As Bitcoin drops 14%, new investors become the need of the hour

- Bitcoin saw short-term volatility increase as the halving event drew closer.

- The metrics forecast a bullish long-term future for Bitcoin.

Bitcoin [BTC] saw a sudden drop in prices on the 12th and 13th of April. The selling pressure heading into the weekend saw BTC fall 14.5% from $70.9k on Friday to $60.6k to mark Saturday’s low.

This led to fear in the altcoin market and contributed to widespread selling pressure.

Market participants who have called for a top as the halving approaches would be ecstatic, but this view could be myopic. The long-term trend remains firmly bullish. An influx of new investors was still underway.

The lifeblood of the bull run

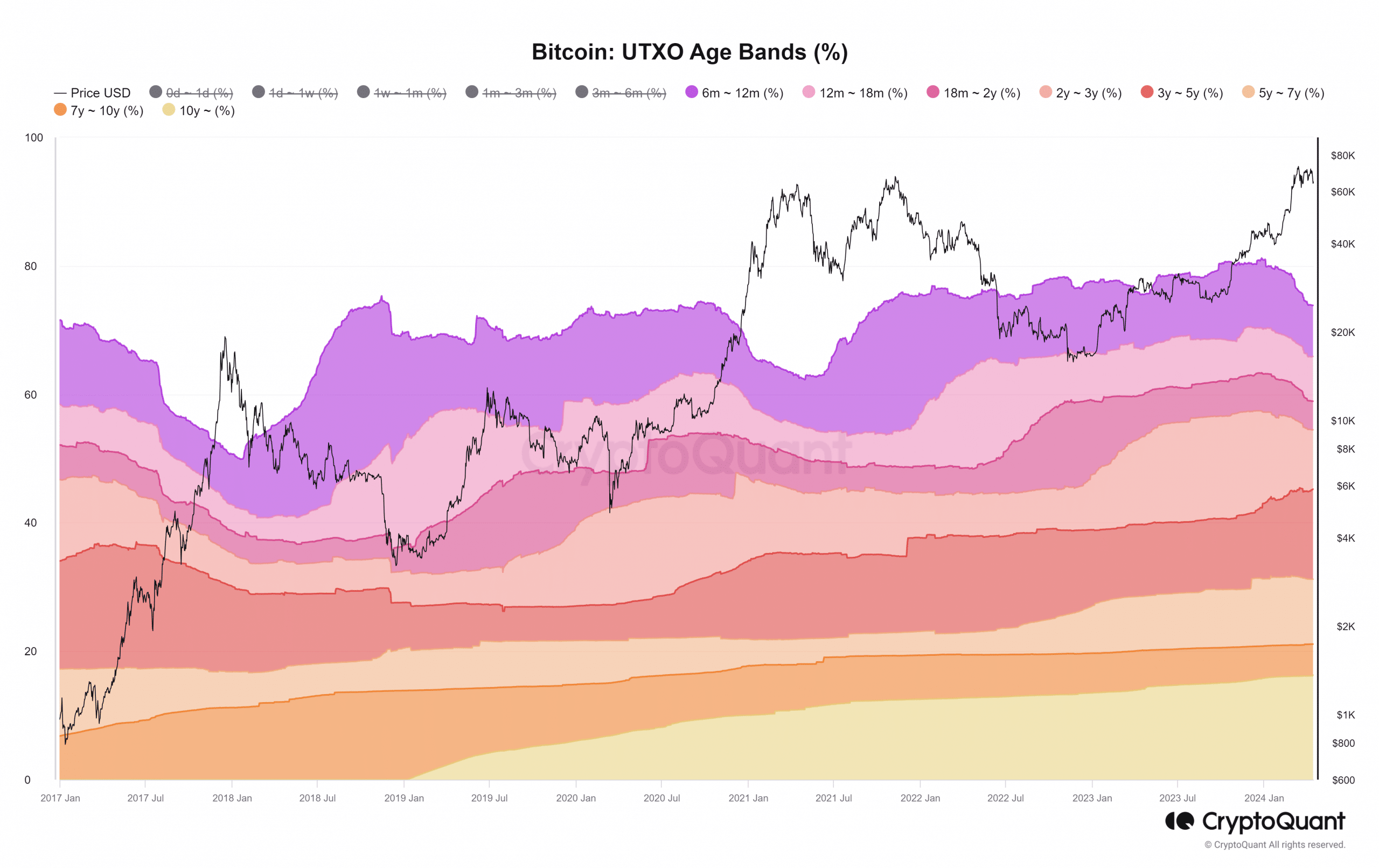

A CryptoQuant Insights post by analyst Crypto Dan noted a decrease in the proportion of Bitcoin held for more than six months. This was evident from the Bitcoin UTXO Age Bands % metric.

