As TerraUSD [UST] careens out of control, is Tether [USDT] headed the same way

When the market crashes, investors usually watch Bitcoin with frantic eyes – but everything is different this time. A Terra-fying saga is in progress, which saw Terra [LUNA] lose more than 95% of its value in a day to trade at $0.1194 at press time. If that wasn’t painful enough, the stablecoin TerraUSD [UST] was changing hands at $0.6079 around press time.

However, many investors had one question on their minds – is it catching?

Are you infectious?

Questions about its backing aside, Tether [USDT] was considered a relatively stable stablecoin, so to speak, thanks to a market cap that put it right under Ether [ETH]. However, as FUD surrounding UST grew, it seems that USDT was also struggling to hold on to its peg.

At press time, USDT was trading at $0.9809 after falling by 1.89% in the last day and slipping by 1.91% in the past week. This sent waves of panic through the crypto and DeFi communities, even as Tether CTO Paolo Ardoino tried to reassure users by tweeting that millions of dollars had been redeemed at the dollar price.

GM

Reminder that tether is honouring USDt redemptions at 1$ via https://t.co/fB12xESSvB .

>300M redeemed in last 24h without a sweat drop.— Paolo Ardoino (@paoloardoino) May 12, 2022

So, Ardoino may believe that all is well, but what do the metrics say?

Out of the peg and into the fire?

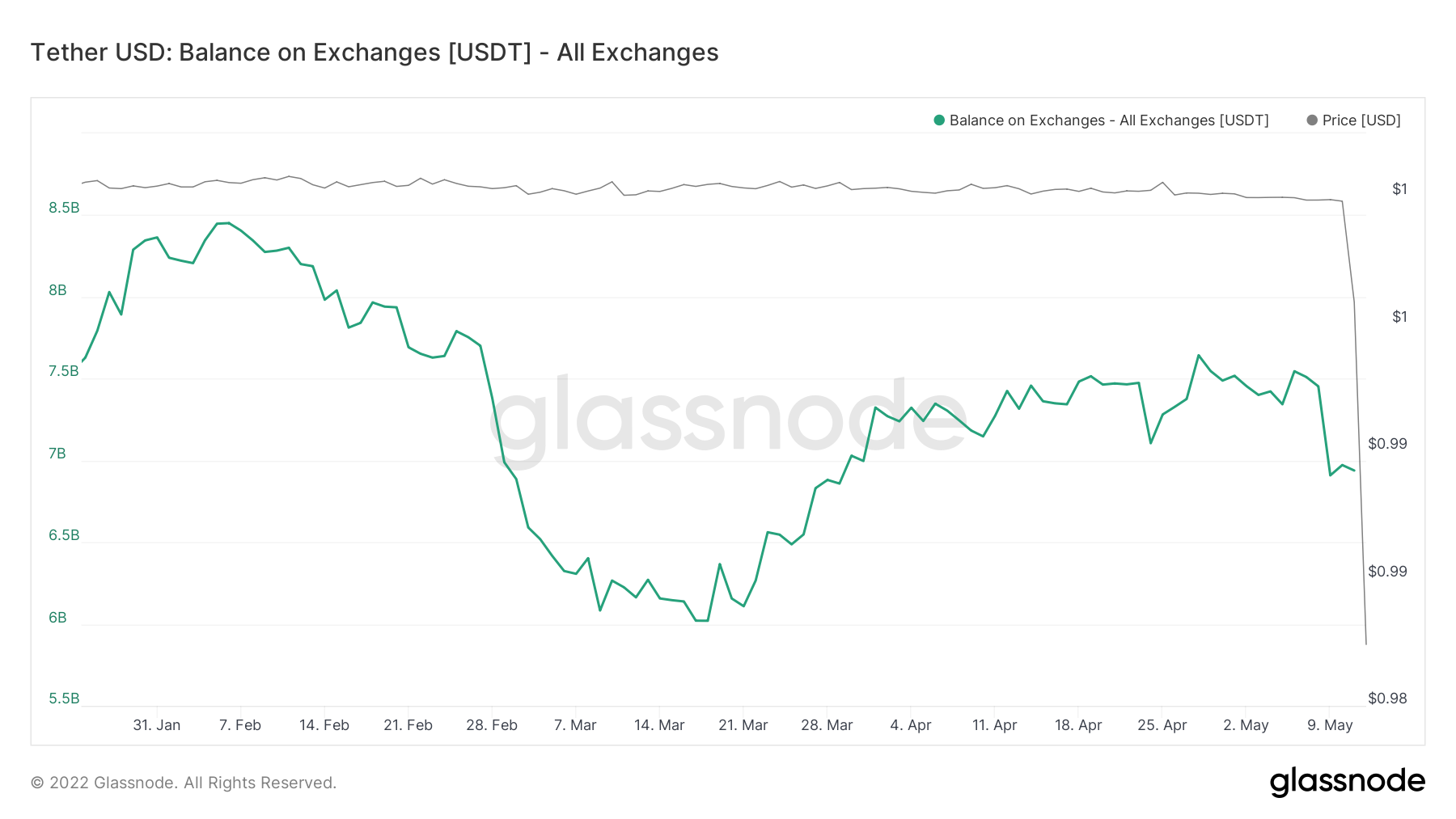

A look at the balance of USDT on exchanges tells us that USDT has been exiting since about 6 May – even before the price crashed. However, 9 May saw millions of USDT returning to the exchanges, before being taken out again. This took place as USDT’s price fell below $0.99.

