As Bitcoin rallies, whales start selling and that means…

- The number of BTC addresses holding 1k-10k BTC dropped over the last three months.

- Market indicators and metrics remained bullish, hinting at a continued price rise.

Bitcoin [BTC] bulls have remained dominant in the market over the last seven days. However, while BTC’s price gained upward momentum, whales chose to sell off a substantial portion of their holdings.

Does this mean BTC will fall victim to a price correction soon?

Bitcoin whales are selling

CoinMarketCap’s data revealed that BTC’s price surged by over 6% in the last seven days. In fact, in the last 24 hours alone, the king of cryptos witnessed a more than 4% value hike.

At the time of writing, BTC was trading at $61,298.02 with a market capitalization of over $1.2 trillion.

AMBCrypto found that while BTC’s price moved up, the big pocketed players in the crypto space chose to sell their BTC holdings.

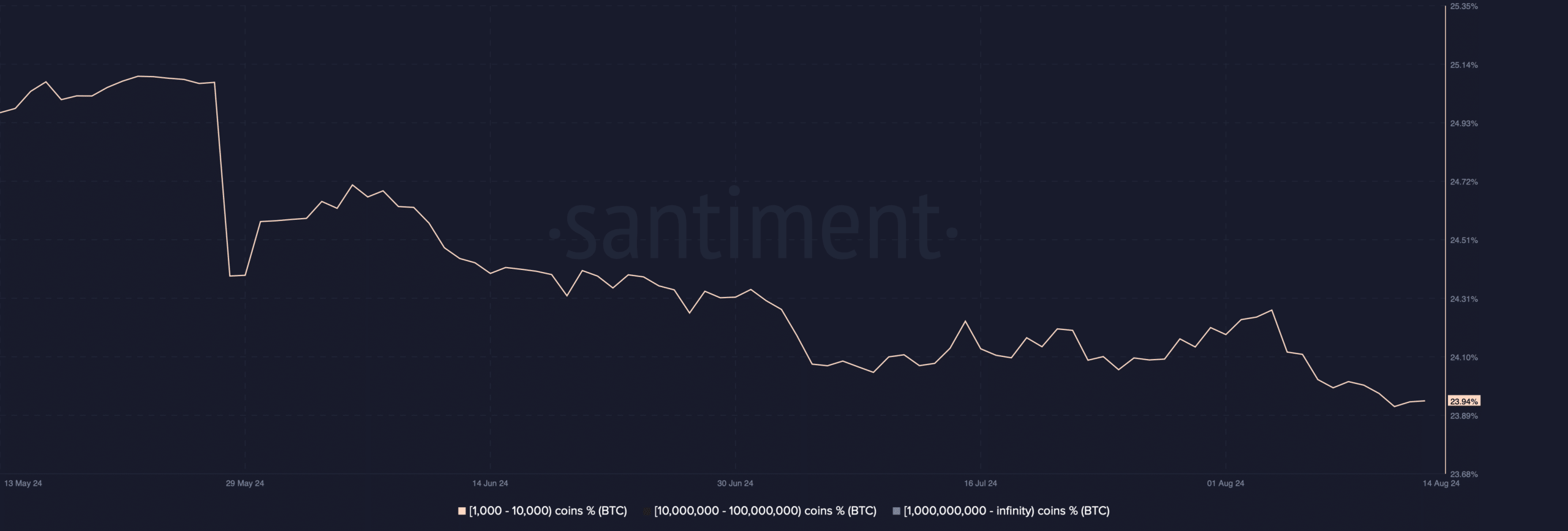

Our analysis of Santiment’s data revealed that the number of BTC addresses holding 1k-10k BTC dropped drastically over the last three months.

Ali, a popular crypto analyst, recently posted a tweet highlighting the same story.

As per the tweet, some of the largest Bitcoin whales have offloaded over 10,000 BTC in the past week, valued at approximately $600 million.

This suggested that BTC whales were lacking confidence in the coin and were expecting its price to drop in the coming days.

Will BTC’s price get affected?

Though whales were selling, buying sentiment was overall dominant in the market. AMBCrypto reported earlier that Bitcoin’s exchange reserve reached as low as it was seen back in 2018.

This indicated that buying pressure on the coin was on the rise. Our look at CryptoQuant’s data revealed quite a few bullish metrics.

