As Bitcoin revisits $26,000, here are the possibilities…

- BTC’s price has re-entered the $26,000 range.

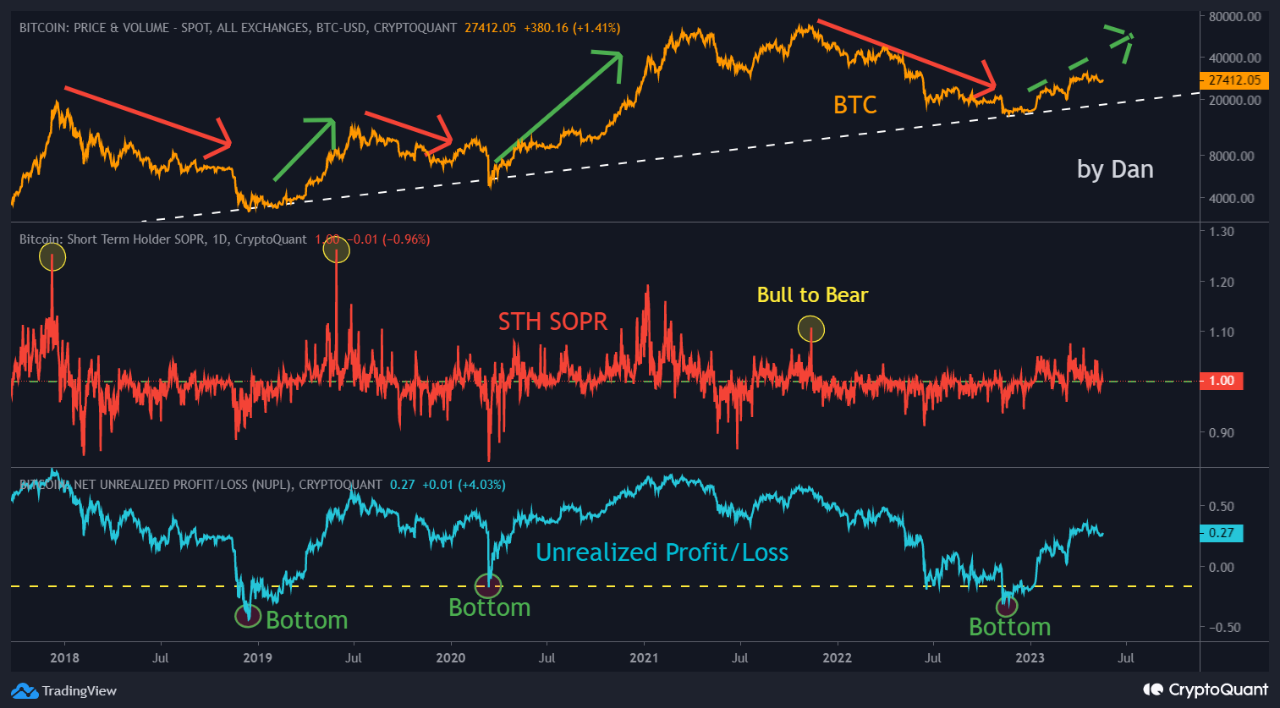

- CryptoQuant analyst Dan Lim opined that a market bottom has been reached.

According to pseudonymous CryptoQuant analyst Dan Lim, while variables such as recession and regulatory actions in the US could impact the cryptocurrency market, the Bitcoin [BTC] market has reached its bottom and is beginning a new bull cycle.

How much are 1,10,100 XRPs worth today?

Lim assessed BTC’s Spent Output Profit Ratio (SOPR) for short-term investors. It found that whenever the king coin’s market bottoms out, its unrealized gain/loss ratio drops below -0.18. This indicates that a considerable amount of BTC is being held at a loss until the market reaches its bottom.

Conversely, during bull market peaks, the short-term SOPR indicator “soars.” This suggests that this cohort of BTC holders (investors that have held for less than six months) has taken to coin distribution.

According to Lim:

“Recently, not only has short-term investors not been very profitable, but from a cycle point of view, (the) recent bull period since the bottom in November 2022 has been less than 6 months.”

Is a Bitcoin price rebound on the horizon?

At press time, BTC exchanged hands at $26,882.14 after oscillating between the $27,000 and $27,800 price range for a few weeks. Traders have become increasingly wary of a potential drop back to the $20,000 to $25,000 range.

According to data from Santiment, BTC’s social dominance, indicated by its prominence in online discussions, has surged. This is often a sign of fear among traders, suggesting an increased likelihood of a price rebound.

When BTC’s price re-entered $27,000 during intraday trading hours on 18 May, its social dominance immediately climbed by over 50%. At press time, this was 28.34%.

Further, data from Santiment’s Trending Keywords dashboard showed that the trending keywords in the past 10 hours were related to hardware wallets & security. According to Santiment, a clear indication of fear in the crypto market is when most top trending keywords center around hardware wallets and security.

This echoes the safety concerns expressed by traders following the unexpected collapse of cryptocurrency exchange FTX in November 2022, which ultimately marked a bottom for the market.

? One of the primary signs of fear is when the top trending #crypto keywords are almost all related to hardware wallets & security. We saw similar safety concerns from traders in November 2021 after the @FTX_Official collapse. That marked a market bottom. https://t.co/0MIfQq1TSd pic.twitter.com/nFIeAwmVPf

— Santiment (@santimentfeed) May 19, 2023

What the metrics say

While the above datasets might hint at a potential price rebound, one key price bottom indicator did not suggest the same at the time of writing. This was BTC’s Network Profit/Loss (NPL) ratio metric.

This metric tracks the average profit or loss of all coins that change addresses daily to record the periods of profit-taking or holder capitulation on-chain. NPL dips are usually a sign of an asset’s price bottoming out.

Is your portfolio green? Check out the Bitcoin Profit Calculator

According to Santiment, this is because they suggest ‘short-term capitulation of ‘weak hands’ and the re-entry of ‘smart money,’ which is why they coincide with local bounce backs and periods of price recovery.”

In the current BTC market, no such dips have occurred yet.