Are whales trying to catch ENA’s price bottom? Metrics suggest…

- Arthur Hayes offloaded ETH at a loss and invested $2.8M in ENA

- With ENA’s price down by 15% in the last 24 hours, Hayes may be trying catching the bottom

Despite its latest bout of depreciation, over the past month, Ethena’s price (ENA) has risen by over 65.13%. By doing so, it significantly outperformed the global cryptocurrency market, with the same up by only 9.40%.

Such a performance can be interpreted to highlight growing investor confidence in ENA. Especially since at the time of writing, Ethena was trading at $0.5941 – A sign of sustained market interest.

Arthur Hayes accumulates 4.916 Million Ethena tokens

Co-Founder of BitMEX & CIO Arthur Hayes’ current crypto portfolio has a balance of $33.167M, with the same showing a significant allocation in Ethereum. The portfolio’s breakdown revealed 5.082K ETH valued at $16.9M, 3.037K ETH in staked ETH (EETH) worth $10.064M, and 5.053M ENA tokens, now valued at $2.89M.

The portfolio’s most-recent transactions reflect two key movements though – Hayes received 4.916M ENA worth approximately $2.8M from Wintermute Trading, signaling a significant hike in his position in ENA. Prior to the same, he sent 874.9 ETH worth $2.8M to Wintermute Trading.

This flow of capital suggests that Hayes has been reallocating his investments and strengthening his position in ENA as a strategic move.

The portfolio’s ETH allocation suggests that Hayes remains heavily invested in Ethereum. However, his move into ENA could signal confidence in the token’s future potential, especially after recent price fluctuations.

His ENA purchases underlined a belief in its growth, despite its latest price dip. Hayes seems to be positioning himself to capitalize on future upside, considering ENA’s drop of 15% in the last 24 hours. In fact, this could be perceived as an opportunity to “catch the bottom” for a rebound.

