Are Solana bears on the move?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

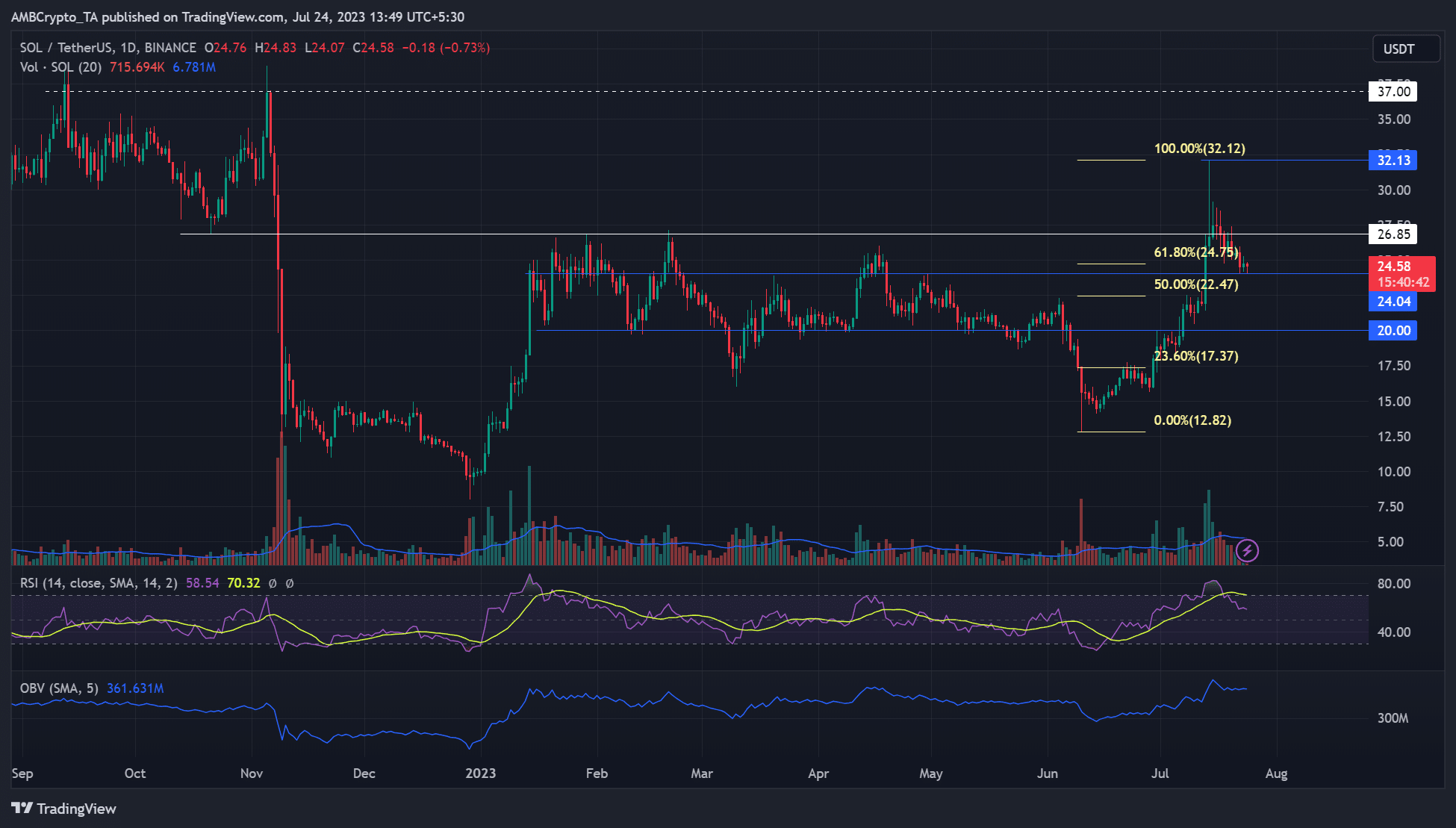

- The bulls failed to secure the breakout level of $26.85.

- Open Interest rates declined, and more long positions wrecked.

Solana’s [SOL] pullback extended ahead of the Fed’s rate decision on 25/26 July. After Ripple Labs’ legal win, SOL graced a new 2023 high of $32. However, the celebration ceded fast afterwards, and SOL reversed part of the gains amidst pullback.

