ARK’s Cathie Wood expects multiple Bitcoin ETFs to be approved at once

- Wood thinks recent actions of the SEC signaled a change in its attitude.

- This change in attitude can be attributed to the recent court judgement in the SEC vs Grayscale Investments case.

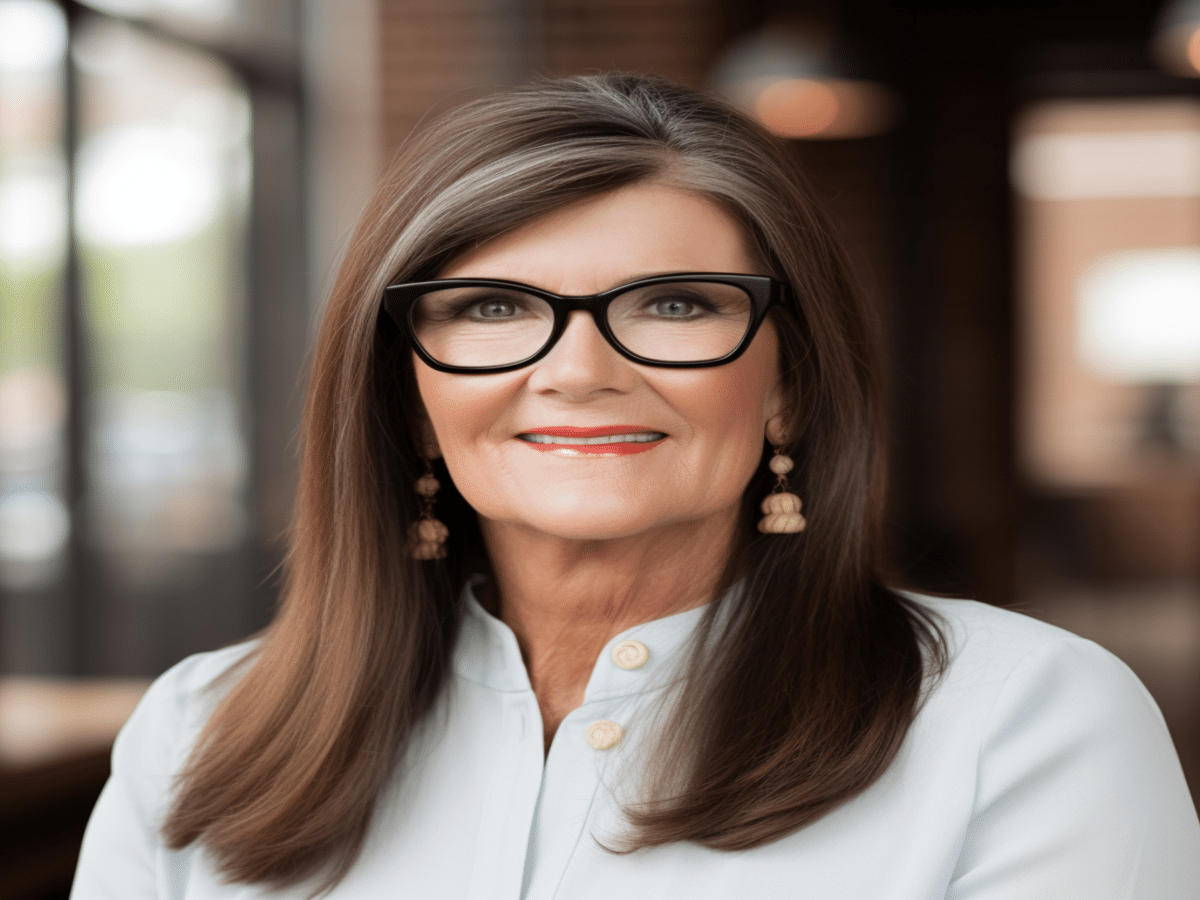

ARK Invest CEO Cathie Wood is optimistic about multiple spot Bitcoin [BTC] exchange-traded funds (ETFs) being approved by the U.S. Securities and Exchange Commission (SEC). In a recent interview with CNBC, Wood talked about ETF applications and the SEC’s changing attitude among other things.

Wood confirmed that ARK Invest has responded to the regulating body’s request for information about its Bitcoin ETF filing.

“It was publicized and disclosed last week that we had responded to the SEC’s request for information around our Bitcoin filing, and we responded. That’s basically all we can say.”

Even though the regulator did not ask for it, ARK, along with 21Shares, nonetheless submitted an amended joint application.

The pair first filed for a joint spot Bitcoin ETF in 2021. Since then, the SEC has time and again denied all of its applications.

Wood added that recent actions on behalf of the SEC signaled a change in its attitude towards spot Bitcoin ETFs. The industry is therefore hopeful about the possibility of the SEC approving these applications.

In due course, the SEC may issue a directive outlining its approach to enforcing rulings on Bitcoin ETFs. It would serve as a framework for the approval of multiple Bitcoin ETFs by the end of the year.

Is the SEC vs Grayscale judgement behind this change in attitude?

We can trace this change in attitude on the part of the regulator to the recent court judgement in the SEC vs Grayscale Investments case.

Remember that in August 2023, the court ruled that the SEC’s decision to reject Grayscale’s application to convert its GBTC to a spot Bitcoin ETF was “arbitrary and capricious.”

Recently, it emerged that the SEC has decided not to appeal the court’s judgment. The regulator will now need to revisit its decision on rejecting the application to covert GBTC to spot Bitcoin ETF.

Wood told the host that ARK Invest has set a decision deadline for 10 January 2024. Though ARK’s application is the first in queue, Wood expected multiple ETFs to be approved at once.

Erroneous tweet leads to Bitcoin rally

In a related development, we witnessed BTC rallying towards the $30K-price mark on 16 October. The trigger for this rally was an erroneous tweet by a leading crypto publication about the SEC approving BlackRock’s spot Bitcoin ETF application.

The publication apologized for the mistake later; Eleanor Terrett, Fox Business journalist, confirmed that the application still awaits review.

?NEW: Official statement to @FoxBusiness from @BlackRock:

“The iShares Spot Bitcoin ETF is still under review by the SEC.”

— Eleanor Terrett (@EleanorTerrett) October 16, 2023

As a result, the price of BTC dropped. At press time, it was exchanging hands at $28,150.