As OpenSea and Blur’s race intensifies, will Gemesis be the catalyst to…

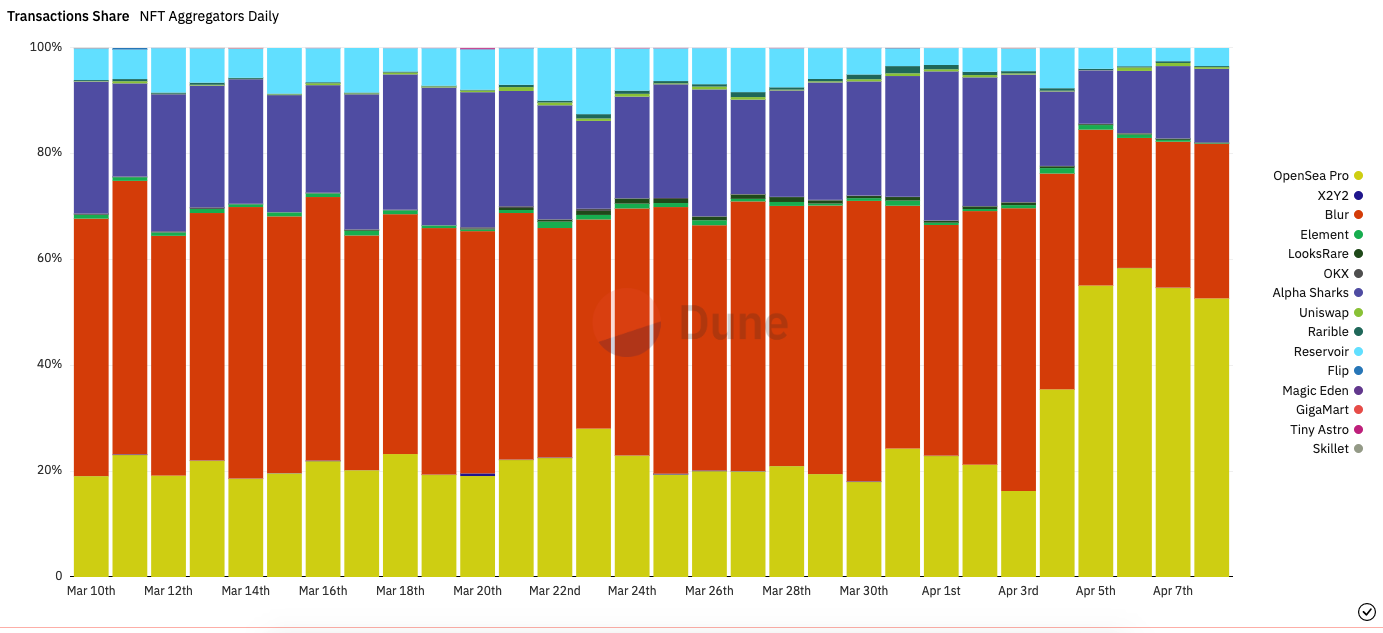

- The OpenSea Pro platform has outstripped Blur in transaction share among NFT marketplaces.

- Users continued to adopt items from the Gemesis collection.

