Altcoin

As Gala Games co-founders take each other to court, here’s what followed

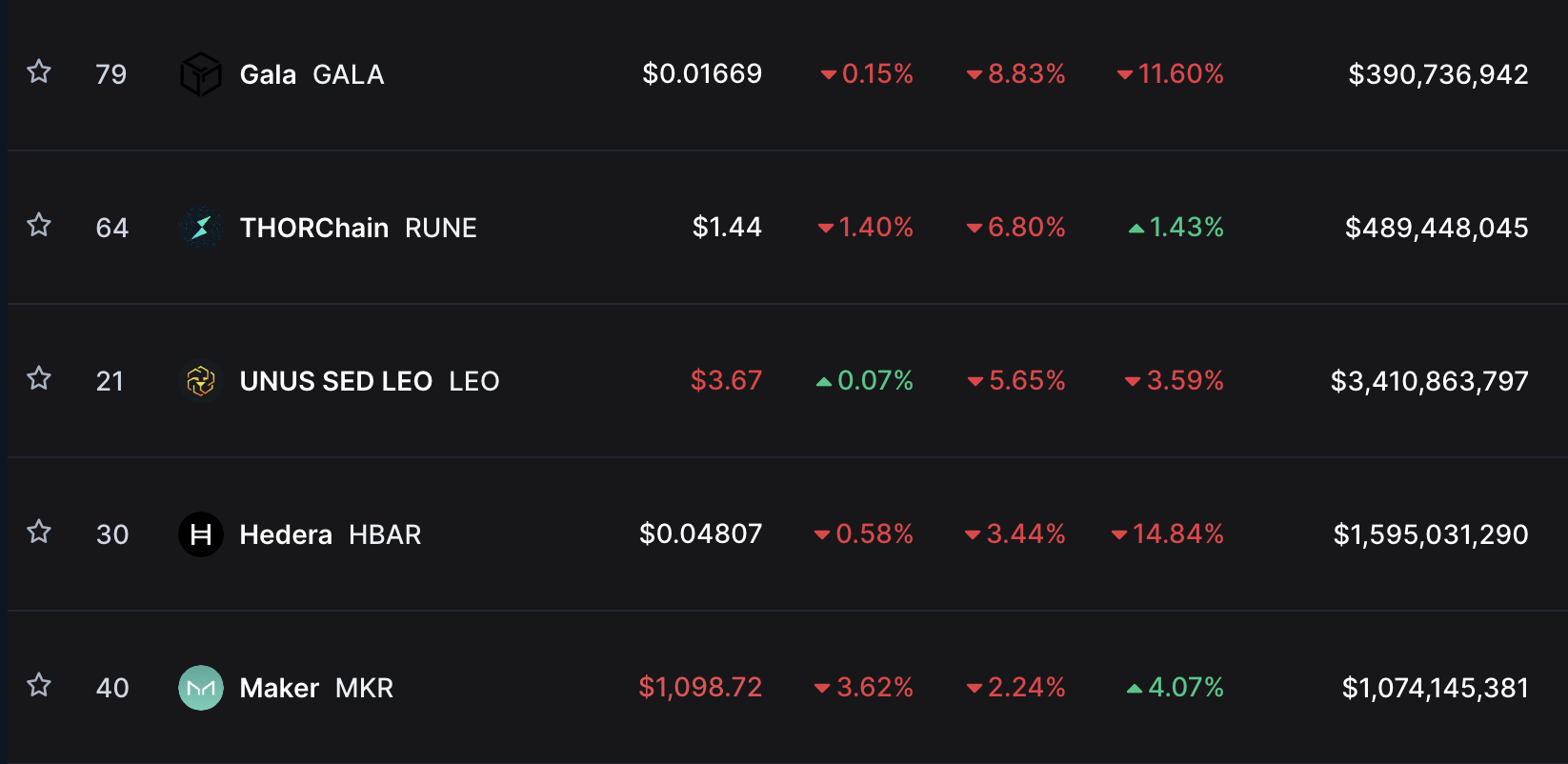

With an 8% fall in price, GALA leads as the crypto asset with the most decline in the past 24 hours. This is due to the lawsuits filed by the project’s co-founders against each other.

- GALA’s value has dropped by almost 10% in the past 24 hours.

- The price decline was due to the lawsuits filed by the project’s co-founders against one another.

GALA has fallen 8% in price, leading the decline among all crypto assets in the past 24 hours, according to data from CoinMarketCap.

The drop in value was attributed to the poor sentiment trailing the blockchain gaming platform after its co-founders filed lawsuits against each other.

You can read both of the lawsuits here:

1. Gala Game's CEO Eric Schiermeyer's Lawsuit against co-founder: https://t.co/92ywN1fPnY

2. Gala Game's co-founder Write Thurston lawsuit against Gala's CEO: https://t.co/xCoFkXRkaG— Jake Browatzke ? (@jakebrowatzke) September 2, 2023

Read GALA’s Price Prediction 2023-2024

According to a filing dated 31 August, the CEO of Gala Games Eric Schiermeyer, filed a lawsuit against co-founder Wright Thurston, alleging that the latter, through his investment firm True North United Investments, had stolen GALA tokens worth $130 million.

Schiermeyer alleged that Thurston was also involved in the theft of node-running licenses and sold them to pocket the proceeds.

On the same day, Thurston filed a lawsuit against Schiermeyer, claiming that the CEO had mismanaged the company’s funds and had wasted millions of dollars in assets.

The market reacts

At press time, GALA exchanged hands at $0.01677. Due to a steady decline in demand for the altcoin, its price has plummeted by 26% in the last month.

Demand has cratered further in the last 24 hours, as daily traders have since taken to selling off their holdings. On a 12-hour chart, GALA distribution exceeded accumulation amongst market participants.

At press time, key momentum indicators plunged downward and rested in oversold zones. The token’s Relative Strength Index (RSI) was 24.53, while its Money Flow Index (MFI) was 18.69

Readings from the token’s Directional Movement Index (DMI) confirmed that GALA bears controlled the market. The sellers’ strength (red) at 42.64 rested solidly above the buyers’ (green) at 11.81.

Additionally, the Average Directional Index (ADX) above 25 showed that the sellers’ strength was a rock-hard one that buyers might find impossible to revoke in the short term.

Sell offs are being conducted below cost basis

As fears mount over whether the actions of these co-founders would significantly tank GALA’s value, the token has recorded its highest count of daily active addresses since 10 June, data from Santiment revealed.

According to the data provider, 580 addresses were involved in GALA transactions in the early hours of today, the highest daily count in the last month.

How much are 1,10,100 GALAs worth today?

A further assessment of whether these transactions were profitable revealed that the traders that have sold in the last 24 hours have done so below their cost basis. In fact, on Sunday, GALA recorded the highest daily on-chain transaction volume in loss it has seen in the last month.

The ratio of daily on-chain transaction volume in profit to loss at 0.28 at press time meant that for every GALA transaction that returned losses, only 0.28 ended in a profit.