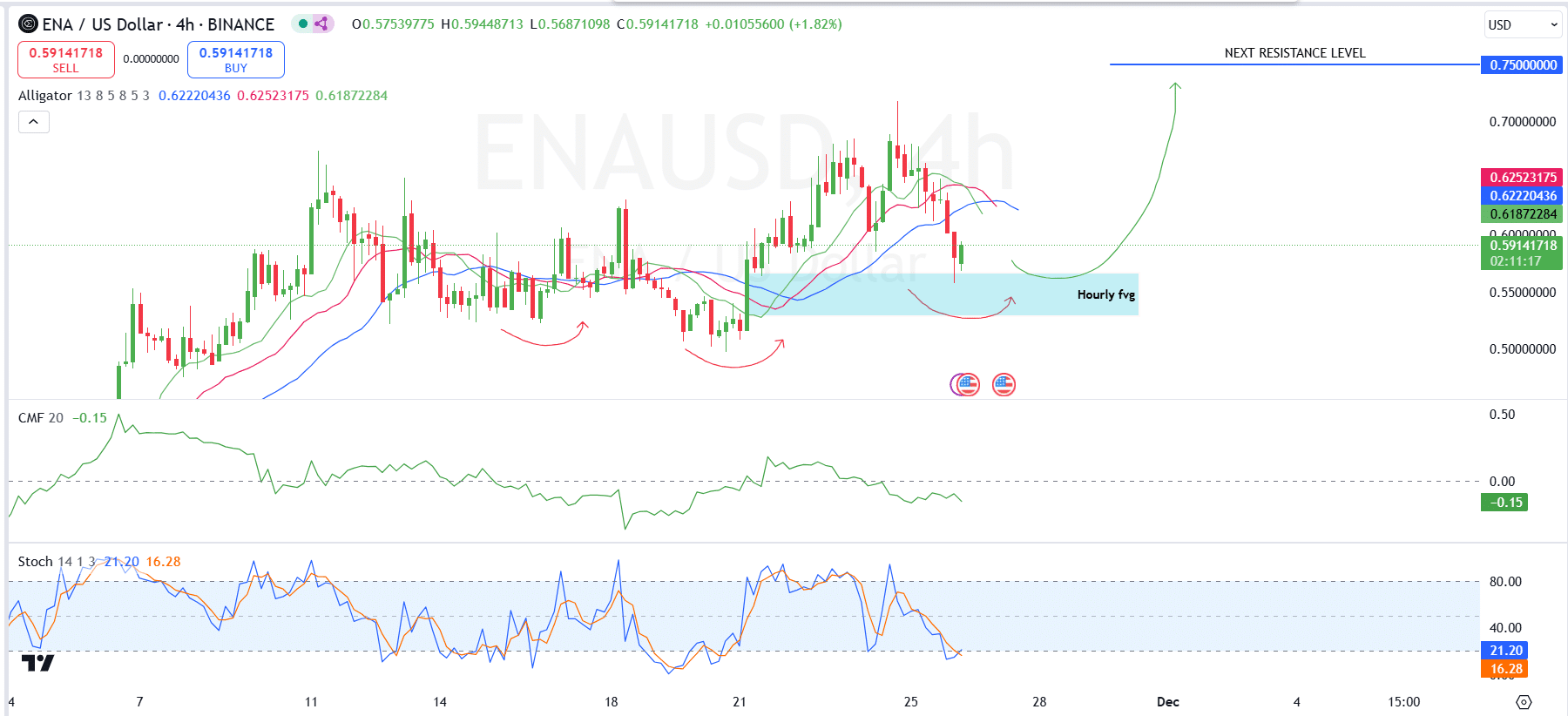

Can ENA Bounce from the 4-hour Fair Value Gap?

Since 23 November, ENA has been consolidating, dipping into the Hourly Fair Value Gap (fvg) near the $0.54-$0.56 support zone – A level crucial for its next move.

This dip is likely part of the process to accumulate more long positions, allowing institutional investors to enter at favorable prices before a breakout.

Additionally, this price action might be serving as a shakeout, removing weak buyers before a possible rally. The fvg holding could act as the catalyst for a move towards the $0.75 resistance, with a successful break above signaling further upside to $0.80.

The Alligator indicator revealed a shift in momentum as the green line recently moved below the red line, indicating light retracements in the short term. This suggested that while the overall trend remains bullish, the market has been recording some mild pullbacks.

However, failure to hold the fvg would indicate a shift in momentum, leading to possible further downside. Finally, the Stochastic Oscillator and CMF confirmed that the price may be oversold and that a rebound could be likely.