For example, BTC’s aSORP was green, meaning that more investors were selling at a loss. In the middle of a bear market, it can indicate a market bottom.

Also, its Binary CDD suggested that long term holders’ movement in the last seven days was lower than the average. Both of these indicators suggested that BTC might continue its upward price movement.

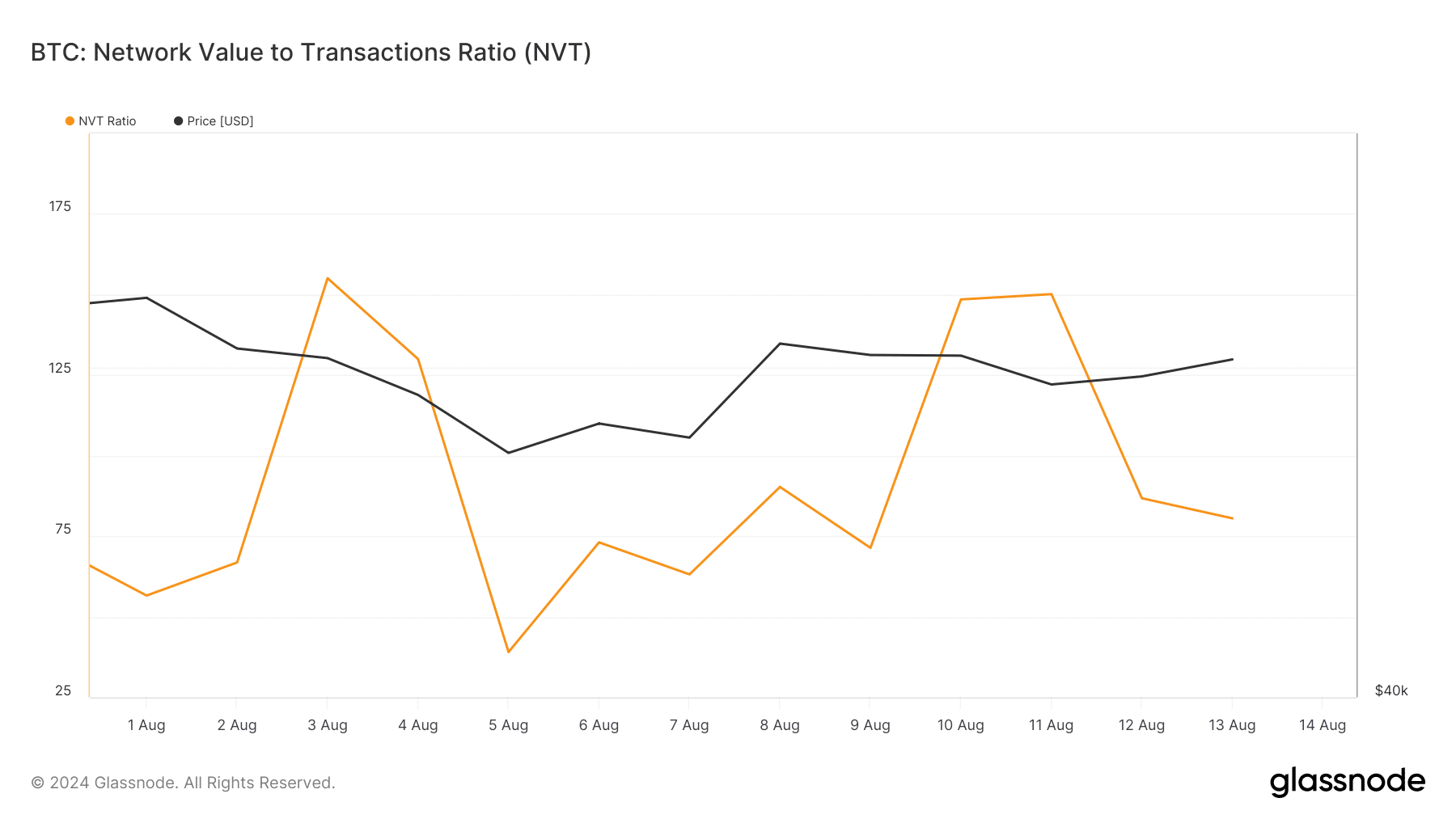

Apart from this, AMBCrypto, when checking Glassnode’s data, found that BTC’s NVT ratio had also dropped. Generally, a drop in the metric means that an asset is undervalued, which hints at a price increase soon.

