As MakerDAO aims for incognito mode, MKR reacts by…

- MakerDAO’s latest proposal aims to allow anonymous representation of delegates.

- There was no even distribution of MKR supply across addresses.

DeFi protocol MakerDAO [MKR] has begun voting on a proposal that would allow its delegates to become anonymous, as well as their whereabouts. The proposal, championed by co-founder Rune Christensen, would become a compulsory requirement for eligible voters if approved.

How much are 1,10,100 MKRs worth today?

The proposal had other parts where there were consequences for those who thwart the directive. According to the proposition, which first surfaced in February, any delegate found guilty of revealing their identity to the public would forgo their salary.

Recompense for the watchful

In addition, any member of the community who provides evidence of wrongdoing in that aspect would get rewards.

Recently, MakerDAO’s founding member had also laid the grounds for an Endgame proposal, which got resounding support from the community. But for this, Christensen believes that compromise would be avoided across board.

For Christensen, the idea would ensure that delegates become less prone to criminality targets. Also, this would ward off situations where delegates take advantage of relationships to favor a particular cause, while the project minimizes the case of hacking. He said,

“The point is that it should not be possible for potential attackers, bribers etc to know which companies or people to target.”

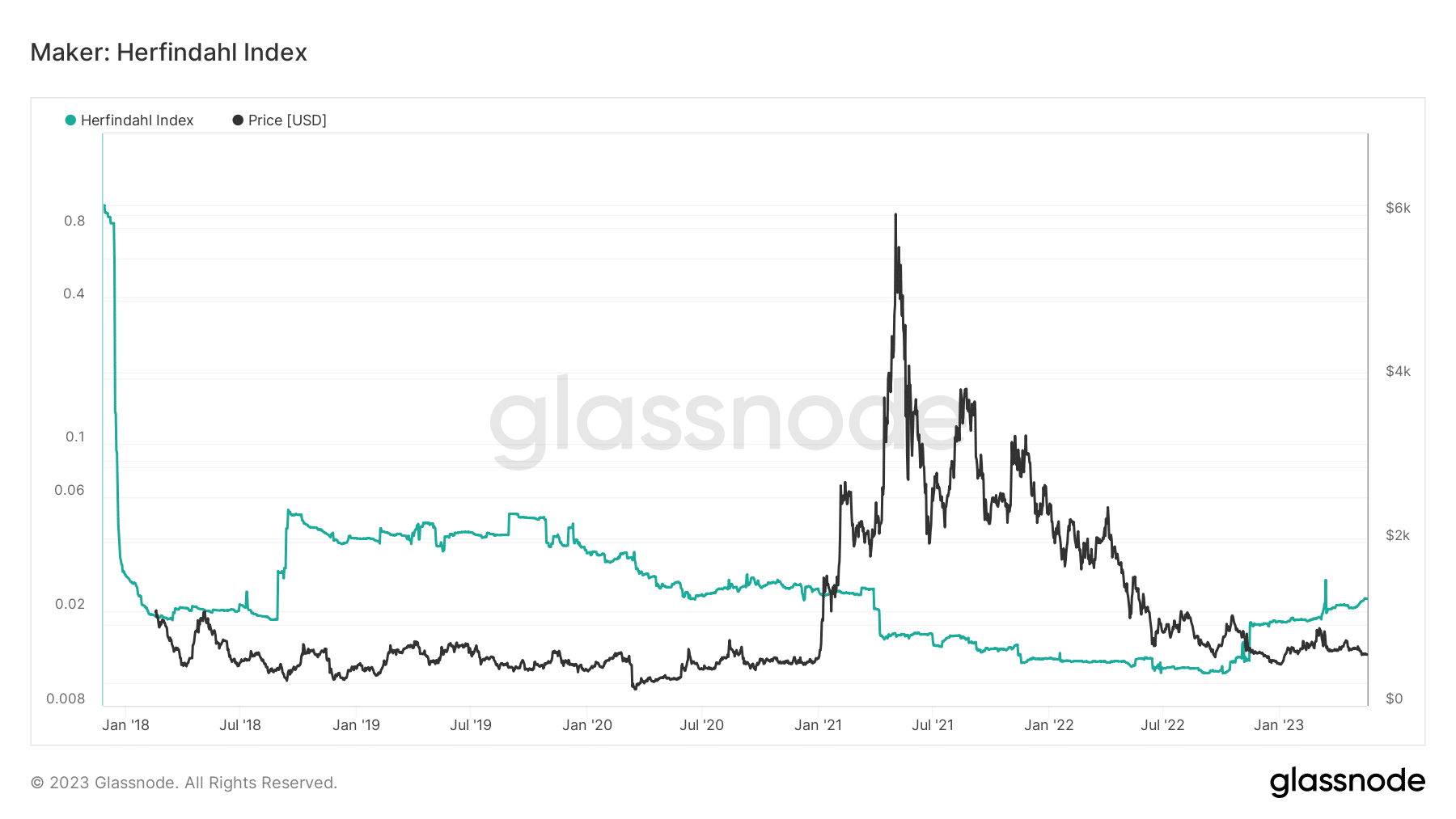

Meanwhile, on-chain data showed that Maker’s Herfindahl Index had risen. At press time, Glassnode revealed that the metric was 0.022.

For context, the metric measures the share of addresses of the current supply in relation to the average address balances on the Maker network. When this metric is low, it serves as an indicator of low supply concentration.

Not yet recovery season

But since it had improved from its lowest of low, it means that funds were more concentrated on certain addresses than others. Therefore, competition on the network was not exactly intense.

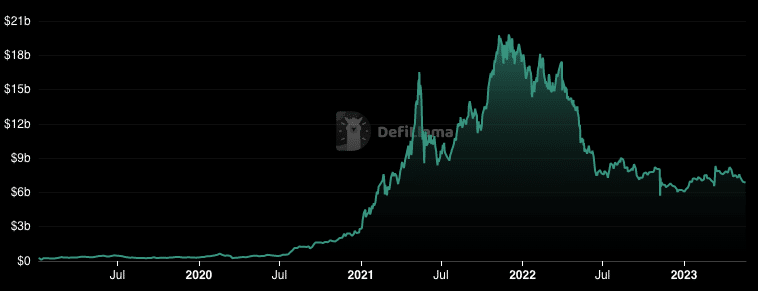

With regards to the Total Value Locked (TVL), MKR still played second-fiddle to Lido Finance [LDO] despite a recent reserves flip. The TVL describes the level of smart contract deposits by investors into chains under a protocol.

At press time, MKR’s TVL was $6.87 billion, representing a 7.30% decrease in the last 30 days. This implies that the unique liquidity addition to Maker had reduced. Hence, the protocol’s health was not functioning at the highest possible rate.

As per the MKR price, data from CoinMarketCap showed that the value had decreased by 12.19% in the last 30 days.