Source: Glassnode

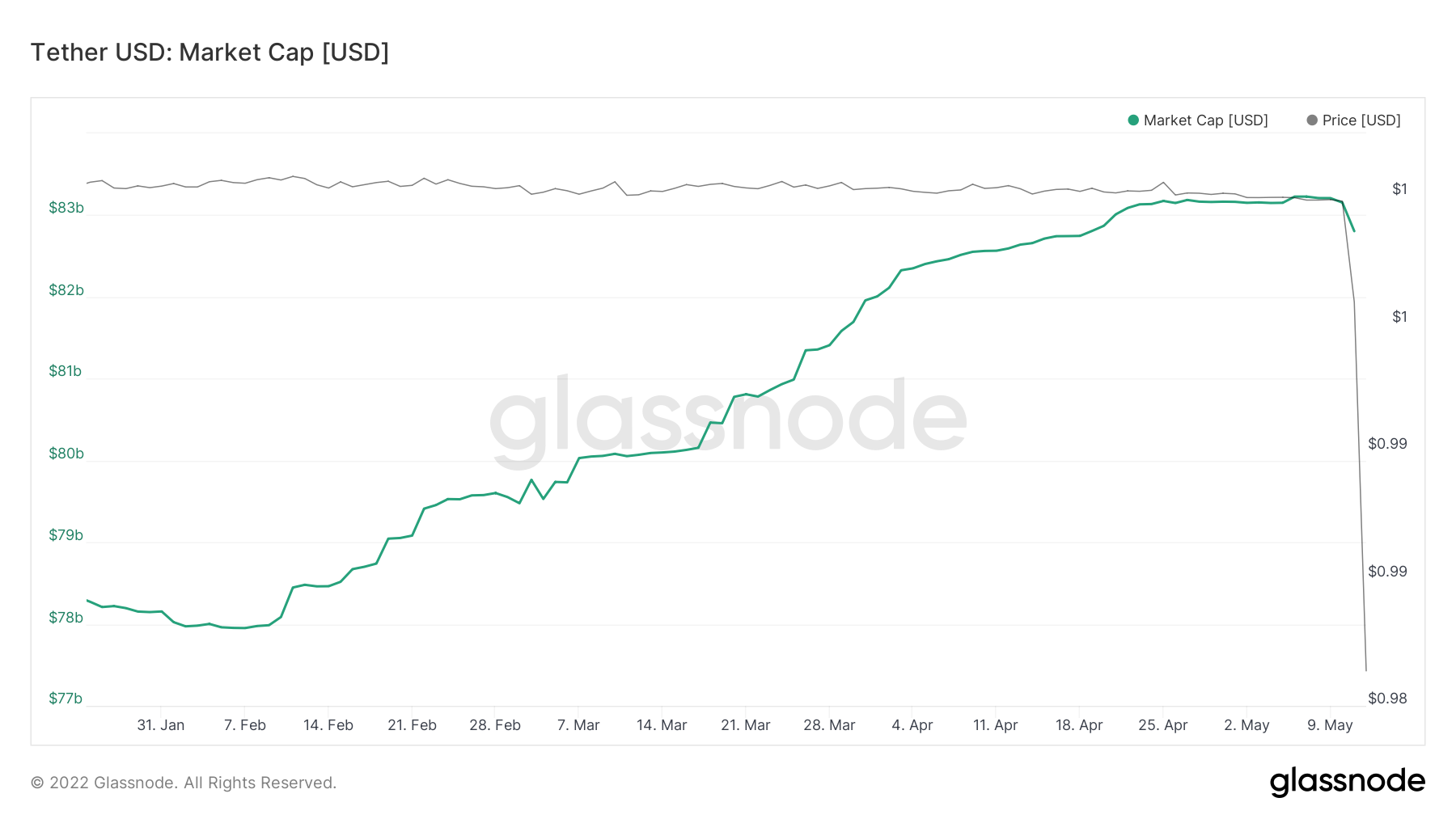

During confusing times such as these, it can help to look at USDT’s market cap. As expected, the market cap had fallen and at press time, was around $81,152,063,275.

So while USDT appears to have come slightly undone from its peg, Tether doesn’t seem anywhere close to losing value the way UST and LUNA did a day ago.