Source: CryptoQuant

This decreased proportion implied that newer investors were entering the market. This new demand is the fuel that would spark the next run. According to the analyst, this run has been in place for three months.

AMBCrypto’s analysis of the same metric also revealed another interesting factor. In the past two cycles, the 6-12-month-old BTC proportion drop during the bull run has been the steepest.

The weeks following the cycle top saw the same age band trend higher.

In 2021, this uptrend only came after the downtrend flattened out for three months.

This suggested that investors could wait for the 6-12 month age band to form a month-long sideways trend before looking to sell their BTC.

This is just one piece of the complex puzzle, and investors must also be using other metrics and market developments to make that decision.

Some of the other metrics that could mark a cycle top

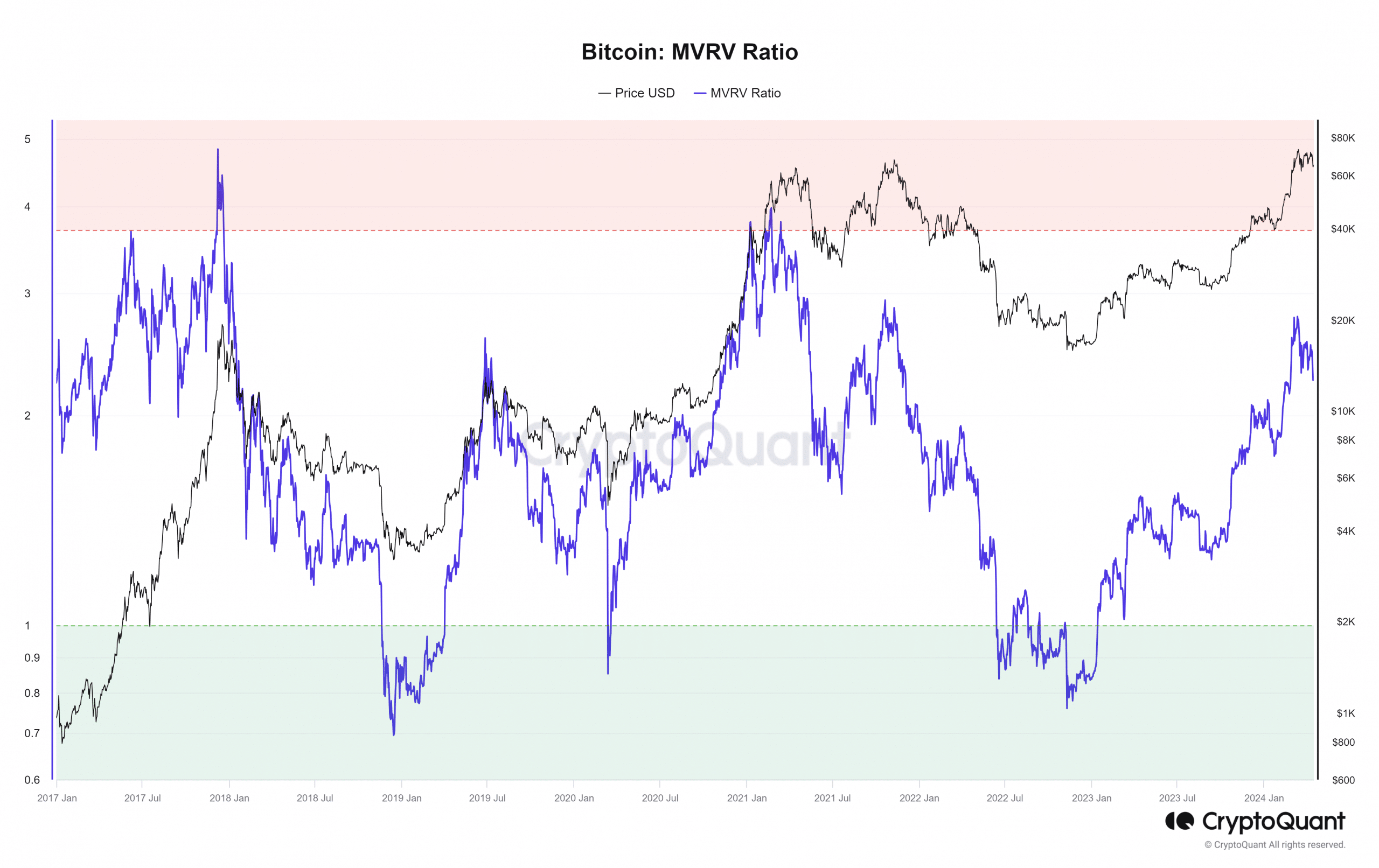

Source: CryptoQuant

Two of the most popular Bitcoin long-term metrics are the MVRV ratio and the Net Unrealized Profit/Loss (NUPL). They, too, reflected the bullish state of the market in recent months.

