Altcoin

As LTC marks 12 years of successful operations, the future holds this…

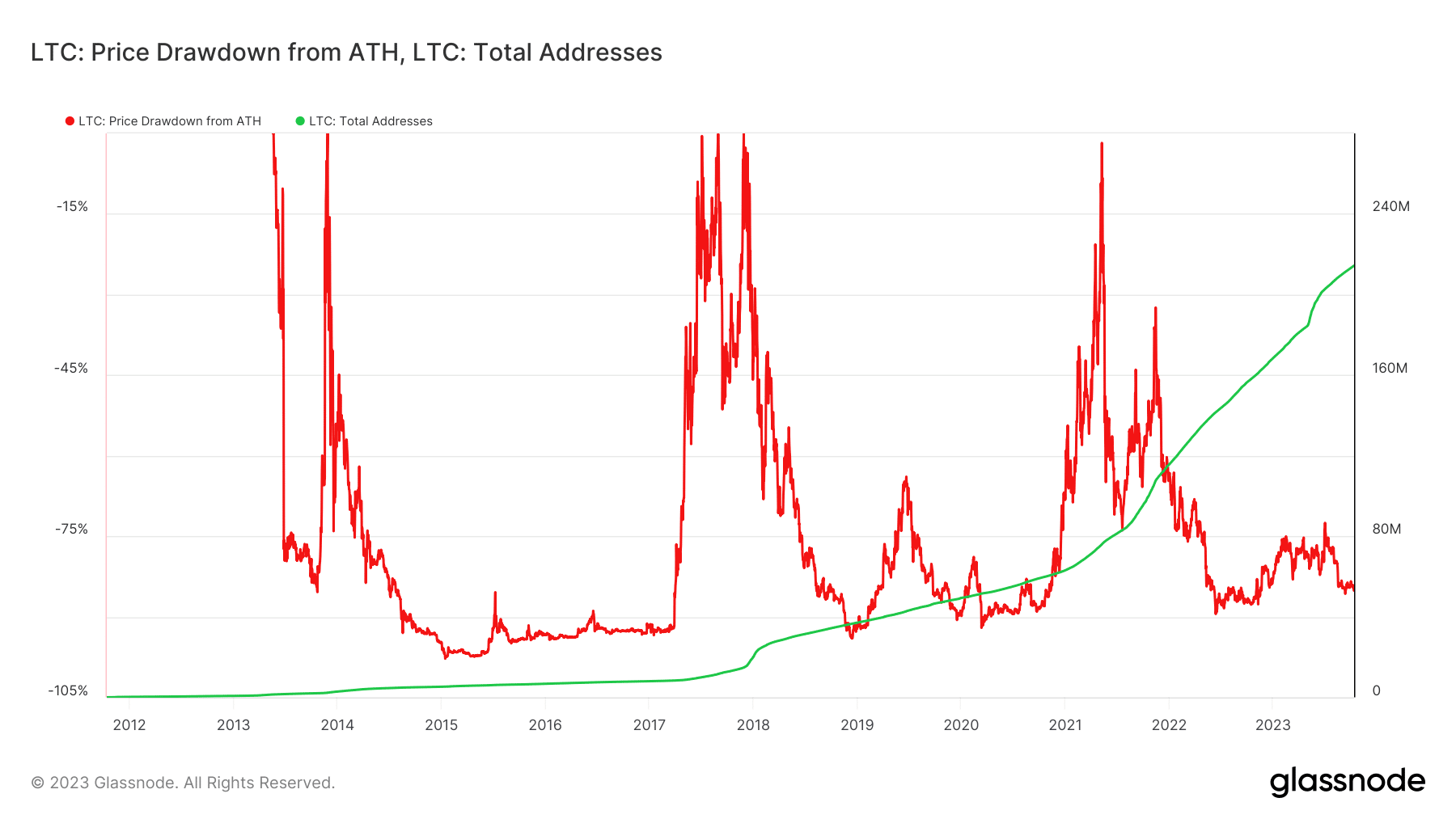

- Litecoin’s price drawdown from its ATH revealed that it was getting closer to the next bull cycle.

- LTC’s short-term sell pressure could soon give way to a bullish relief.

Litecoin [LTC] has been around for 12 years since it was launched and today, 13 October, happens to be its anniversary. It also happens to be Friday the 13th, a day that is popular for a lot of negative superstitions. So, could the timing of the anniversary be a foreshadowing of Litecoin’s future?

Is your portfolio green? Check out the Litecoin Profit Calculator

The good news is that Litecoin is safe from Jason and his machete. Or at least the chances are low and probably zero. Puns aside, perhaps it is best to look back at how far Litecoin has come in those 12 years. Let’s start with addressing growth which has experienced exponential growth.

Litecoin had less than 10,000 addresses on 13 October, 11 years ago. Fast forward to the present and the network has over 214 million addresses. Quite an achievement as far as adoption is concerned and puts into perspective how far the network has grown.

The above chart also highlighted something interesting about the LTC price performance. Pullbacks from previous all-time highs revealed something interesting. Litecoin has experienced previous major drawdowns from its ATHs and the latest bear market in 2022-2023 saw the price drawdown to previous lows.

The price drawdown metric highlighted LTC’s long-term bullish and bearish cycle. It also revealed that the bear markets made themselves quite evident before the next bullish wave occurred. And when a rally finally commenced, it was often a sharp rally that took a shorter period than the bear market.

LTC could be on the verge of a rally

LTC’s massive pullback from its 2021 highs suggested that the next bullish cycle could be drawing closer every day. However, prevailing market conditions do not exactly spell confidence for the market. Exploring whale activity on the supply distribution metric revealed mixed activity that wasn’t exactly consistent with strong demand.

The largest whale category (addresses holding over 1 million LTC) has been selling since July. Meanwhile, addresses that have the largest share of the circulating supply (addresses holding between 100,000 and 1 million LTC) have not shown much activity in the last three months.

How many are 1,10,100 LTCs worth today

While the above findings suggested that it might be a while before the next long-term rally

, things may turn out differently in the short run. This was because Litecoin, at press time, showed signs that it could be on the verge of a relief rally after the 46% pullback since June highs. LTC exchanged hands at $61.52 at the time of writing.Furthermore, LTC’s Relative Strength Index (RSI) already showed signs that bullish strength was building up. However, the Money Flow Index (MFI) recently showed that outflows associated with the bearish condition prevailed since the start of October.