As Bitcoin dips below key support level, this group makes major moves

- Bitcoin remained in the $64,000 price range.

- Close to 2 million addresses bought BTC in this price range.

Bitcoin [BTC] has recently fallen below a key support level that had held for several weeks. Although it has broken past this support line, there is another, less visible support level.

If BTC drops below this unseen threshold, it could trigger a series of declines due to a potential sell-off.

This situation is already being exacerbated as miners have sold a record number of BTCs in response to the price decline.

Bitcoin’s former support continues as resistance

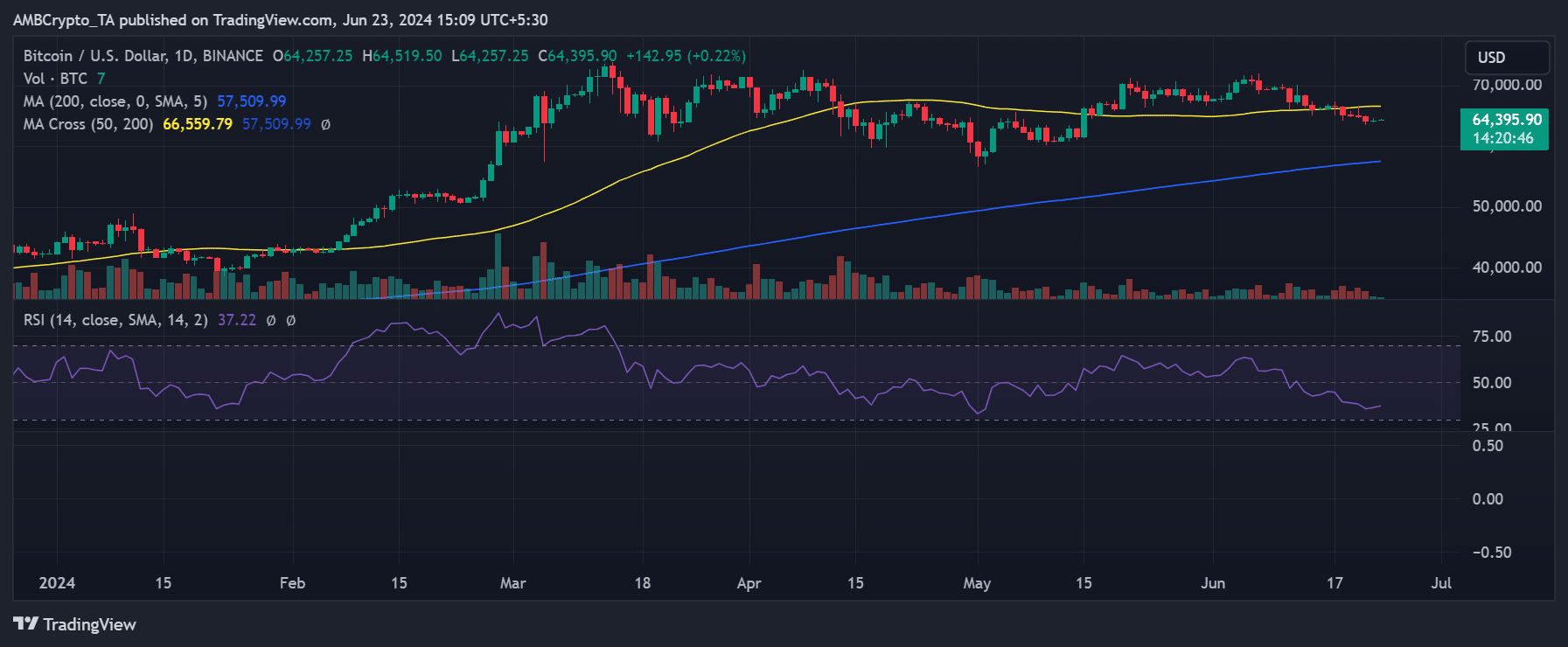

AMBCrypto’s analysis of Bitcoin on a daily time frame chart revealed that it has recently broken through its support level. The level was previously established around the $66,000 price range.

This support was marked by its short-term moving average (yellow line). It had held steady from about the 16th of May until the 17th of June. This breach indicated a significant shift in Bitcoin’s market behavior.

As of the latest update, Bitcoin was trading at approximately $64,380, showing a slight increase. It also closed with a minor gain on the 22nd of June, ending the day at around $64,252.

However, these figures are still significantly below the former support level of $66,000, which has now turned into a resistance level. This indicated a challenge for Bitcoin to reclaim this price point in the near term.

The importance of this price level, around $66,000 for Bitcoin, is underscored by the significant number of addresses that purchased BTC at this range.

