DOGE traders are increasing their holdings, should you do too?

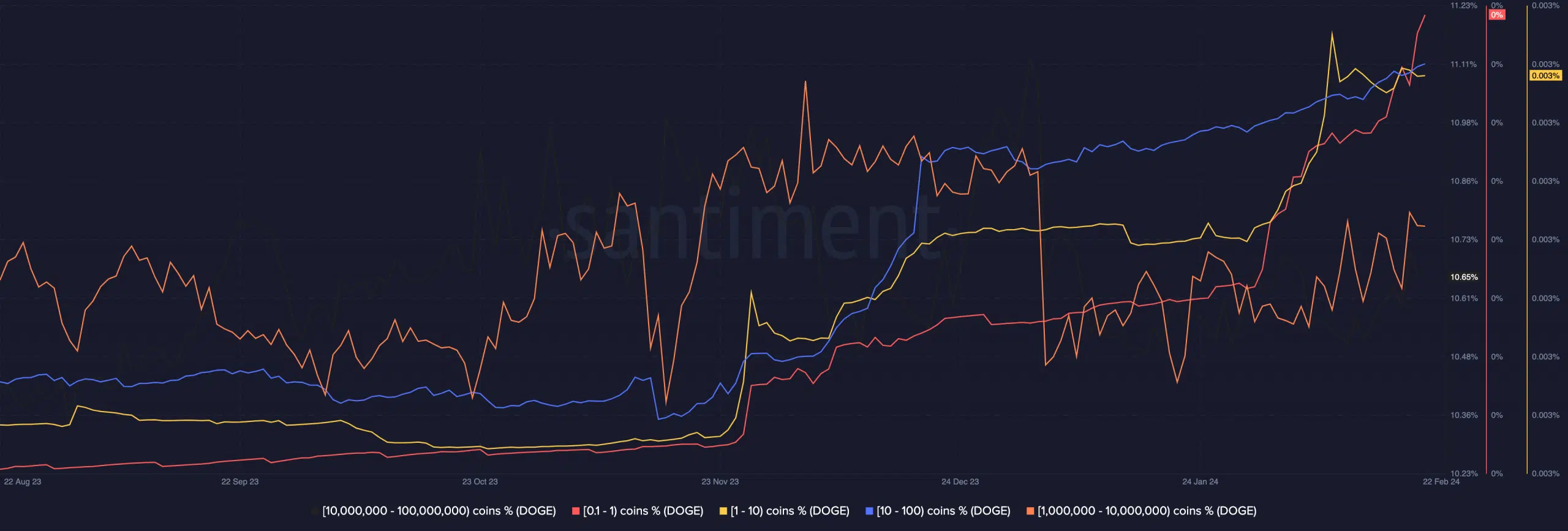

- The 0 to 100 coins and 1 million to 10 million cohort have increased their balances.

- DOGE might dump into the $0.80 before it bounces.

AMBCrypto’s analysis on the 21st of February showed that Dogecoin [DOGE] holders have been adding more coins to their portfolio. Using Santiment’s on-chain data, we observed that the balance of addresses of the 0 to 100 Dogecoin holding cohort has been increasing.

However, the retail segment was not the only one accumulating. A further assessment showed that the 1 million to 10 million whale cohort have also done the same. Actions like this suggest conviction that DOGE would perform well over the coming weeks.

Rocky moves to come before the calm

When the new year began, DOGE started on a slow note. As a result, the Year-To-Date (YTD) performance of the coin stood at a 7.36% decrease.

But the last 30 days has brought some sort of relief as the cryptocurrency registered a 9.81% increase. If we were to go by the actions mentioned above, then DOGE could be set to surpass the highs it hit recently.

However, it is important to check out other indicators before concluding. From a technical perspective, it could take a while before DOGE hits a high value. This was because the price had dropped to $0.084. Looking at the 4-hour chart, it could face another hurdle around $0.087 if bulls attempt to push the price up.

A successful close above $0.087 might send Dogecoin to $0.095. But if the effort to break the resistance is futile, the price might drop to $0.080.

However, if bulls can defend the coin from going below $0.083, the Suprtrend indicate that it could be a buying opportunity.

Furthermore, the Chaikin Money Flow (CMF) showed a reading of 0.10. But the indicator has turned downwards, indicating that buying pressure had subsided.

In a highly bearish scenario, DOGE could slide as low as $0.077. But if demand for the coin increases, a rally close to $0.1 could be validated.

Open Interest drops but what’s next?

In terms of the Open Interest, Coinglass data showed that the value had decreased. On the 20th of February, Dogecoin’s Open Interest was over $610 million. But as of this writing, it had decreased to $533.15 million. Open Interest is the sum of all open positions in a contract.

Unlike what you might have heard in some corners, longs and shorts are typically 50-50 in the market. However, an increase in the Open Interest might imply that more liquidity is coming into the market.

But if the Open Interest decreases, it implies as slump in net positioning.

Dogecoin’s price decrease alongside the decrease in Open Interest suggests that buyers were no longer aggressive. This position offers DOGE’s sellers to take control on the price action.

Is your portfolio green? Check the Dogecoin Profit Calculator

From a trading perspective, the decreasing Open Interest could lead DOGE to dump into the support at $0.080. However, the potential price decrease could mean market participants could buy at a discount which is where you might want to watch.