As a trader, should the Bitcoin pump bother you?

- The movement of dormant coins makes another bullish case for BTC.

- Bitcoin may consolidate over the weekend, but a breakout could occur as early as 30 October.

Trading the crypto market can be complicated, and for a volatile asset like Bitcoin [BTC], it’s not always a straight path to profits neither is a downtrend confirmation that it’s time to short the coin.

Read Bitcoin’s [BTC] Price Prediction 2023-2024

To put you out of confusion, a short refers to a trading strategy that speculates on the decline of an asset. So, when a trader opens a short position and the value of the cryptocurrency in question decreases, the trader tends to make a profit. The opposite of this is a long where the position opened is geared towards a price increase.

Possible stops in between the rise

Lately, Bitcoin has mostly favored long-positioned traders. This is because of the coin’s impressive increase over the last few weeks. As a result, there is a great deal of confidence in the market. At the same time, greed seems to be present as well. But here’s where it matters most.

Bitcoin’s uptick has left many traders wondering if the coin’s value would continue to defy the odds and increase, or if it’s time for a correction. Needless to say, technical and/or on-chain analysis gives insights into the price action.

However, the current circumstance has some macroeconomic factors backing it. So, dependence on the aforementioned models could only leave a sour taste in a trader’s mouth.

Most times, a long period of uptick leads to some period of consolidation or drawdown. For context, consolidation occurs when a coin like BTC hovers around prices very close to one another with no significant direction.

From an on-chain perspective, Santiment, an analytic platform in that regard, mentioned that traders do not need to fret. According to its post on X (formerly Twitter), there has been an increase in the movement of dormant coins.

? If you're concerned about a #crypto retrace, note that #Bitcoin still maintains a high pace of active addresses. Additionally, the top market cap asset is seeing a high level of dormant tokens now moving, typically synonymous with #bullish conditions. https://t.co/bvjDL2Shga pic.twitter.com/NvxKkQpkg8

— Santiment (@santimentfeed) October 26, 2023

Dormant coins are assets that have been stored for a long time and have been stagnant in the wallets they reside in. Santiment noted that the increase in migration alongside the fast pace of active addresses means that the BTC is still in pole position for a continuous increase.

Active addresses are the number of unique addresses making transactions on a network. When the metric increases, it means that there is a surge in speculation.

On the other hand, a decrease suggests a fall in interaction with the cryptocurrency discussed. Therefore, the active addresses here mean that many addresses are making Bitcoin transactions.

For now, a downtrend is plausible

Besides these two factors, there are other reasons why BTC may not experience a significant plunge. At the same time, that is not to say the rally would continue without a decline. One narrative that has played a significant part in the hike is the optimism around ETF applications that are on the table of the U.S. SEC.

Although there is no confirmation about the period of approval, many market players are of the view that one of the numerous approvals would get the regulator’s nod soon. Alex Adler Jr, a verified author at CryptoQuant, noted that BTC may continue to consolidate.

Adler’s opinion was born out of the position displayed by the futures dynamics index. The BTC futures dynamic index gives an insight into the bullish or bearish sentiment of traders.

In 48h, the market has yet to decide which direction to move in. Currently, there's a slight tilt towards short positions.

The best scenario would be for the market to continue to remain flat, decrease activity over the weekend, and then consolidate on Monday with a breakout. pic.twitter.com/qh7gE2Mel3

— Axel ?? Adler Jr (@AxelAdlerJr) October 27, 2023

From Adler’s post, most of the traders’ positions tilted toward the short side. The analyst also mentioned that there could be a drop in activity over the weekend. So, if any breakout needs to happen, it might wait till 30 October.

