Are retail traders ready to spend their Bitcoin?

Mastercard’s recent move to enable crypto on its network is a significant update that will help further Bitcoin’s adoption and make it mainstream. However, following the purchase of Bitcoin by Tesla and MicroStrategy the obvious next step was to consider Bitcoin payments, however, a critical question is, are retail traders willing to spend their Bitcoin holdings?

Based on recent research by Dealaid.org on consumer Sentiment on Bitcoin as a payment method that surveyed one thousand American consumers, the report’s key findings included the following:

– 60.2% of consumers would like more companies to accept Bitcoin as a payment method

– Amazon, Apple, and Walmart are the top 3 companies that consumers want to see accept Bitcoin

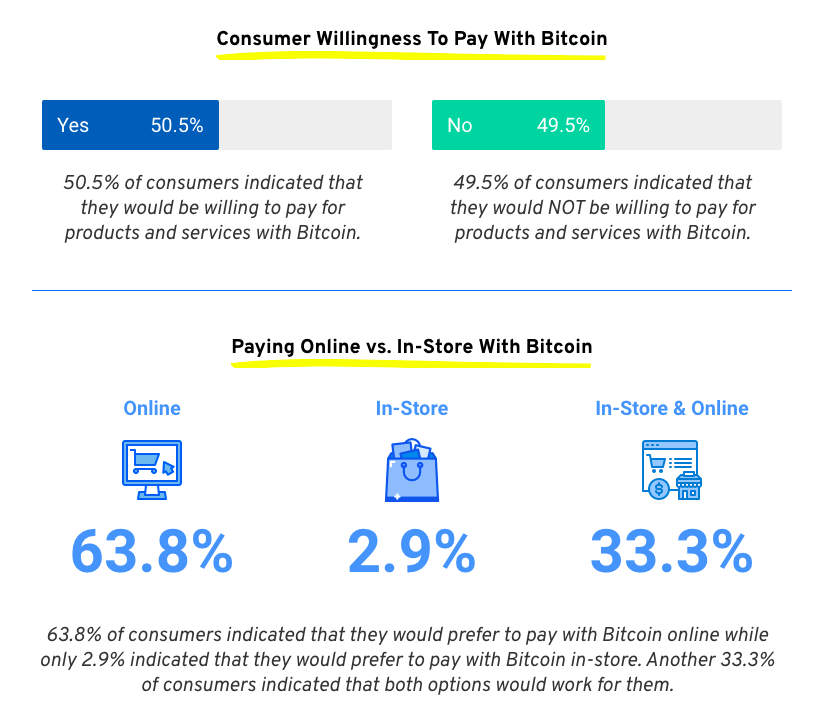

– 50.5% of consumers are willing to pay for products and services with Bitcoin

– Ethereum and Doge are the most popular alternatives to Bitcoin as a payment method

The survey’s findings on consumer willingness to pay with Bitcoin and paying online vs in-store with Bitcoin, were as follows

Source: Dealaid Research

Though these findings point towards an inclination to spending Bitcoin online, influencers and experts on Crypto Twitter suggest otherwise. Michael Saylor recently tweeted on how institutions would need Bitcoin for moving money, and that is a more relevant use case for the asset, citing reasons of transaction and settlement fees for overseas transactions.

Will retail transactions in Bitcoin pick up speed, and if they do in the bull market, will that continue in a price drop or a bear market? Based on Dealaid’s survey report, among the top payment processors, 62.9% of consumers indicated that they would prefer to use Paypal as their payment processing service of choice when paying with Bitcoin. Other preferred choices were Visa, Mastercard, and their own bank at 33.3%, 24.8%, and 22.9% respectively.

However, since Visa, Mastercard, and Paypal have caught up on Bitcoin payments, banks are yet to catch up in several countries. Though over 62% of consumers have expressed readiness, commercial use and use in payment settlements by retail customers may change the Bitcoin landscape, and the metrics like volatility may factor in substantially. This would have a direct impact on the portfolio of HODLers and day traders. On-chain analysis suggests that the sentiment is currently bearish, and 100% HODLers are profitable, however with increasing active supply this may change and there may be an impact on the price in the long-term.