Is your portfolio green? Check out the SOL Profit Calculator

Will the 50% Fib stop sellers?

Fibonacci retracement levels (yellow) were plotted between the recent high of $32 and the swing low in mid-June of $12.8. At the time of writing, Solana price action had retreated to the $24 level. Based on the Fib tool, the 50% Fib level of $22.5 was the next key support level after the $24.

Besides, the 50% Fib level also coincided with the June highs; hence bulls are expected to front defence at the area should the pullback extend lower. If the drop eases at the $22.5 – $24 area, then bulls could re-target $30, but they’ll have to bypass the $26.5 obstacle to advance.

But the drop below the 50% Fib level will weaken SOL’s market further. Such an extended bearish overdrive could set SOL to retest the $20 psychological mark, especially if BTC records massive losses after the Fed decision.

Meanwhile, the Relative Strength Index and On Balance Volume retreated lower, denoting a dip in buying pressure and demand in the past few days.

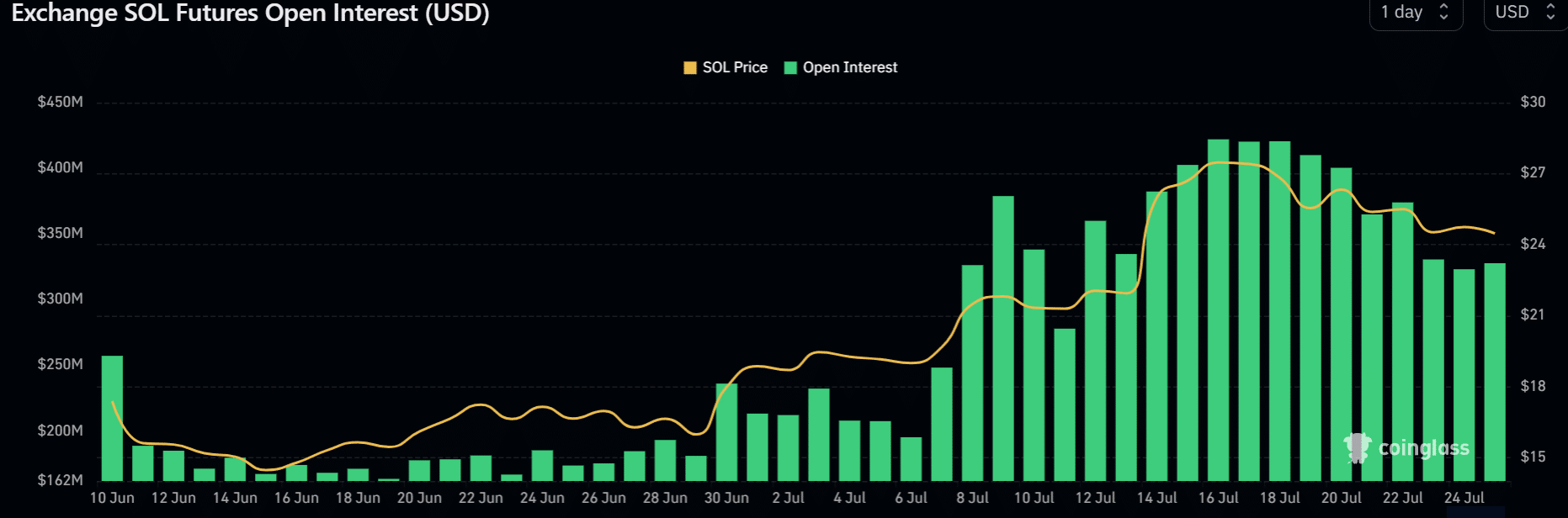

Open Interest rates retreated too

The declining Open Interest (OI) rates further confirmed the bearish grip. SOL’s OI has been treading southwards after peaking in mid-July.

How much are 1,10,100 SOL worth today?

Between mid-July and the time of writing, SOL’s OI dropped from >$400 million to below <$350 million, emphasizing the declining demand for SOL in the futures market ahead of the Fed decision.

So further pullback could be on the cards, and the $24 could crack, forcing bulls to regroup at the June high and the 50% Fib level of $22.5.