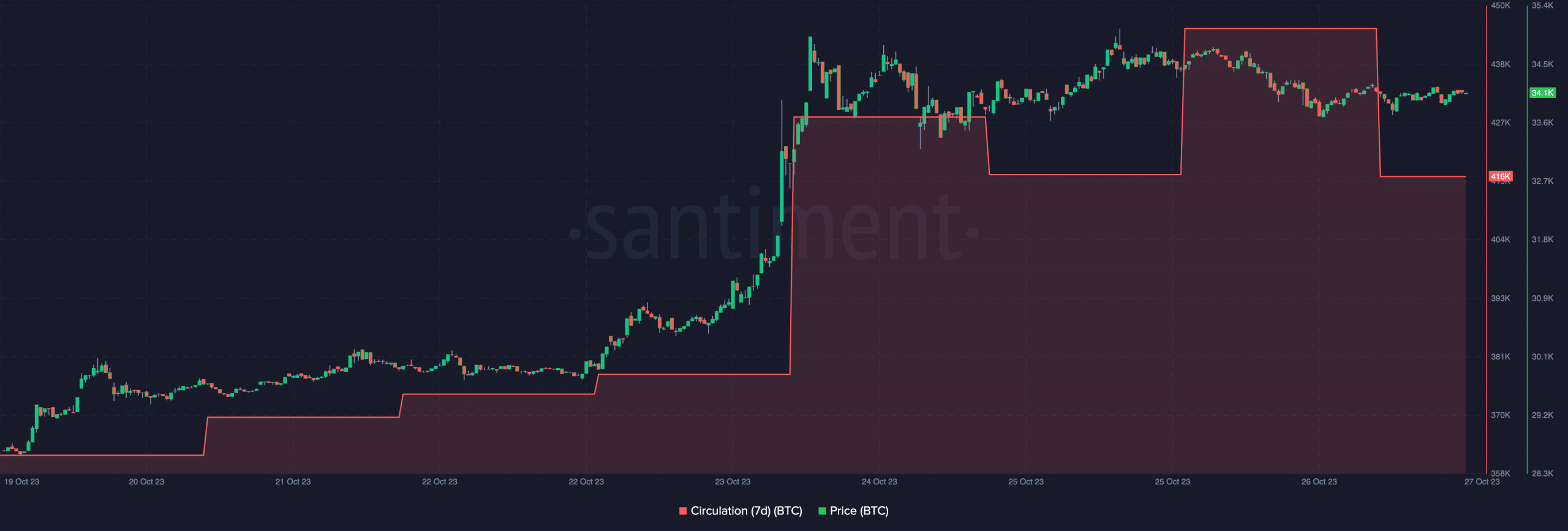

On-chain data from Santiment also showed that BTC could continue consolidating. This assertion was derived from the seven-day circulation. At press time, the Bitcoin circulation was 416,000. This metric is the number of coins used in transactions within a given timeframe.

Also, the value has been almost the same since 26 October. So, there is no significant sign of selling pressure. As a trader, the indication by the circulation is to continue to monitor the market. This is because it is highly unlikely for Bitcoin to choose a specific direction to move in for the main time.

New entry points looming

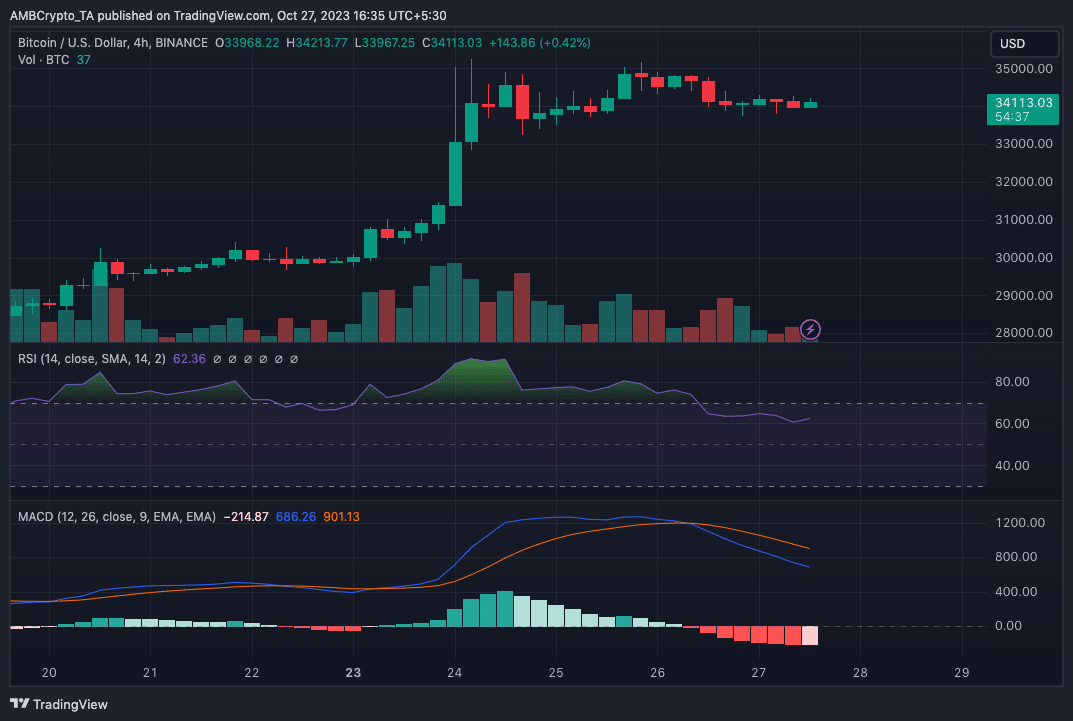

From the technical point of view, the BTC/USD chart showed that the coin’s buying strength has decreased. At press time, the Relative Strength Index (RSI) was 62.61. Previously, the RSI reading reached 90.86.

This means BTC was overbought at that point. Thus, it was inevitable for the indicator to retrace, the same as the Bitcoin price.

This was one of the factors that led to the drop below $35,000. However, the current reading of the RSI does not mean buyers are exhausted. So, any significant buying momentum could drive an uptick above toward $36,000.

