As investors flock to Bitcoin’s ‘safe-haven,’ is $80K inevitable for BTC?

- With major institutions betting on its future, Bitcoin is increasingly being seen as a store of value

- Massive amounts of USDT is flooding the market, indicating signs of liquidity

Investors moved from traditional equities to Bitcoin [BTC] as they view the latter as a lower-risk asset with strong potential.

The aforementioned trend was highlighting by the 10% gains on Bitcoin’s weekly charts, pushing it to a new all-time high of $77,000. This, on the back of rising uncertainty over Trump’s fiscal policies – Particularly China tariffs and the growing national debt.

With the new administration setting sights on positioning the United States as a crypto capital, Bitcoin’s position as a safe haven might be revised.

Big institutions are betting on Bitcoin’s future

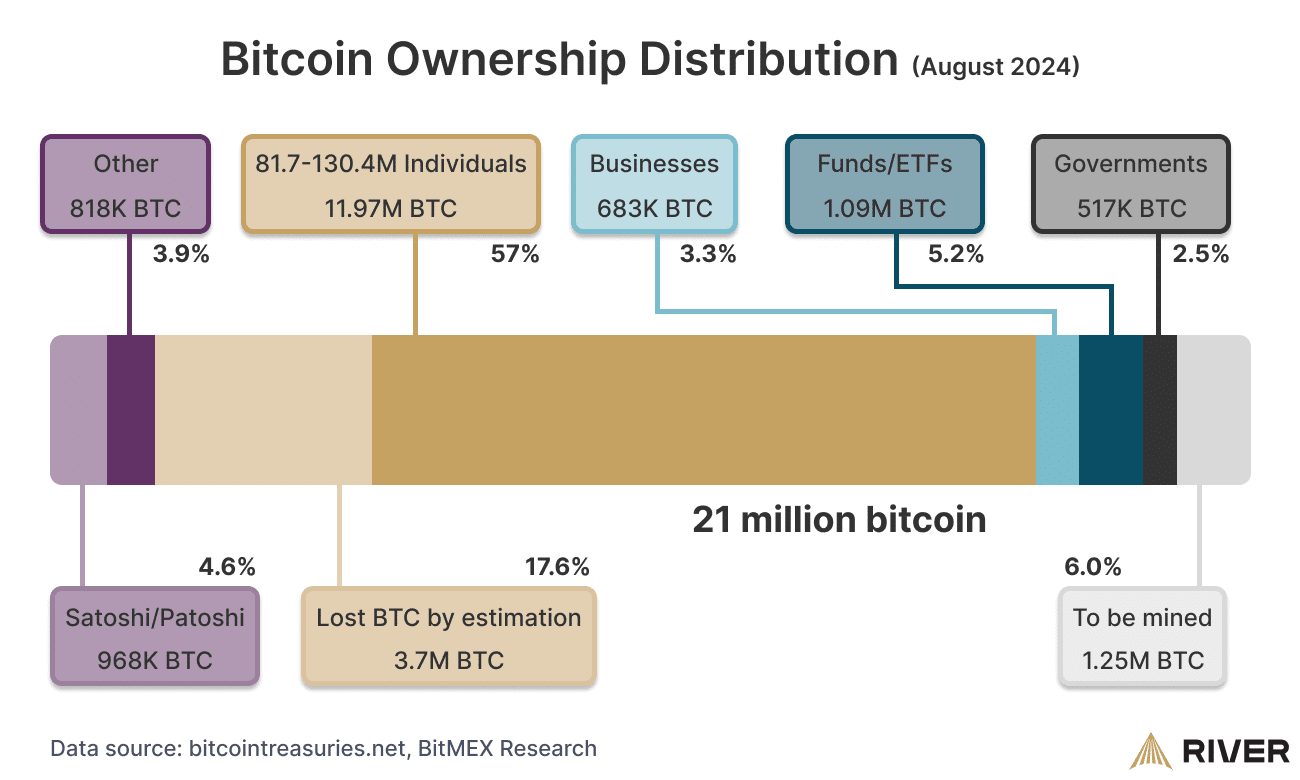

With Bitcoin’s fixed supply of 21 million coins, investors are increasingly stacking BTC as a true store of value. In fact, a report by financial intelligence firm River highlighted BTC’s ownership across key stakeholders.

This backing was crucial, especially as the derivative markets have evolved since the last presidential election, with Open Interest (OI) hitting a record $45 billion.

Growing institutional interest offers long-term security, helping absorb speculative swings. As a result, over the last 24 hours, $36.28 million in liquidations occurred, with $25.20 million in short positions being closed.

Additionally, BTC ETFs shattered records with massive inflows, just a day after the election results. This has given retail investors a strong foothold as they view the current price as a high-risk, high-reward dip.

