Are Layer 2s hurting Ethereum? ‘Bot’ allegations raise concerns

- Galaxy research noted that since Dencun, transactions on Ethereum layer 2s have more than doubled, likely because of bots.

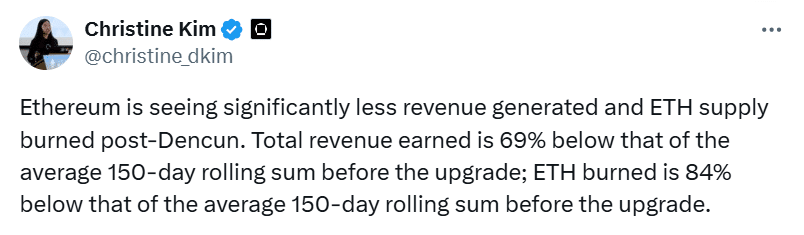

- The Ethereum mainnet has also seen a notable decline in total revenue and ETH burned.

The Ethereum [ETH] Dencun upgrade went live in March this year. While it had the desired effect of making layer 2s scalable and cost-efficient, it has also had an unintended downside.

Per an in-depth analysis by Galaxy, the EIP-4844 upgrade saw costs for Ethereum rollups reduce substantially, which fueled their usage. This also shifted revenue away from the Ethereum mainnet.

Galaxy researcher Christine Kim notes that since this upgrade, the Ethereum network has seen a decline in revenue and burn rate.

Data from Ultrasound Money showed that since the 13th of March, when the Dencun upgrade went live, ETH’s burn rate has dropped by around 0.18%.

Bots driving transaction surge?

Ethereum rollups have a Total Value Locked (TVL) of $33 billion per L2Beat data. This TVL has grown by more than 200% in the past year.

Besides the surging TVL, Galaxy noted that transactions on layer-2s have more than doubled to 6.6 million transactions since Dencun. This increase comes as transaction costs also reduced significantly.

However, the high transaction count has coincided with an increase in failure rates. Base has the highest transaction failure rate at 21%. It is closely followed by Arbitrum with a 15.4% failure rate and Optimism with 10.4%.

The research attributed this failure rate to bot activity. Due to the low transaction costs, addresses making over 100 transactions per day, which are likely bots, have increased.

Impact on ETH

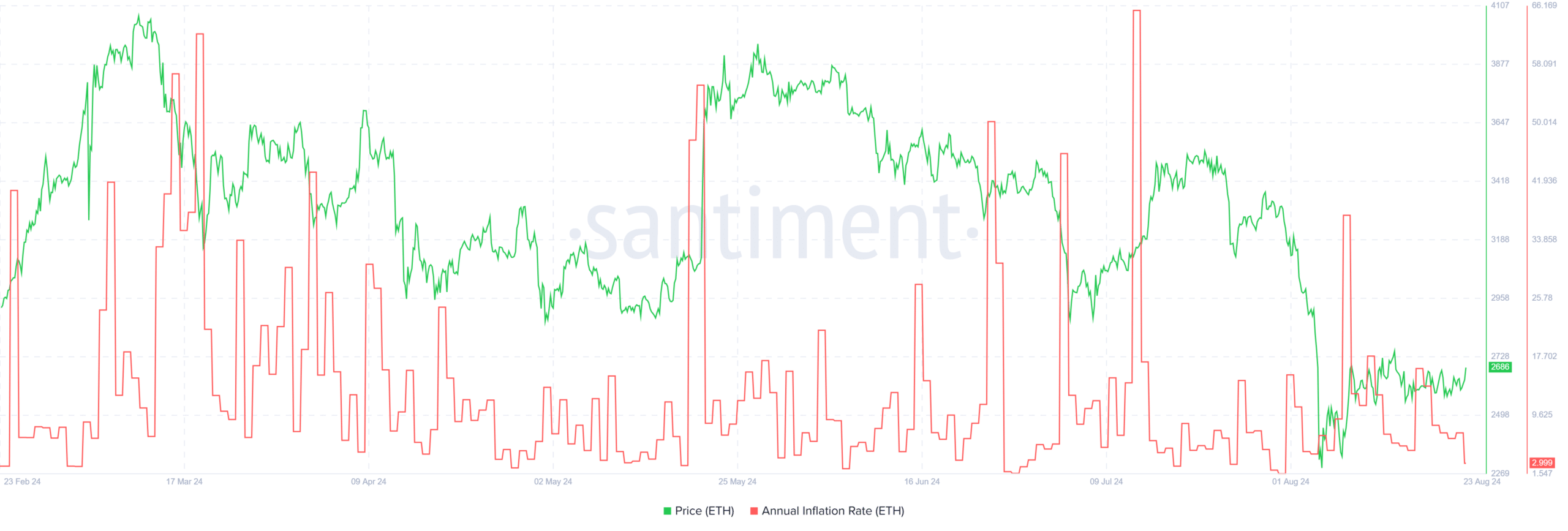

The decreasing revenue and slowing burn rate on Ethereum have stifled ETH price growth. Ether is down by 22% in the last 30 days, a significant gap from Bitcoin’s 7.5% dip.

ETH was trading at $2,668 at the time of writing after a 1.3% gain in 24 hours. A look at the Chaikin Money Flow shows buying pressure, but the trend is weakening.

While the index was positive, the CMF line was tipping south at press time, showing that sellers might be entering the market.

Traders should watch out for the key support level at $2,572. If ETH fails to hold this support, a possible liquidity sweep below $2,200 is likely.

Ether’s uptrend also faces a key barrier at $2,689. The price has failed to break this level since the 19th of August.

Is your portfolio green? Check out the ETH Profit Calculator

While the implications of rising supply might be hampering ETH price action, the annual inflation rate, which is approaching monthly lows, pointed to a positive picture.

A drop in this metric tends to increase investor confidence and, consequently, price.