This high concentration of purchases creates a psychological and technical significance for the price level.

Just how many addresses bought Bitcoin in this range?

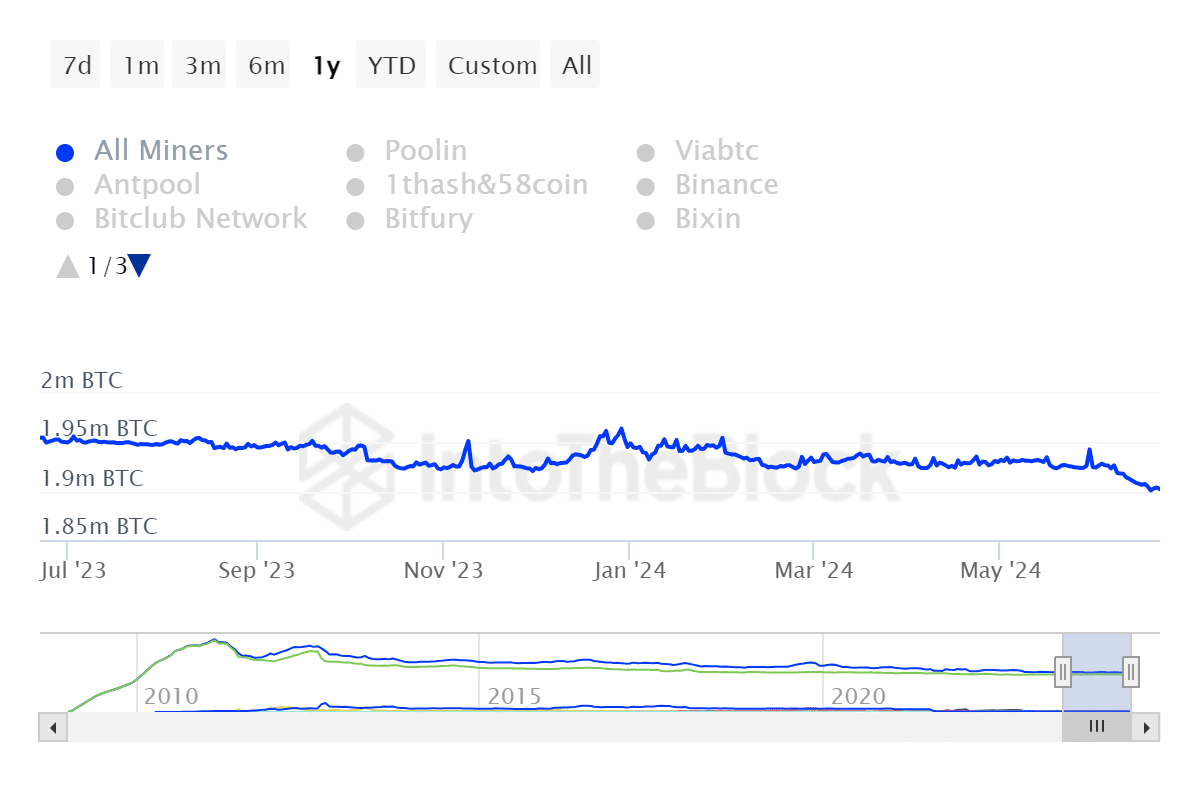

The data from IntoTheBlock indicated that the current price range of Bitcoin, between approximately $63,493 and $64,931, is particularly significant due to the high number of addresses involved in transactions at this level.

Specifically, about 1.9 million addresses purchased BTC within this range. Additionally, the average purchase price for these transactions was around $64,237. T

his concentration of buying activity at these levels highlights their importance in the market.

They represent key points where a significant volume of Bitcoin changed hands, influencing potential resistance or support dynamics in the market.

With many investors at or near this price, it can act as a strong resistance level when the price tries to rise back to that point.

These investors might look to break even on their investments, potentially selling their holdings, which adds selling pressure at this level.

Conversely, if the price dips back down to this range, the same investors might buy more to average their costs. They might also hold off selling to avoid losses, providing potential support.

Miners panicking?

Further data from IntoTheBlock reveals that Bitcoin miners have significantly increased their selling activities since the beginning of the year.

Miners have sold approximately 30,000 BTC, valued at around $2 billion, since June. This volume of sales is noted as the highest from the mining community in over a year.

This substantial selling by miners could be a response to various market conditions, including price volatility or the need to cover operational costs.

Read Bitcoin’s [BTC] Price Prediction 2024-25

However, it plays a critical role in influencing Bitcoin’s market dynamics, particularly affecting supply and price.

The significance of miners selling a large amount of Bitcoin becomes even more pronounced when considering the number of BTC held by various addresses within the current price range.