If this momentum holds, BTC may hit $80k by the end of November’s final trading days. This can be confirmed a different set of bullish factors too.

Massive liquidity is coming but…

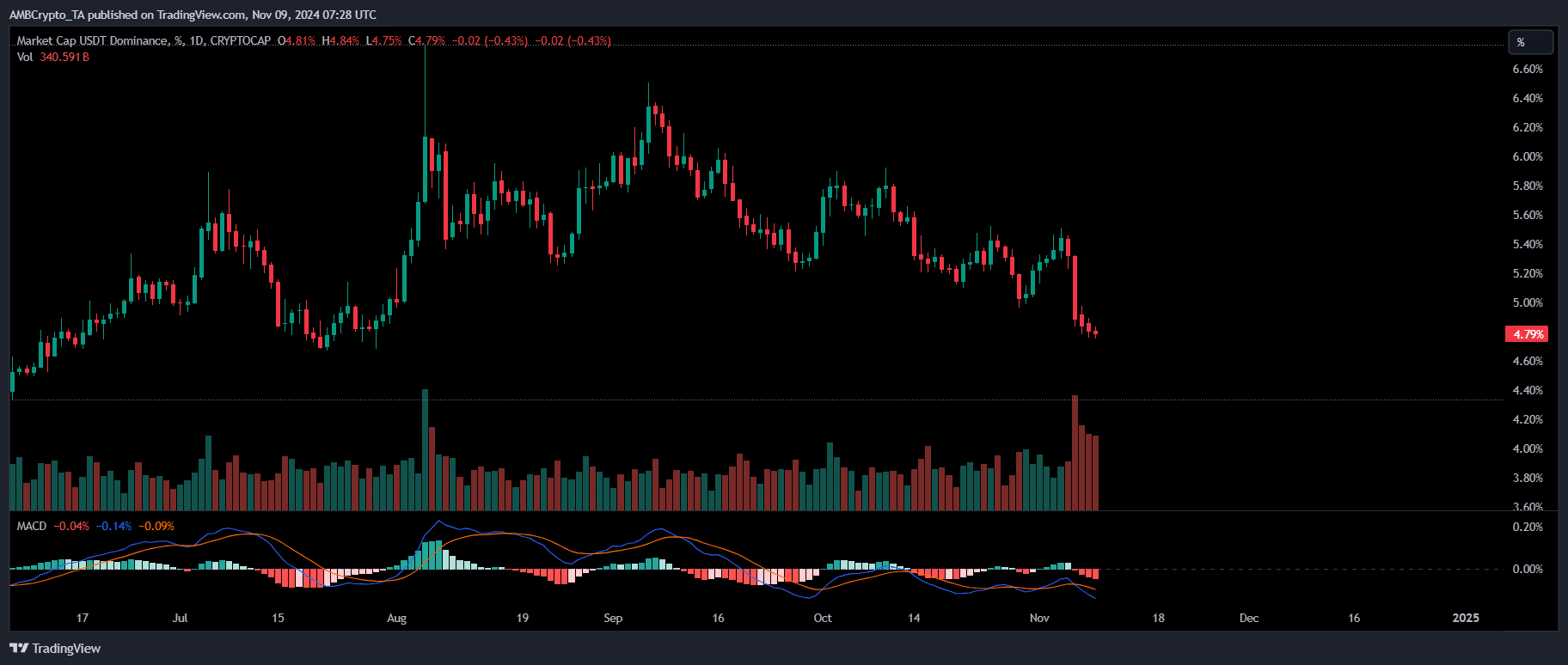

Unlike previous cycles, where USDT market dominance slid but rebounded, this time, its dominance has steadily dropped. Despite BTC entering a high-risk zone, the dominance showed consistent red bands, hitting a daily low of 6% on Election Day.

A low USDT market share typically signals BTC nearing a market bottom, as investors move stablecoins back into the asset. They see the prevailing price as an attractive entry point.

Tether’s Treasury recently minted 1 billion USDT tokens, given the current market conditions as Bitcoin emerged as a safer asset.

Despite bullish signs, the market may be overheating now. The RSI indicated an overbought condition, with 74% of price movement upwards in the last two weeks.

Weak hands might cash out, triggering a slight reversal. So, monitoring big addresses is essential, as their support will be crucial in absorbing this pressure. Thus, Bitcoin was at a crossroads at press time.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Short-Term Holders (STHs) might sell out on profits, causing a minor pullback. However, the overall market sentiment still pointed to a rally to $80k before the end of the month.

A key factor supporting this trend is the rising uncertainty around ‘Trump trades.’ This makes Bitcoin a safer bet than equities, bolstering institutional interest.

While a small dip did seem possible, BTC’s bull rally appeared poised to continue at press time.