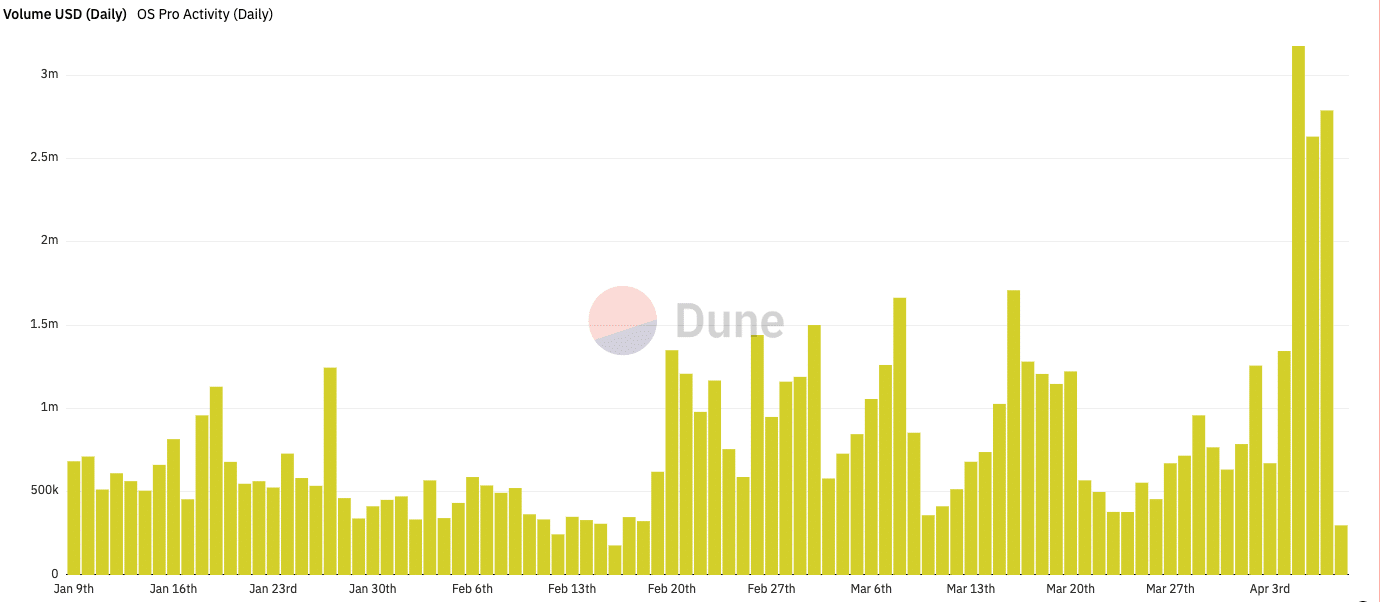

Gemesis, OpenSea Pro’s community NFT collection, has attracted an incredible number of active users and subsequently turned to an incredible hike in volume for the newly launched NFT aggregator. According to Dune Analytics, OpenSea Pro’s daily transaction volume on 7 April surpassed $2.7 million.

How much are 1,10,100 ETHs worth today?

Volume and active addresses soar, thanks to…

This increase in volume means that higher liquidity flowed into the ecosystem, and there was a more active market for buying and selling collectibles on the platform.

OpenSea, which was the undisputable NFT marketplace of the 2021 bull market, has been facing intense competition from Blur since 2023 began. As a response to the already-heated rivalry, the Devin Finzer and Alex Atallah-founded platform developed the pro version.

Although a lot of users have been considering OpenSea Pro since it offered similar trading conditions as Blur, the major propeller seems to be Gemesis. The collection serves as an addition to the pro launch. And was termed as a “thank you” initiative for the OpenSea community, while it also marked the rebirth of the marketplace.

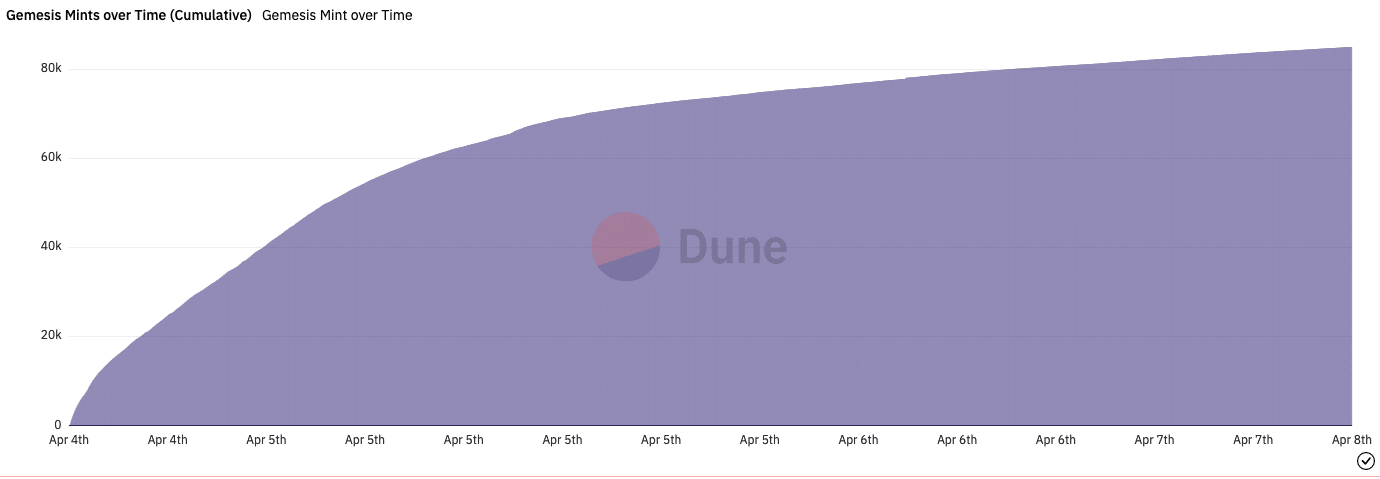

Interestingly, the marketplace had announced that users who had bought an NFT on Gem before 31 March were eligible to claim one of the items in the collection. Gem was an NFT aggregator integrated into the OpenSea Pro platform.

At press time, the floor price of the Gemesis collection was 0.044 ETH. Although this represented a decline from 0.07 ETH, addresses attracted to the collection continue to swell. At the time of writing, 85,306 out of the 180,000 items have been minted.

OpenSea: Reclaiming its lost mandate

As a result of the increasing participation in the collection, Blur seems to have lost its reign in the fight for the NFT share. According to the blockchain query data provider, Daily Active Users (DAU) on OpenSea Pro was 53.2% as of this writing. Blur, on the other hand, garnered 30% of the activity.

Read Ethereum’s [ETH] Price Prediction 2023-2024

The DAU serves as a metric that gauges the number of unique public addresses that interact with a decentralized application. Hence, the assessment of the Blur and OpenSea Pro data implies that more addresses preferred to transact on the latter. This, successively, improved its performance and laid the foundation for a larger market share.

With OpenSea’s new offering, Blur’s superiority could be a thing of the past. Moreso, it was not only on 7 April that the OpenSea Pro platform began dominating. Rather, it took the mantle as early as 5 April — a day after it officially launched.

![Solana [SOL] gains on Ethereum [ETH] but faces sell-off risks](https://ambcrypto.com/wp-content/uploads/2025/04/5B92B32E-5F8B-49F6-94A3-D0086EF6CCA2-400x240.webp)