Ethereum

Can Ethereum’s ‘multi-year high’ push ETH above $4K after price crash?

ETH Futures saw significant growth in March as trading activity climbed to a multi-year high.

- ETH’s Futures Open Interest touched an all-time high.

- Its Funding Rate across exchanges remained positive.

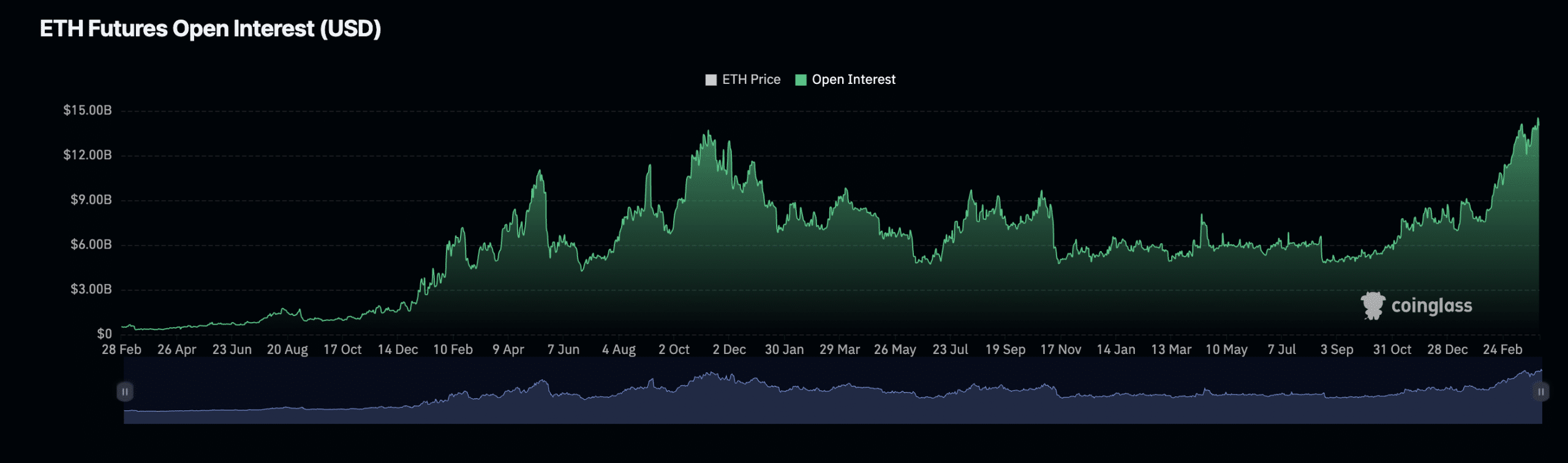

Ethereum [ETH] Futures Open Interest climbed to an all-time high as the uncertainty around the potential approval of a spot Ether exchange-traded fund (ETF) in the U.S. deepened.

Futures Open Interest refers to the total number of a coin’s Futures contracts that have yet to be settled or closed. When it rises, it indicates an increase in the number of market participants entering new positions.

According to AMBCrypto’s analysis of Coinglass’ data, ETH’s Futures Open Interest totaled $14.53 billion on the 1st of April, having risen by 86% year-to-date.

For context, ETH’s Futures Open Interest was below $10 billion at the beginning of the year.

March was good for Ethereum’s Futures market

ETH’s Futures market recorded significant success in March, on-chain data has revealed.

According to AMBCrypto’s analysis of The Block’s data dashboard, ETH Futures’ monthly trading volume across the largest cryptocurrency exchanges touched a three-year during the 31-day period.

Our look at The Block further showed that ETH Futures trading volume across these platforms exceeded $1 trillion. The last time the coin’s monthly trading volume was that high was in May 2021.

Following a similar trend, the coin’s monthly futures trading volume on the Chicago Mercantile Exchange (CME) market also rose to a three-year high.

With over 120,000 active users spread across 60 countries, CME is one of the world’s largest derivatives marketplaces.

When the trading volume on the exchange climbs in this manner, it signals a spike in market participation by institutional investors such as hedge funds and large asset managers.

AMBCrypto found that during the 31-day period, the aggregated monthly trading volumes of CME Ethereum Futures totaled $30 billion. The last time it was this high was in November 2021.

Market unmoved by recent headwinds

ETH’s price has faced significant headwinds in the last month as it continued to face resistance at the $3500 level at press time.

In fact, on the 20th of March, the coin’s value plummeted to a 30-day low of $3100 before reclaiming its gains to exchange hands at $3354 at press time.

Despite this, the coin’s Funding Rates across cryptocurrency exchanges remained positive at press time.

Is your portfolio green? Check out the ETH Profit Calculator

A positive Funding Rate is a good sign, as it suggests a surge in market demand for bullish leverage positions. This means more market participants are entering trade positions in favor of a price rally.

At press time, ETH’s Funding Rate was 0.019%