Source: Glassnode

Even if Cardano founder Charles Hoskinson thinks that Tether is the next TerraUSD, the fact of the matter remains that USDT recovered from a price of about $0.9514 at press time.

Et Tu, Tether?

— Charles Hoskinson (@IOHK_Charles) May 12, 2022

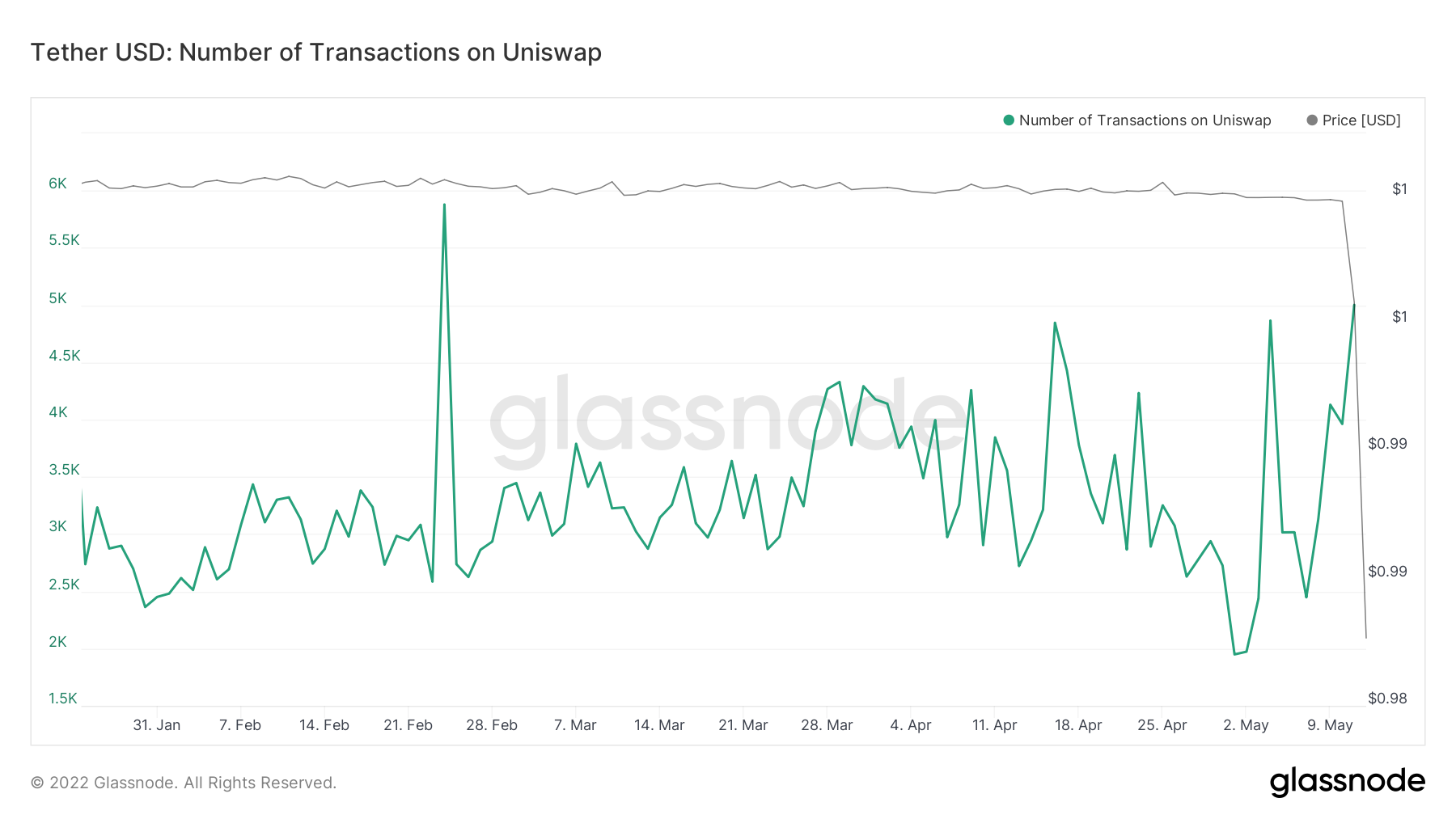

That being said, as USDT prices slipped, one metric which drastically increased was Uniswap transactions. The number of transactions involving USDT shot to a high which was last seen in February 2022, even as USDT’s price fell on 11 May.

This indicates that some investors were waiting for the opportunity to carry out DeFi transactions at discounted rates.

Source: Glassnode

Don’t lump us in the same category!

So Tether might have been feeling a little under the weather, but this was not the case with USD Coin [USDC] and Binance USD [BUSD], both of which went above $1 briefly, even as UST plunged.

![Solana [SOL] gains on Ethereum [ETH] but faces sell-off risks](https://ambcrypto.com/wp-content/uploads/2025/04/5B92B32E-5F8B-49F6-94A3-D0086EF6CCA2-400x240.webp)