Bitcoin

As Bitcoin gets ready for 2024, this investor cohort should take note

The user cohort holding Bitcoins for 2-3 years owns a majority of the wealth stored in the asset.

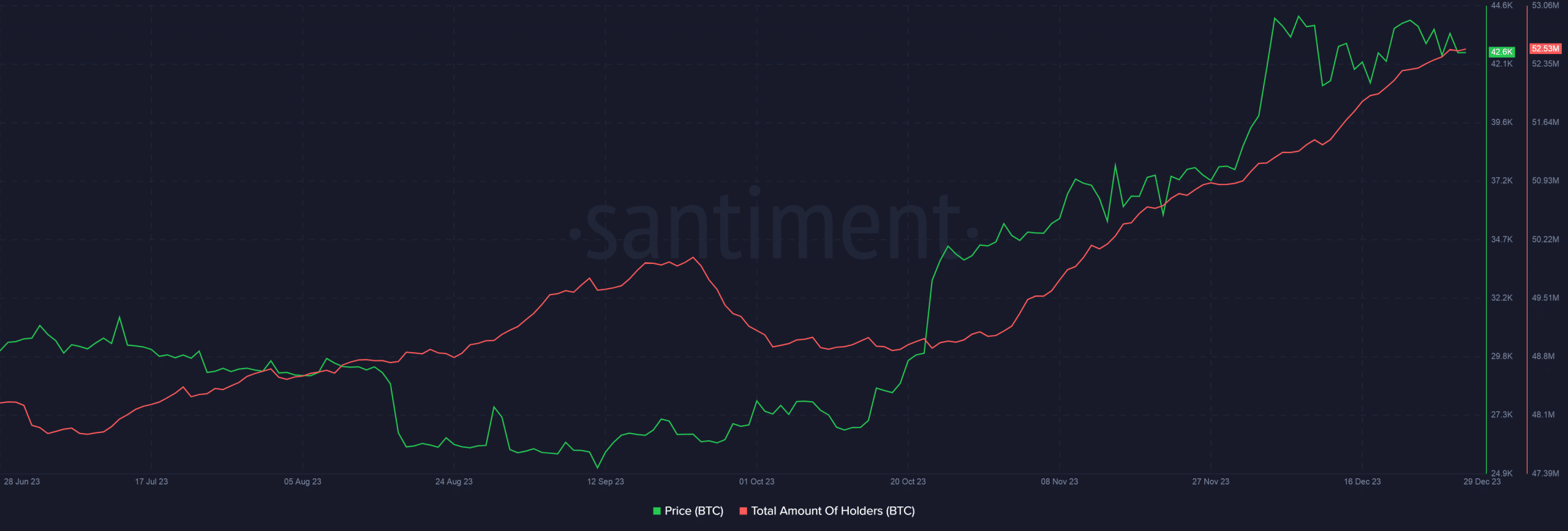

- The total number of Bitcoin holders stood at 52.53 million at press time.

- Users who have held BTCs for 2-3 years formed the lion’s share of Bitcoin’s total realized cap.

Bitcoin [BTC] held on to the $42,000 level over the last 24 hours of trading, as the countdown for an expected super cycle in the new year kept participants excited.

At press time, the king coin was exchanging hands at $42,641, having accumulated significant gains of 12.29% over the last months, AMBCrypto found using CoinMarketCap

data.Number of Bitcoin holders increase sharply

On expected lines, the rally which began in mid-October, shot up demand for the world’s largest cryptocurrency.

The total number of BTC holders increased by 3.6 million since then, equating to a 7.35% jump, AMBCrypto’s examination of Santiment’s data revealed.

With this, the total number of holders stood at 52.53 million at press time.

This user cohort holds the key

As demand for Bitcoin rises, many market analysts turned their attention to long-term holders of the coin who stuck with the asset through thick and thin.

On-chain research firm CryptoQuant highlighted the particular case of investors who have held BTCs for more than two years but less than three years. This cohort accounted for about 1/3 of the total realized capitalization across all age groups.

For the curious, the realized cap, or the stored value of the coin, is calculated by summing up each coin at the price when it was last moved. Similarly, Realized Cap – UTXO Value Bands show the distribution of realized cap of a specified value band.

Coming back to the 2y-3y cohort, the realized market cap of the group has been high throughout history. This basically meant that most long-term investors have held on to their stashes in this period.

In other words, this cohort owns majority of the wealth stored in Bitcoin. Hence, aggressive sell-offs from this group could put considerable downward pressure on BTC’s price.

Read BTC’s Price Prediction 2023-24

Is a sell-off event on the way?

However, it was still early to press the panic button. The Net Unrealized Profit/Loss indicator for the cohort showed a break-even point, ruling out any immediate liquidation worries.