Is your portfolio green? Check out the BTC Profit Calculator

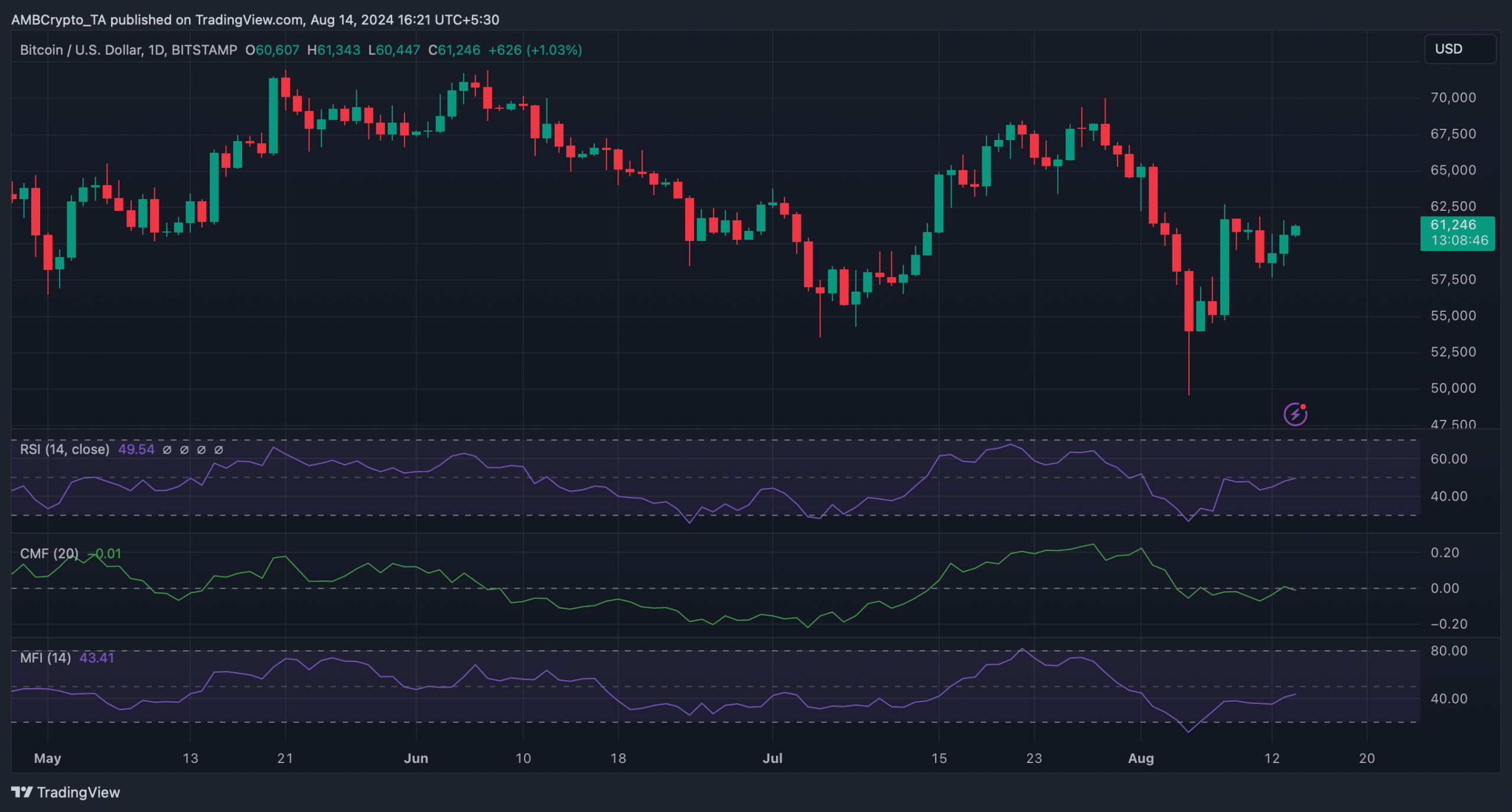

We then assessed Bitcoin’s daily chart to better understand which direction BTC was planning to move. The technical indicator Relative Strength Index (RSI) gained upward momentum.

Similarly, the Money Flow Index (MFI) also registered an uptick, indicating a continued price increase. Nonetheless, the Chaikin Money Flow (CMF) turned bearish as it went down slightly.