Arthur Hayes joins PEPE frenzy, but will this fuel a 30% rally?

- PEPE appeared super bullish and could soar by 30% to reach the $0.0000132 level

- PEPE’s Long/Short ratio, at press time, stood at 1.084 – Indicating strong bullish sentiment among traders

PEPE, the market’s third-biggest memecoin, has been making waves in the crypto landscape with its significant price surge of over 27% in the last two days. Following PEPE’s impressive performance, however, it would seem that Arthur Hayes, ex-CEO of BitMEX, couldn’t resist himself joining the rally.

Arthur Hayes’s big bet on PEPE

On 27 September, 2024, the on-chain analytics firm lookonchain revealed that that Hayes withdrew a notable 24.39 billion PEPE tokens, worth $252,680 from Binance.

This significant withdrawal from the exchange may be a sign that PEPE’s rally may have just begun and could soar significantly in the coming days.

Current price momentum

At press time, PEPE was trading near the $0.000001058 level, following a notable price surge of over 17.2% in the last 24 hours. Ocer the same period, its trading volume jumped by 40%, according to CoinMarketCap.

PEPE technical analysis and key levels

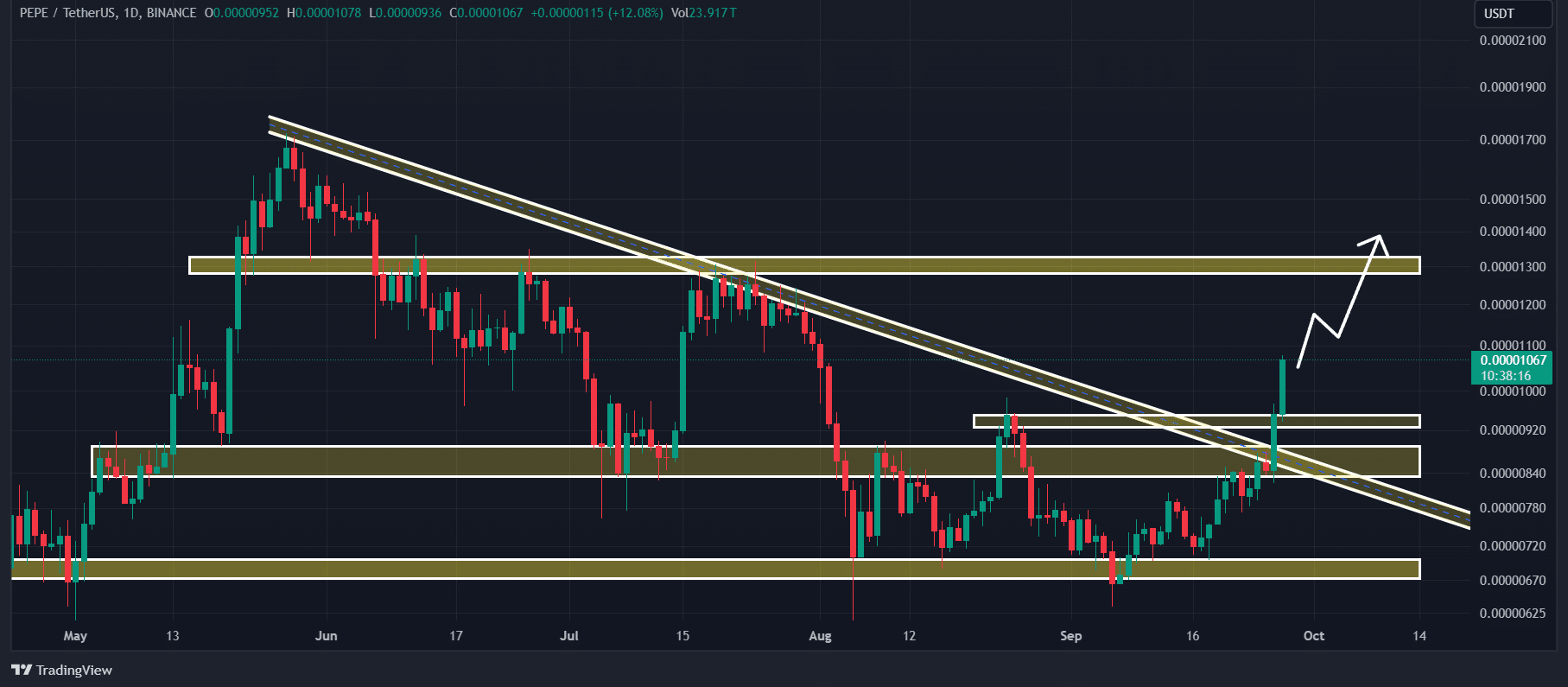

According to AMBCrypto’s technical analysis, PEPE appeared bullish and looked poised to rally by 30% in the coming days. This sentiment recently shifted following the breakout from the long descending trendline and horizontal level of $0.00000875.

Based on the historical price momentum, after a price surge of over 27% in just two days, a small price correction may occur. However, over the long term, PEPE may be super bullish and could soar by 30% to reach the $0.0000132 level in the coming days.

