Analysis

As Pepe embarks on a downward spiral, where can buyers re-enter

PEPE’s price rejection at the range-high could present a buying opportunity at these levels.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- PEPE faced price rejection at a range-high.

- Sellers gained a market edge; funding rates remained positive.

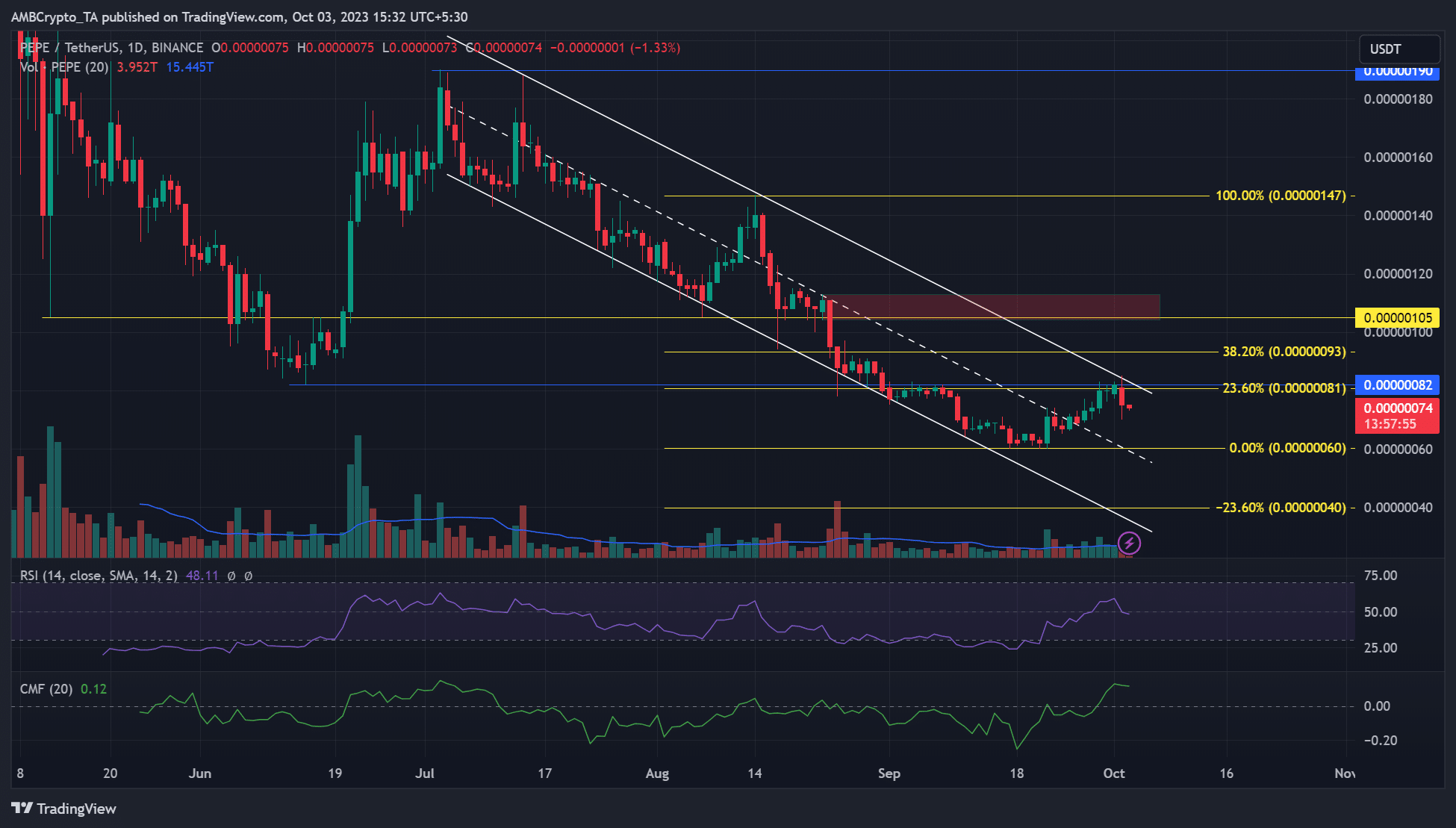

Pepe [PEPE] has been on a steady decline in Q3 2024, chalking a descending channel. The recent recovery attempt faced a price rejection at the range-high of $0.00000085, which could further derail bullish efforts.

Read Pepe [PEPE] Price Prediction 2023-24

PEPE hasn’t been on the declining spree alone. Other memecoins posted significant losses in Q3 as well.

Will the mid-range stop further drop?

The recovery attempt in the second half of September was interrupted at the range-high. A Fibonacci retracement tool was placed between the August high and the recent low. Based on the Fib tool, the 23% Fib level ($0.00000081) aligned with the range-high.

In addition, the level was close to June lows. As such, the area could be a bearish zone, and PEPE could re-target it if the drop eases at the confluence of the 0 Fib level and the mid-range near $0.00000060.

An extended plunge could tip bulls to re-group at $0.00000040, especially if BTC reverses most of the recent gains.

Meanwhile, the buying pressure peaked and eased after hitting the range high, as demonstrated by the RSI. Similarly, PEPE registered significant capital inflows, as shown by the positive CMF.

Sellers consolidated the market

The decline in CVD (Cumulative Volume Delta) indicated sellers sought more ground as of press time. The price reversal was followed by a dip in Open Interest (OI) rates. It illustrates that the demand for PEPE also eased in the Futures market in the past few hours before press time.

How much are 1,10,100 PEPE worth today?

But OI improved, and the funding rates remained positive at press time. It meant that bulls were attempting market re-entry.

The confluence level of $0.00000060 could be the ideal re-entry point for bulls, but tracking BTC is crucial for optimized set-ups.