Bitcoin

As Bitcoin prices remain muted, will FOMC decision inject some volatility

Bitcoin deposits to centralized exchanges dwindled to a 3-year low, indicative of the lull in trading activity.

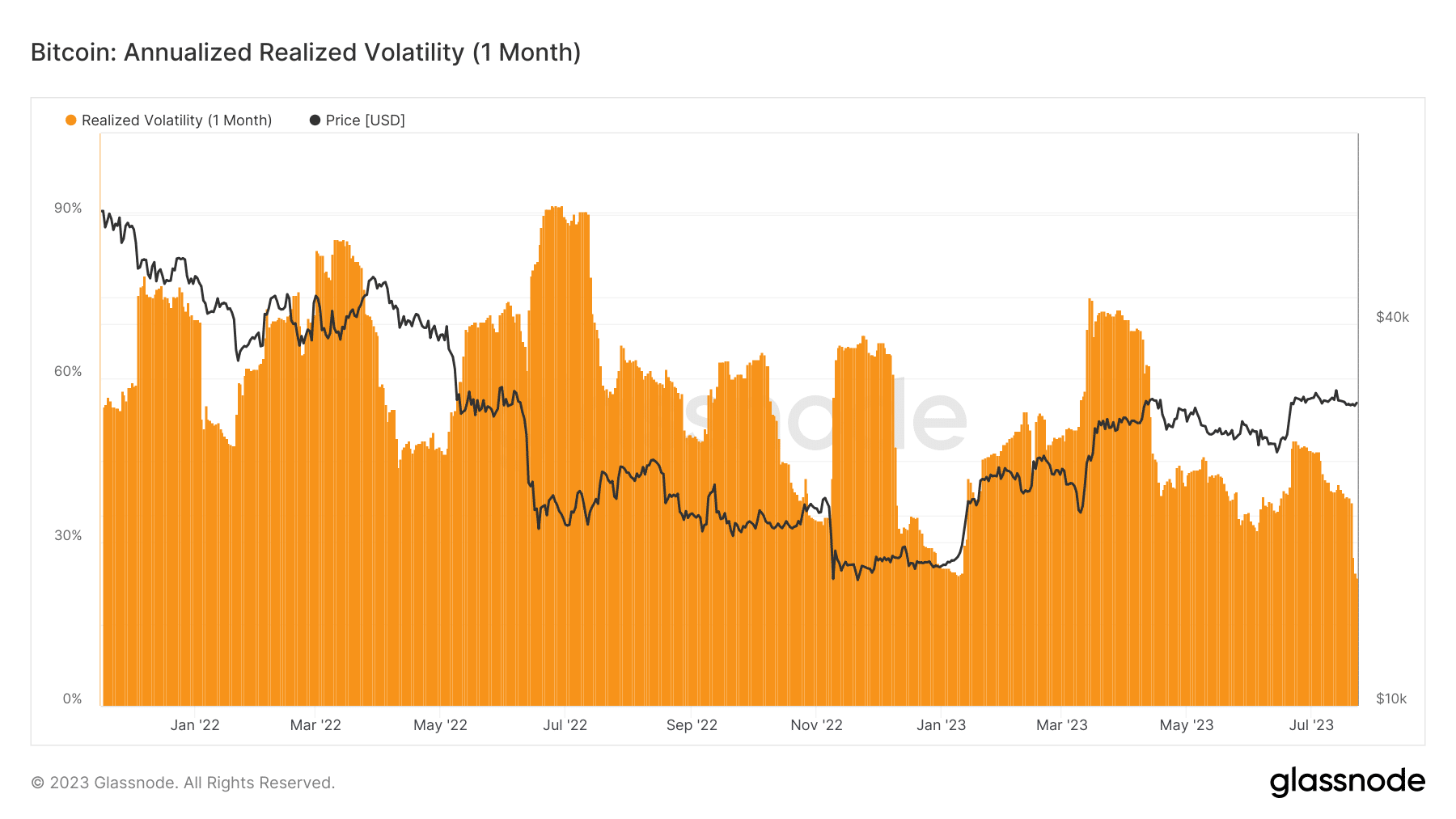

- BTC’s latest 1-month realized volatility mirrored historically low figures.

- BTC’s transfer volume retreated sharply from its early June highs.

Bitcoin’s [BTC] price movement continued to disappoint both the bulls and bears alike as the crypto community desperately waited for a breakout in either direction.

Read Bitcoin’s [BTC] Price Prediction 2023-24

BTC remains sluggish

Ever since the rally induced by institutional interest in cryptos, BTC has meandered in a narrow trading range of $30k-$31k. This has resulted in a noticeable decline in its volatility.

As per Glassnode, BTC’s 1-month realized volatility on 23 July dipped to 23.68%, comparable to historically low levels recorded in the late 2022 and early 2023 market.

Trading activity dips

The dip in volatility was primarily due to the decline in trading activity and investors’ preference to hoard coins. BTC deposits to centralized exchanges dwindled to a 3-year low as per a recent update shared by Glassnode, indicative of the lull in trading activity.

? #Bitcoin $BTC Number of Exchange Deposits (7d MA) just reached a 3-year low of 1,817.923

Previous 3-year low of 1,819.321 was observed on 23 July 2023

View metric:https://t.co/v3uKq4dCjX pic.twitter.com/inAIJZvNlv

— glassnode alerts (@glassnodealerts) July 24, 2023

Liquid supply is the amount of BTC tokens available to be traded in the secondary market, like exchanges. With the supply dropping to multi-year lows, the tokens transferred on-chain also trended downwards.

As evident below, BTC’s transfer volume retreated sharply from its early June highs.

Bitcoin’s bullish prospects

While the HODLing activity was spearheaded by long-term holders, known to store coins for extended periods, short-term holders didn’t stay behind. After cashing out their holdings during April’s rally, these supposedly “weak hands” have steadily accumulated to their portfolios.

The sentiment to HODL is rooted in the growing optimism behind BTC’s future prospects. With institutional interest peaking for digital assets in the backdrop of multiple spot Bitcoin Exchange-Traded Fund (ETF) applications, many of these investors were trying to be market ready during BTC’s next bull run.

The halving event, which have preceded bull markets in the past, could also be a major factor behind the HODLing strategy.

Is your portfolio green? Check out the Bitcoin Profit Calculator

As things stand, the market is in an equilibrium phase. Generally, macroeconmic conditions have played a part in injecting volatility to BTC’s price movements.

Traders were counting on the upcoming FOMC meeting this week to give some direction to BTC’s trajectory. Experts believed that the U.S. Federal Reserve could raise the interest rates by 25 bps this time after pausing the hike cycle in June.