PEPE’s bullish on-chain metrics

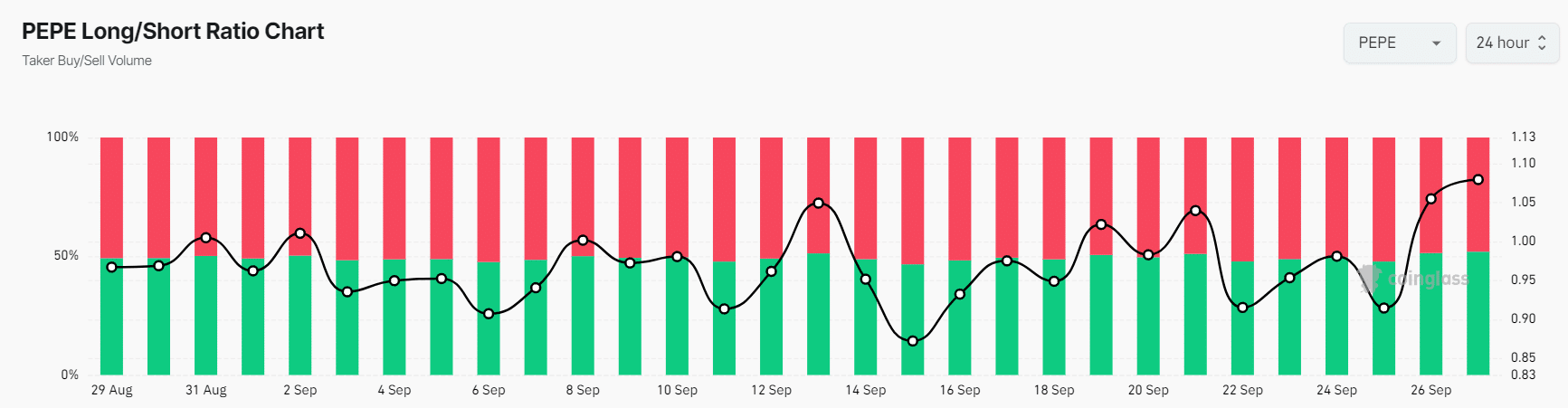

This positive outlook was further supported by on-chain metrics. According to the on-chain analytics firm Coinglass, PEPE’s Long/Short ratio stood at 1.084, indicating strong bullish sentiment among traders.

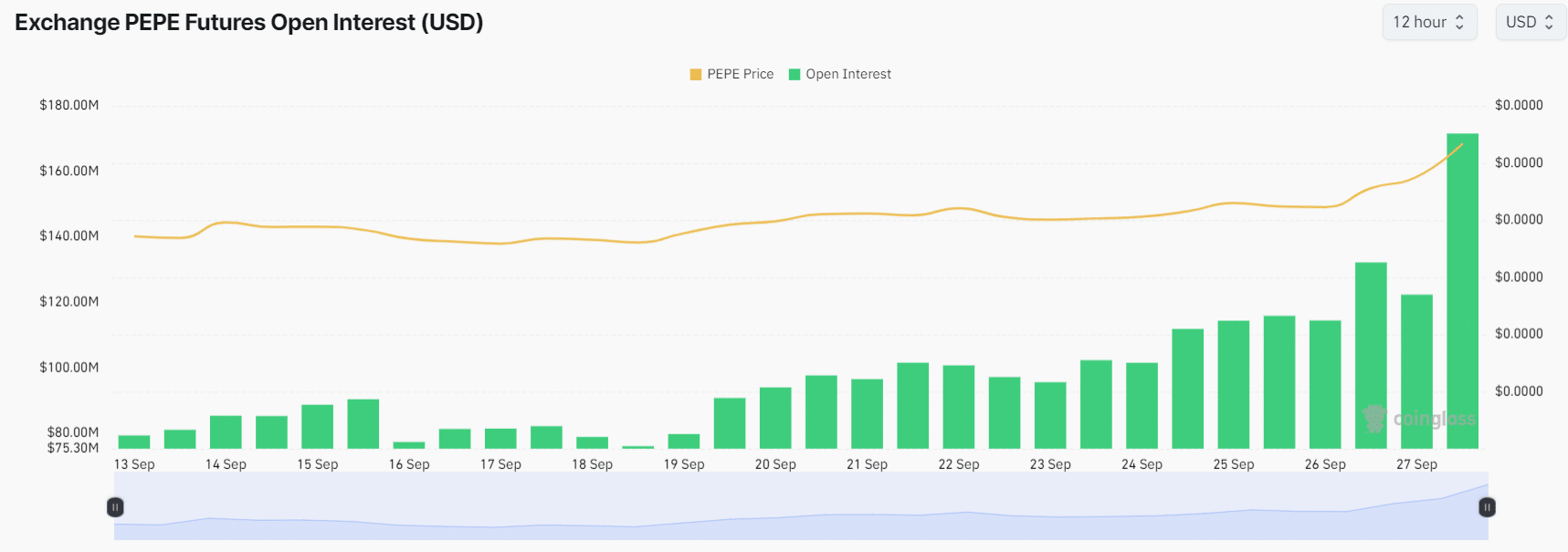

Additionally, its Futures Open Interest increased by 30%, with the same steadily rising since. This massive surge in PEPE’s Open Interest is a sign that bulls are potentially building larger long positions, compared to short ones.

However, investors and traders often use the combination of rising Open Interest and a long/short ratio above 1, when building long positions. At press time, 51% of top traders held long positions, while 48.09% held short positions.