Bitcoin

As Bitcoin miners dump $10 billion BTC, should you hold or sell?

The Pi Cycle Top indicator suggested a rally above $120K could trigger an overheated BTC market and potential cycle top.

- Miners sold over 110,000 BTC in a week; will it stall price rally?

- There was little room for growth before euphoria hit BTC markets per cycle tops indicators.

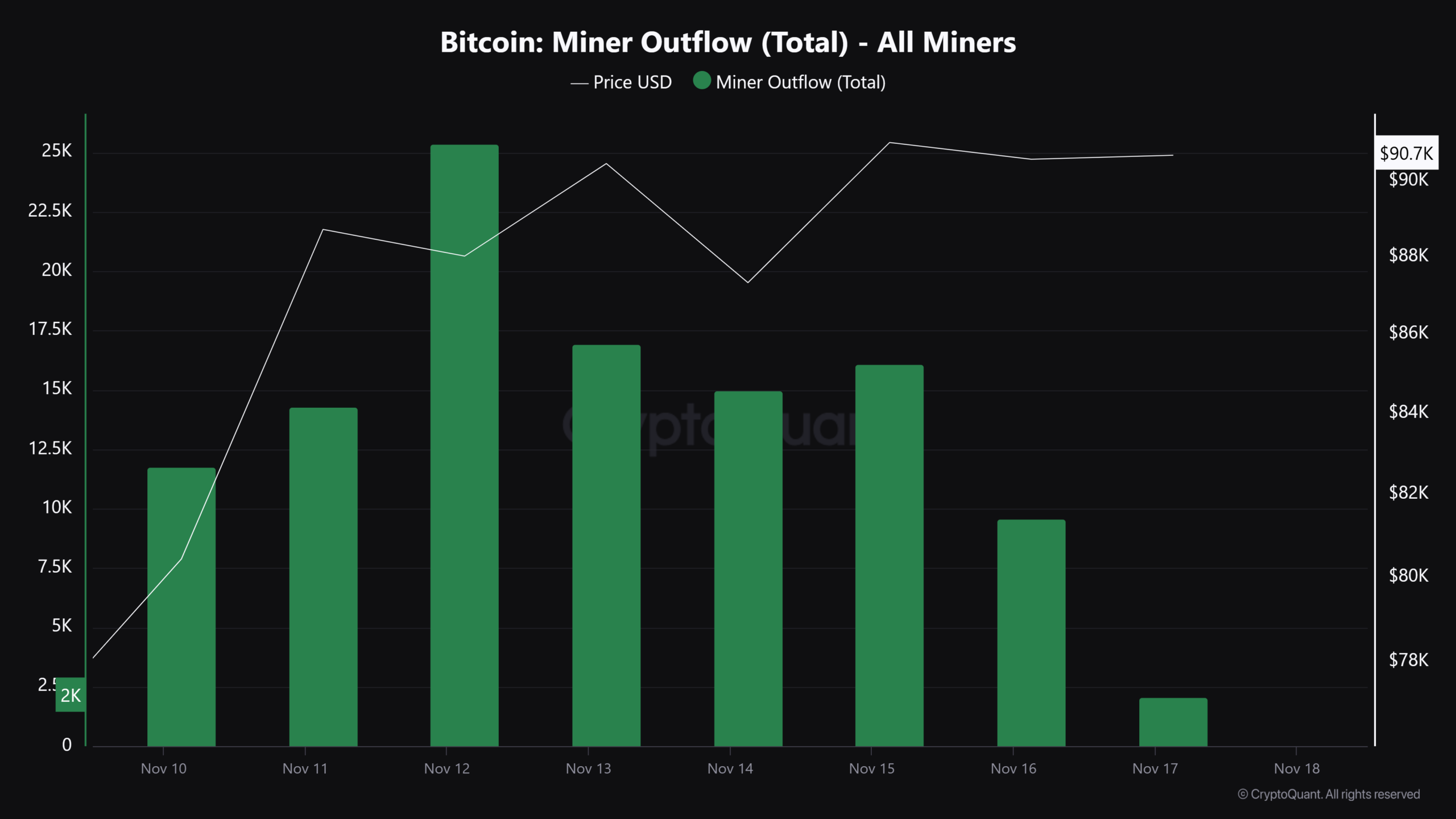

Bitcoin [BTC] miners’ selling pressure has intensified as the price of BTC crossed $90K. Between the 10th to the 17th of November, miners sold over 110K BTC, valued at nearly $10 billion, in a week.

The highest daily sell-off, 25 367 BTC (worth $2.2B), occurred on the 12th of November as the miners’ dump intensified.

Since October, miner sell-off has been rising amid overall broader market recovery.

However, this week’s intensified sell-pressure has raised doubts about whether it could derail BTC from crossing the $100K psychological target.

In the past, increased miner sell-offs and revenue marked local and cycle tops. If the current trend and reading leaned on the latter (cycle top), that could also trigger other holders to sell.

So, what’s the current cycle status as BTC flirts with $90K and eyes $100K?

Decoding BTC’s cycle top

From a miner’s perspective, a spike in miner fees (yellow) above 30% of total revenue has typically been correlated with past BTC cycle tops.

A high reading means elevated euphoria in BTC markets, which drives transaction fees to record high against rewards. That’s an overheated market signal.

In November, the miner fees hovered around 10% of total revenue, meaning the market was not still overheated.

Another indicator, the Pi Cycle Top, showed little room for a rally for BTC before the market became overheated.

In past trends, BTC’s move above the moving average (350DMA x2, green line) marked the cycle top and a signal for holders to offload.

The green line reading showed $120K, so the BTC surge past the level could be deemed a sell signal.

Read Bitcoin [BTC] Price Prediction 2024-2025

Interestingly, the $100K-$120K targets were wildly expected by large players across the options market, as noted QCP Capital, one of the world’s largest crypto options trading desks. The firm recently noted,

“In view of Bitcoin’s impressive rally since the US election, our view is that $100,000 – $120,000 may not be too far off.”

If so, a strong move above $120K could trigger the Pi Cycle Top and, by extension, increase profit booking across all cohorts of BTC holders. That would imply a 30% move from the $90K level at press time.