So, it might be great to watch out for the period when the RSI moves toward 65.00. If this happens, it could be a good entry point to long BTC. For now, shorts may make more profits than those who opened positions expecting an upward movement.

This conclusion was based on the Moving Average Convergence Divergence (MACD). At the time of writing, the MACD was down to -2.14.94. The negative value of the indicator means there are more sell orders than buys. So, the coin price would most likely decrease (no matter how negligible) rather than increase.

Looking at the long term?

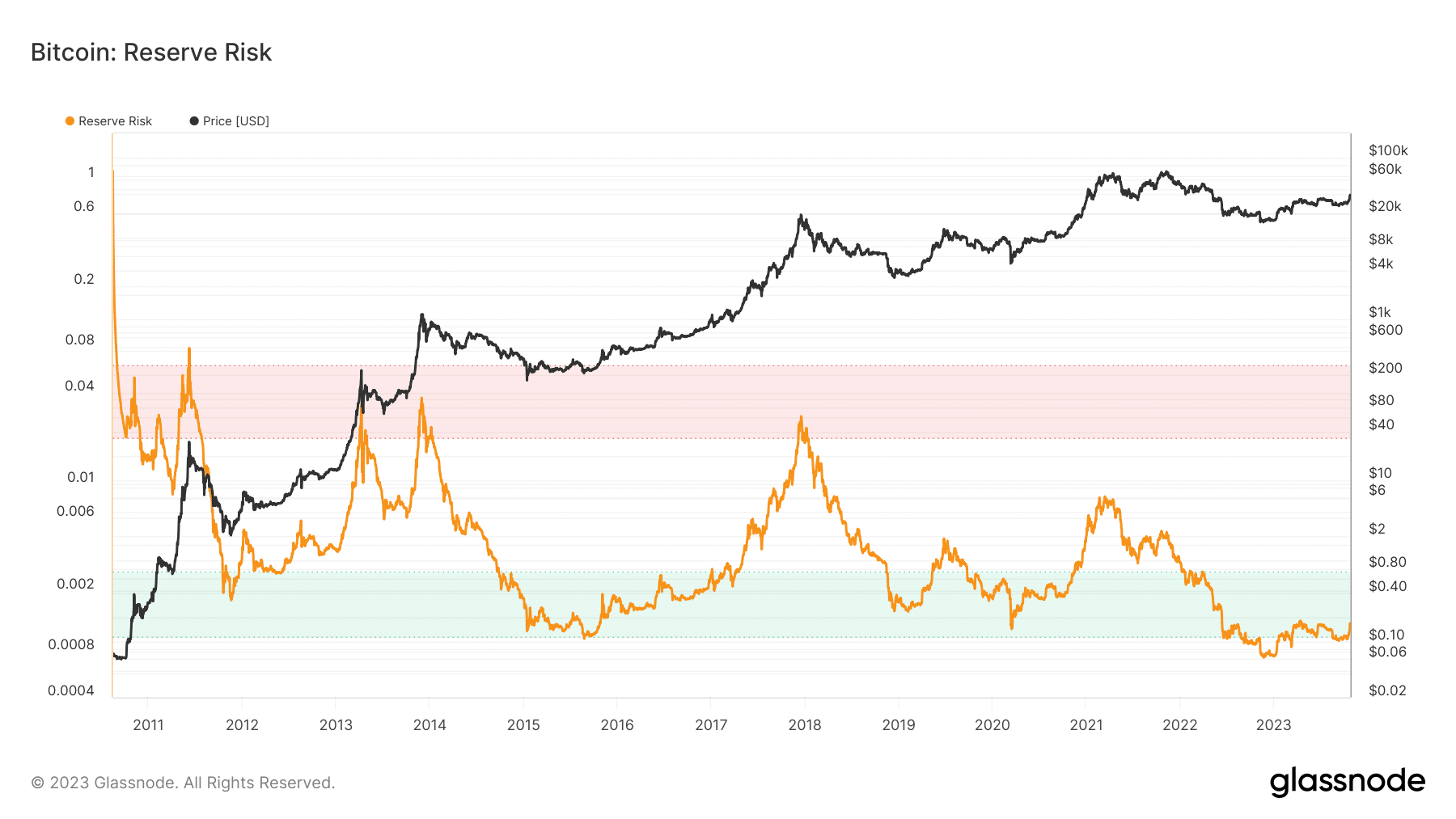

However, if as a trader, you are looking to potentially profit from Bitcoin in the mid to long term, the reserve risk can give you an idea of which side to choose. The Bitcoin reserve risk is used to assess the confidence of long-term holders relative to the price action.

Is your portfolio green? Check the BTC Profit Calculator

When the metric is high, it means confidence in the market is low and the price is high. Conversely, a low reserve risk means that confidence is high and the price is low. At press time, the risk of the reserve was 0.001, depicting high confidence in the market and an undervalued Bitcoin.

![Sei [SEI]](https://ambcrypto.com/wp-content/uploads/2025/06/Erastus-2025-06-29T145427.668-1-400x240.png)