The MVRV ratio was at 2.25 on 13th April. This is well below the 3.7 mark that has historically marked the cycle tops. The price trend of the past few months saw the MVRV ratio trend higher.

The meaning is that the market cap of Bitcoin has increased faster than the realized cap of Bitcoin. In other words, the motive to sell has been growing but was not critical yet.

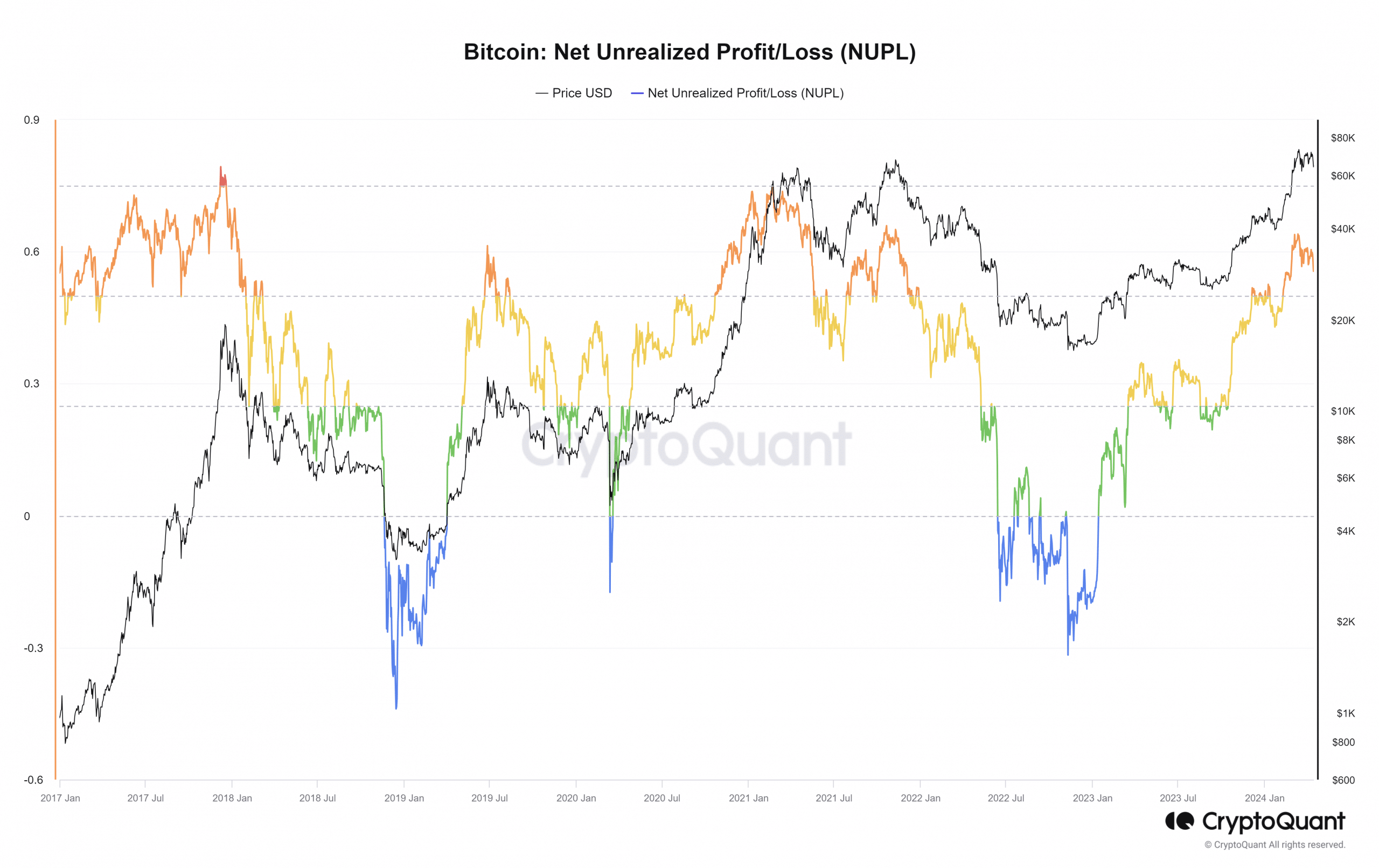

Source: CryptoQuant

Similarly, the NUPL was also rising, showing that it was more profitable to sell Bitcoin as the prices climbed.

With a reading of 0.55 on the 13th of April, there was still some way to go for the metric to reach the 0.7 mark that has marked cycle tops in the past.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Investors can keep an eye on the behavior of all three metrics in the coming months to understand just how close Bitcoin is to this run’s top.

However, it should be remembered that the Bitcoin ETFs are a colossal new addition to the market. It is unique to this cycle, and the effects of such behemoths on the market are hard to predict.