses, were in profits at press time, while 18% were in losses.

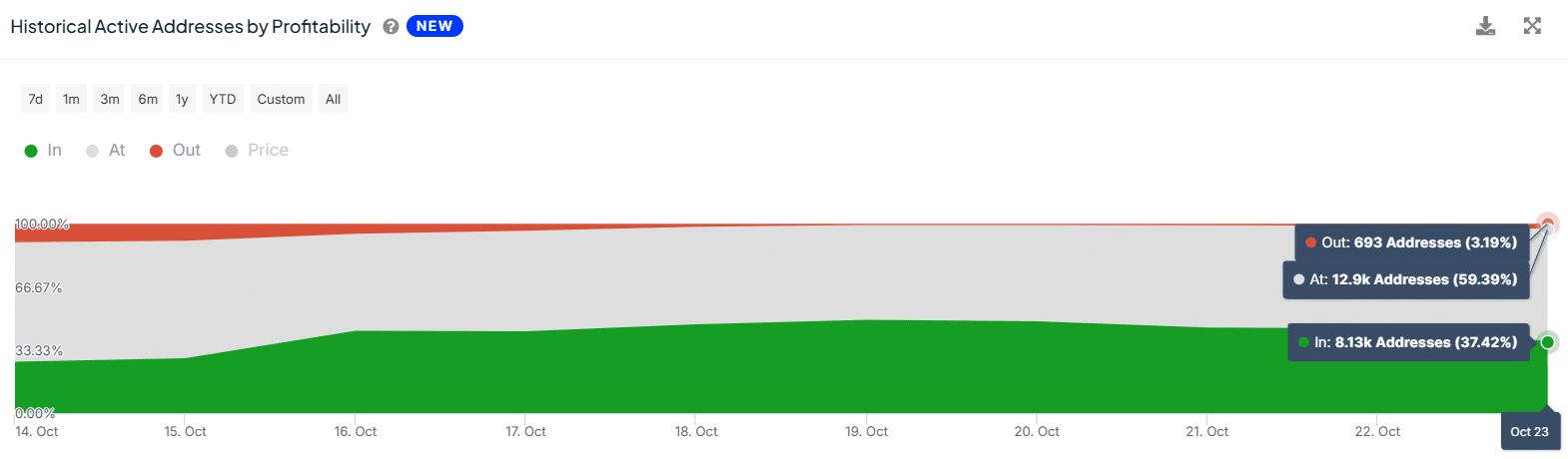

However, a look at the active addresses by profitability showed a sudden drop. These addresses have dropped by 11% from 10,890 to 8,130.

At the same time, the active wallets in losses have increased by around 2%.

When the profit margins for these wallet addresses decline, traders are bound to start taking profits. This profit-taking activity might have weakened Dogecoin’s uptrend.

A look at inflow data shows a surge in DOGE deposits to exchanges. These inflows reached 372M coins, an increase of around 38% from the previous day.

If these inflows persist, Dogecoin could be set for a bearish trend reversal.

Dogecoin whale activity

Dogecoin whale activity has dropped significantly this week. After a period of accumulation, large DOGE addresses appear to have stepped aside due to uncertainty after the uptrend started weakening.

In the last six days, large DOGE transactions exceeding $100,000 have declined from 17 billion to 9 billion.

This sharp decline shows a lack of whale interest after the rally started showing signs of exhaustion.

Given that whales control a large percentage of Dogecoin’s supply, whale inactivity could dampen volatility, leading to price consolidation.

Read Dogecoin’s [DOGE] Price Prediction: 2024, 2025

Liquidation zone could pull DOGE lower

A look at Dogecoin’s liquidation heatmap shows that there is a hot liquidation zone below the current price between $0.135 and $0.136. These zones tend to act as a magnet that could push the prices lower.

If Dogecoin continues with the downtrend and the price drops to this level, it could result in additional selling pressure, with long traders rushing to sell to close their positions.