Analysis

As DOT hits new year low, late sellers can target this price level

With DOT sinking to a new low of $4, can late sellers benefit from the bearish dominance for extra gains?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- Sellers extinguished bullish rebound, as DOT sunk to $4.

- The absence of buying pressure could see further losses in the short term.

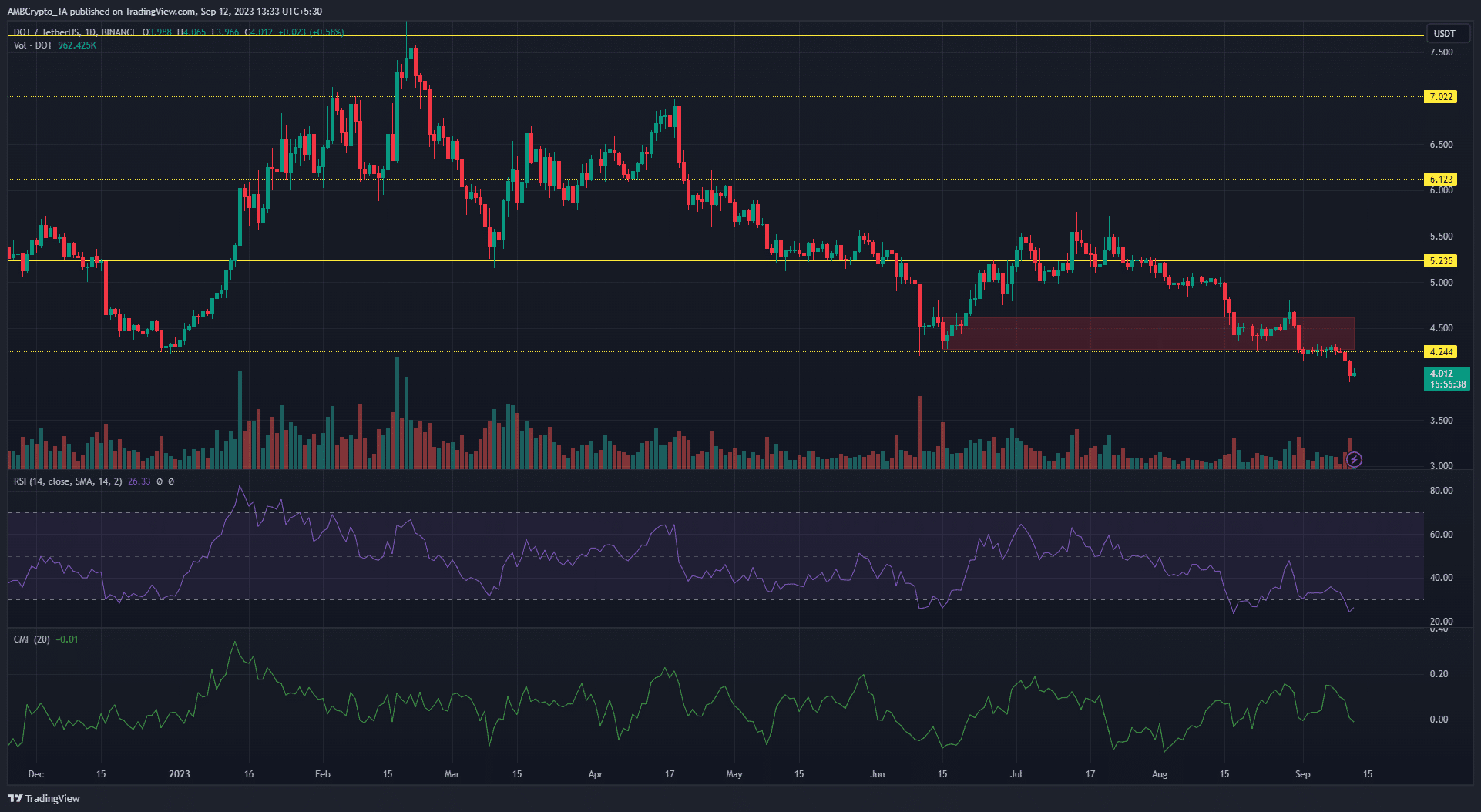

Polkadot’s [DOT] 7.9% dip over the past 48 hours saw the altcoin sink to a new-year low of $4. Previously, bulls had put up a last-gasp defense of the $4.24 support level over a week-long period.

How much are 1,10, or 100 DOT worth today?

However, the selling pressure on DOT and the bearish bias in the crypto market saw it register another significant dip. In the meantime, Bitcoin [BTC] continued to trade within the $25.8k range after recovering from the sharp drop to $25k over the past day.

Bullish defense of $4.24 support level not enough to stop sellers

The swift decline of the Relative Strength Index (RSI) into the oversold zone highlighted the intense selling pressure on DOT. With bulls unable to defend the support level, sellers broke through the bullish order block (OB) to produce a new price low.

Investors quickly reacted by pulling out capital as evidenced by the Chaikin Money Flow dropping from +0.15 to -0.01.

While bears extended their dominance through the break of a key price level, bulls could still mount a rally from the $4 price zone. This could be initiated by Bitcoin recovering the $26.5k price level this week.

Else, bears can register more gains by aggressively selling DOT to the weekly chart lows of $3.6.

Read Polkadot’s [DOT] Price Prediction 2023-24

Negative funding rate highlighted the absence of buyers

The $14 million difference between short and long positions on the daily timeframe in the futures market showed that sellers were actively on the hunt for more gains. According to Coinglass

, this translated to a 52.43% share of the open positions for shorts.The large long/short holdings by sellers along with the negative funding rate signaled the absence of buyers. This meant DOT was likely to dip even more from the current price level.

Source: Coinglass