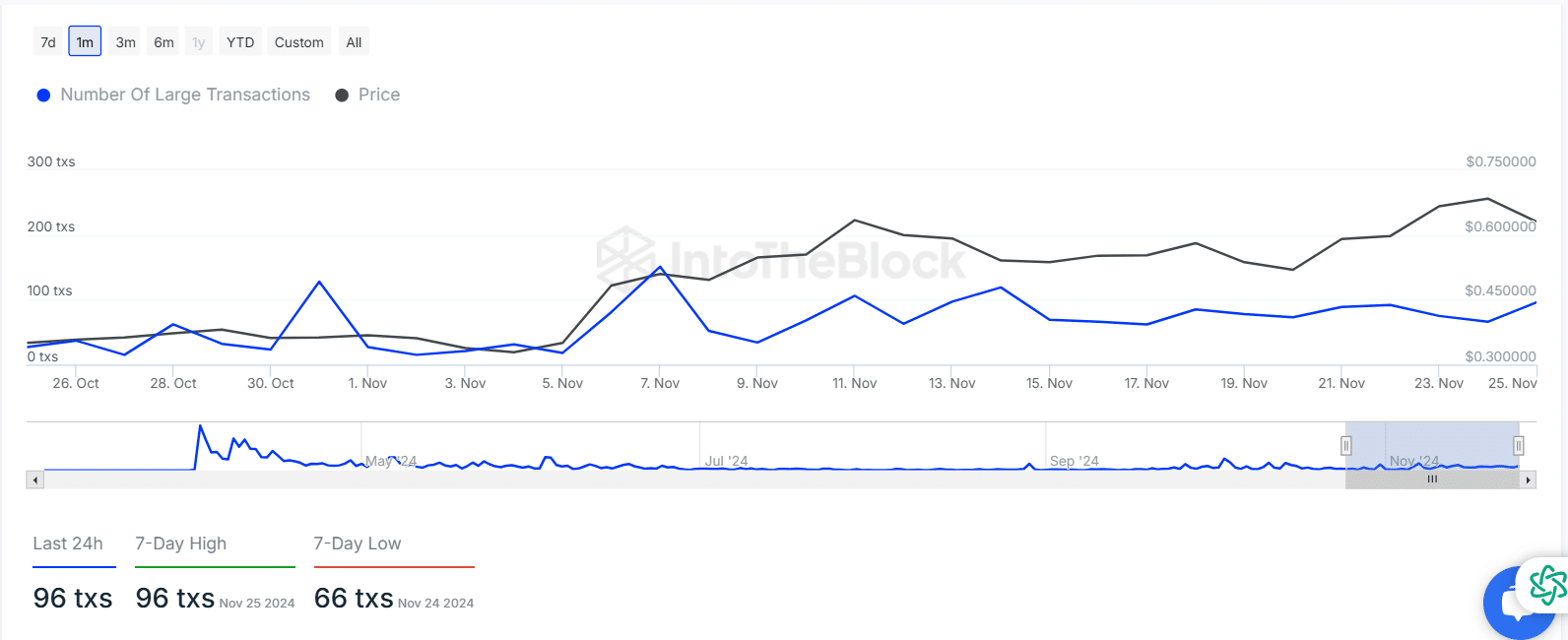

Large transactions surge for ENA

AMBCrypto’s analysis of large transactions, based on IntoTheBlock data, revealed a notable surge in large transactions for ENA during November 2024.

The chart indicated that the number of large transactions has increased significantly, with spikes on 1st, 5th, and 23rd November – A sign of growing interest and activity in the token.

In fact, on 25 November, there were 96 large transactions, matching its 7-day high. This indicated strong buying activity at a relatively stable price point of $0.60.

ENA’s price has been steadily rising too, from $0.32 towards the beginning of the month to $0.60 in the last few days. This hike in price, combined with the higher transaction volume, suggested that institutional or whale activity may be driving the altcoin’s price movement.

This uptick in large transactions could be an early signal of a bullish move or greater demand for ENA, possibly indicating the token’s readiness for further upside.

Notably, on 24 November, 66 large transactions were recorded, which is on the lower end of the 7-day range. However, the overall trend still pointed to growing confidence in ENA, especially with the price maintaining its momentum around $0.60.

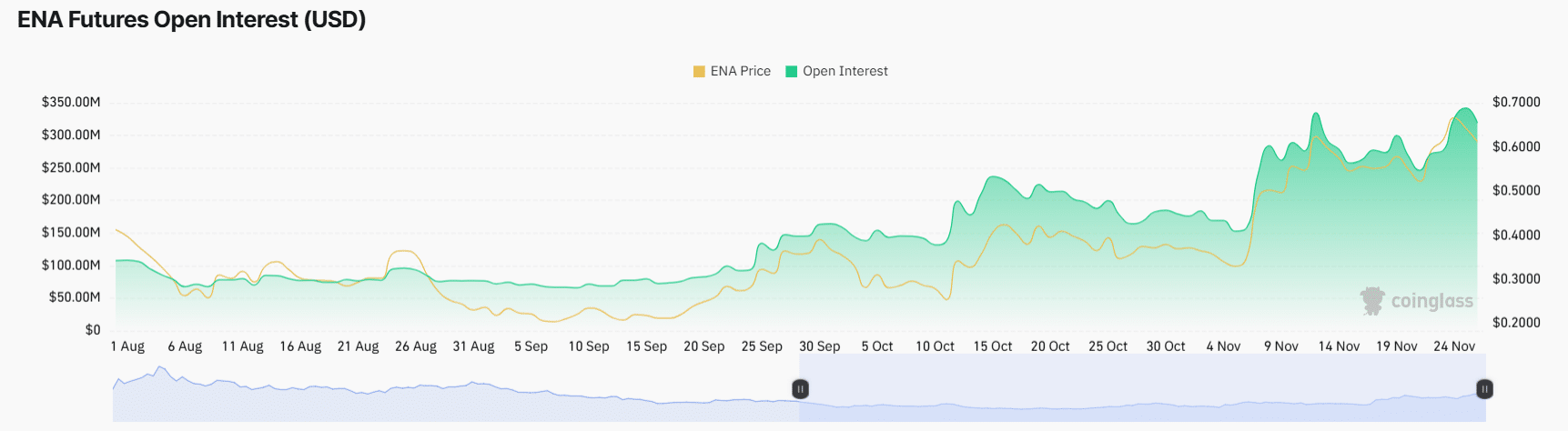

ENA’s rising Open Interest

ENA Futures’ Open Interest has been on an uptrend since mid-September 2024. In fact, Open Interest steadily increased from under $100M in early August to over $350M by late November – A sign of growing market participation and interest in ENA Futures contracts.

Meanwhile, ENA price, has mirrored this upward movement, rising from $0.20 to $0.70 by the end of November.

This hike in Open Interest seemed to correlate strongly with the price surge, indicating that traders are increasingly confident in ENA’s potential for sustained growth. What this also means is that more positions are being opened, likely as traders position themselves for future price movements – Another sign of bullish sentiment.